Source Credit : Portfolio Prints

Why the big corporate splits are on the rise

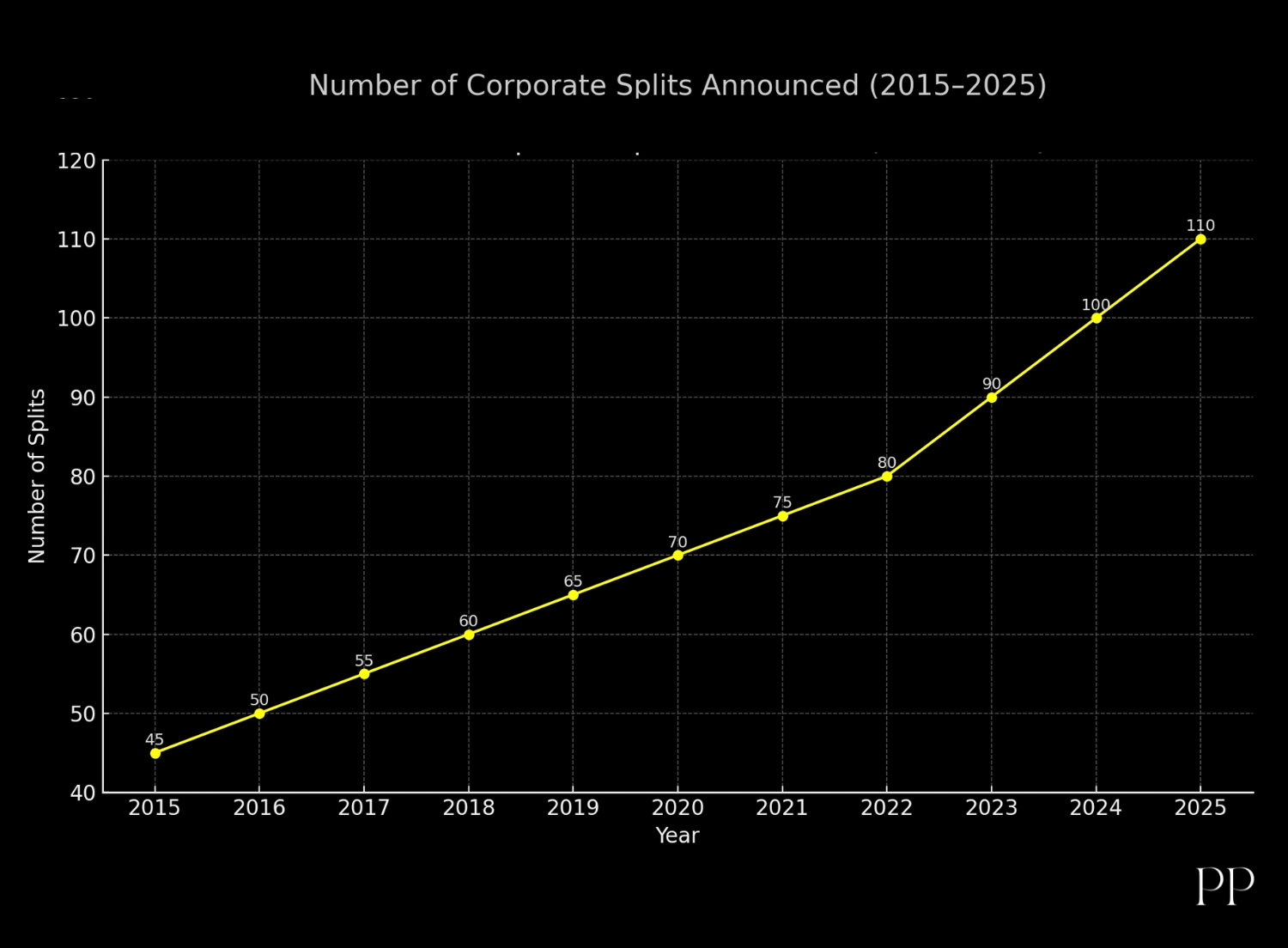

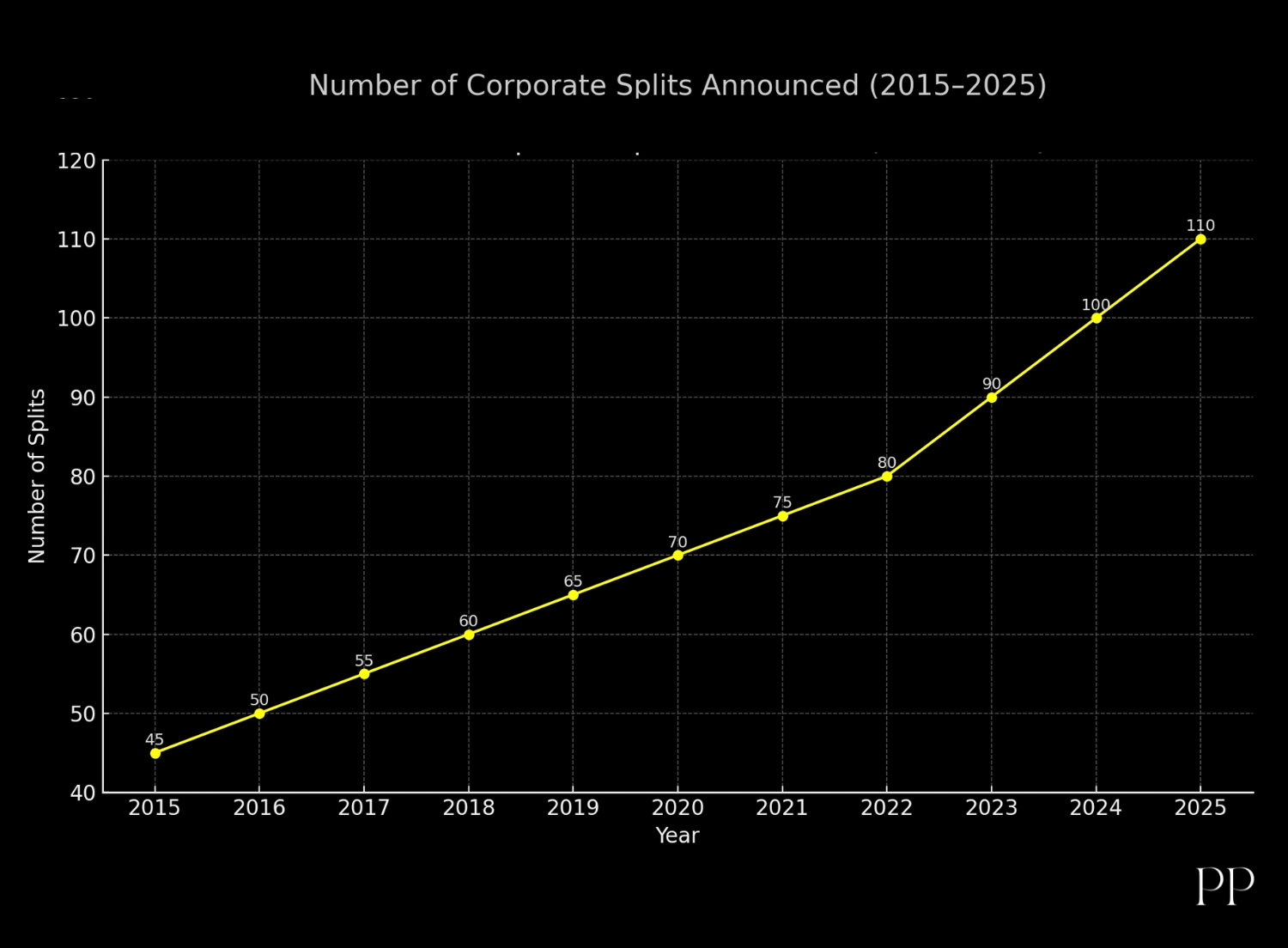

In recent years, more and more large companies are announcing break-ups, spin-offs or structural splits of business units. For example, Kraft Heinz recently announced it will split into two publicly-traded companies — one focused on groceries, the other on sauces and spreads. And wide-ranging studies show this isn’t just an isolated event: many conglomerates and multi-business firms are reassessing their scope.

Conglomerate discount & investor pressure

When a company operates a wide variety of businesses — say, manufacturing, services, consumer goods, technology — often the sum of the parts trades at less than if the parts were separate. This so-called “conglomerate discount” creates pressure to unlock value by separating.

Also, activist investors and capital markets increasingly demand clarity and focus. When businesses get too sprawling, capital allocation becomes murky, synergies harder to capture, and performance lags. For instance, Kraft Heinz cited complexity in its current structure as one reason for splitting.

Diverging business models & evolving ecosystems

Another driver: as the business ecosystem changes (technology disruption, consumer preferences, supply-chain shifts), parts of the business may require very different strategies. A large company might find that its different units face radically different competitive dynamics, which hinders performance when managed together. Research discusses how CEOs of multi-business corporations use splits when “inter-business model complementarity” declines and “intra-business model complexity” increases.

In short: What once fit together under one roof no longer does as easily. One unit might need rapid innovation and agility; another might be stable but slow-growing. Separating allows each to pursue its own best path.

Operational focus & agility

Large conglomerates often suffer from slack, bureaucratic inertia, and difficulty investing aggressively in the fastest-growing units because of the drag of slower ones. Splitting can sharpen operational focus: each standalone company can make decisions faster, allocate resources to its priority areas, and pursue tailored strategies.

Market / cost pressures & changing consumer behavior

In industries facing disruption, rising costs or shifting consumer needs, being too large and diversified can hurt. For example, food industry players face volatile commodity prices, changing diet trends, private label competition — all of which push firms to rethink their strategy. The article on Kraft Heinz notes that consumer goods companies are restructuring to “unlock value and realign with shifting market and consumer demands.”

Better investor appeal & unlocking value

From a capital-markets perspective, a more focused company is often easier to understand, to value, and to invest in. Splits may reveal hidden value and give investors a clearer investment thesis. Some firms hope for higher multiples once they’re standalone. Research also shows that one benefit of splitting is to reduce information asymmetry and improve market responsiveness.

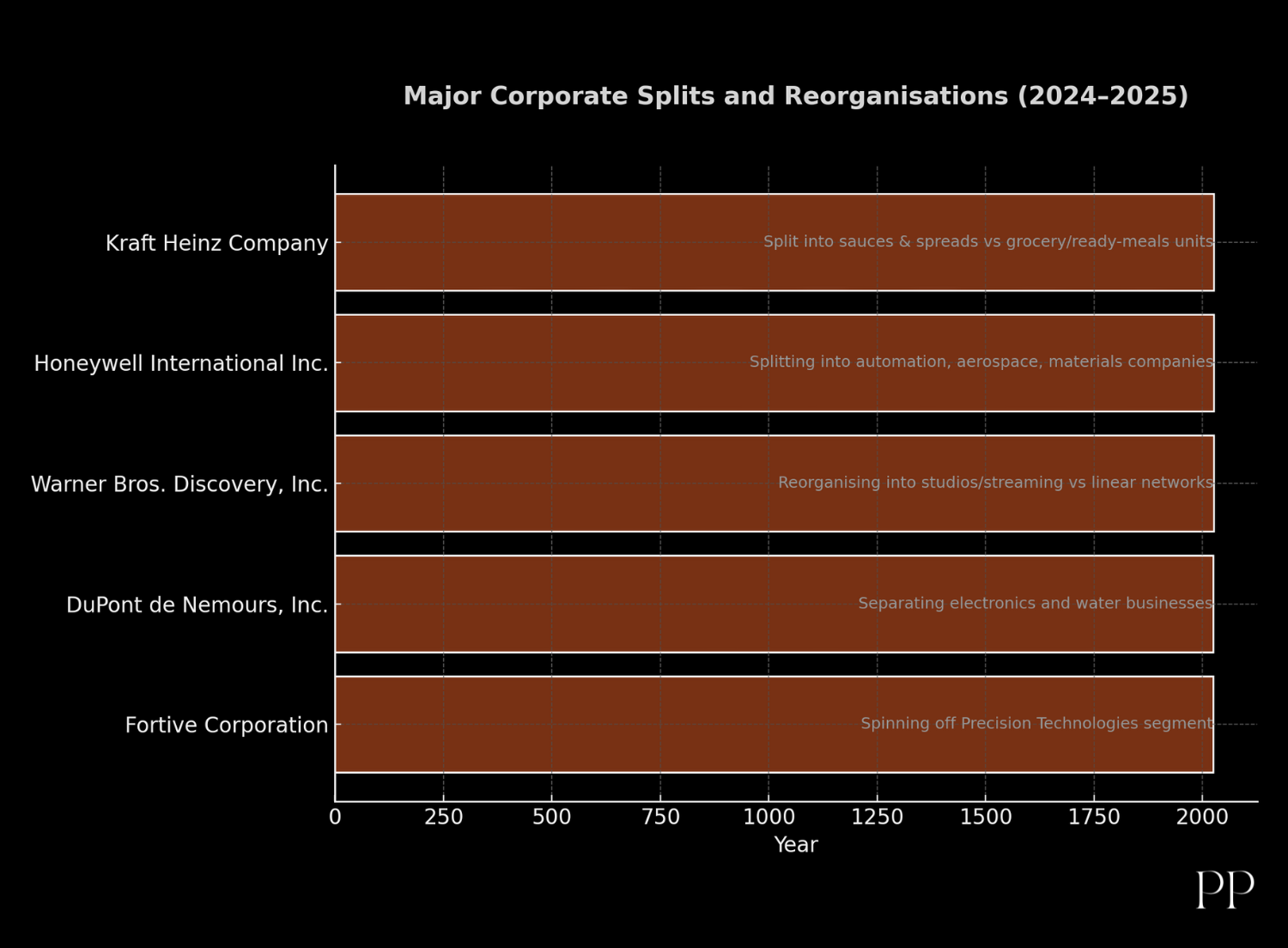

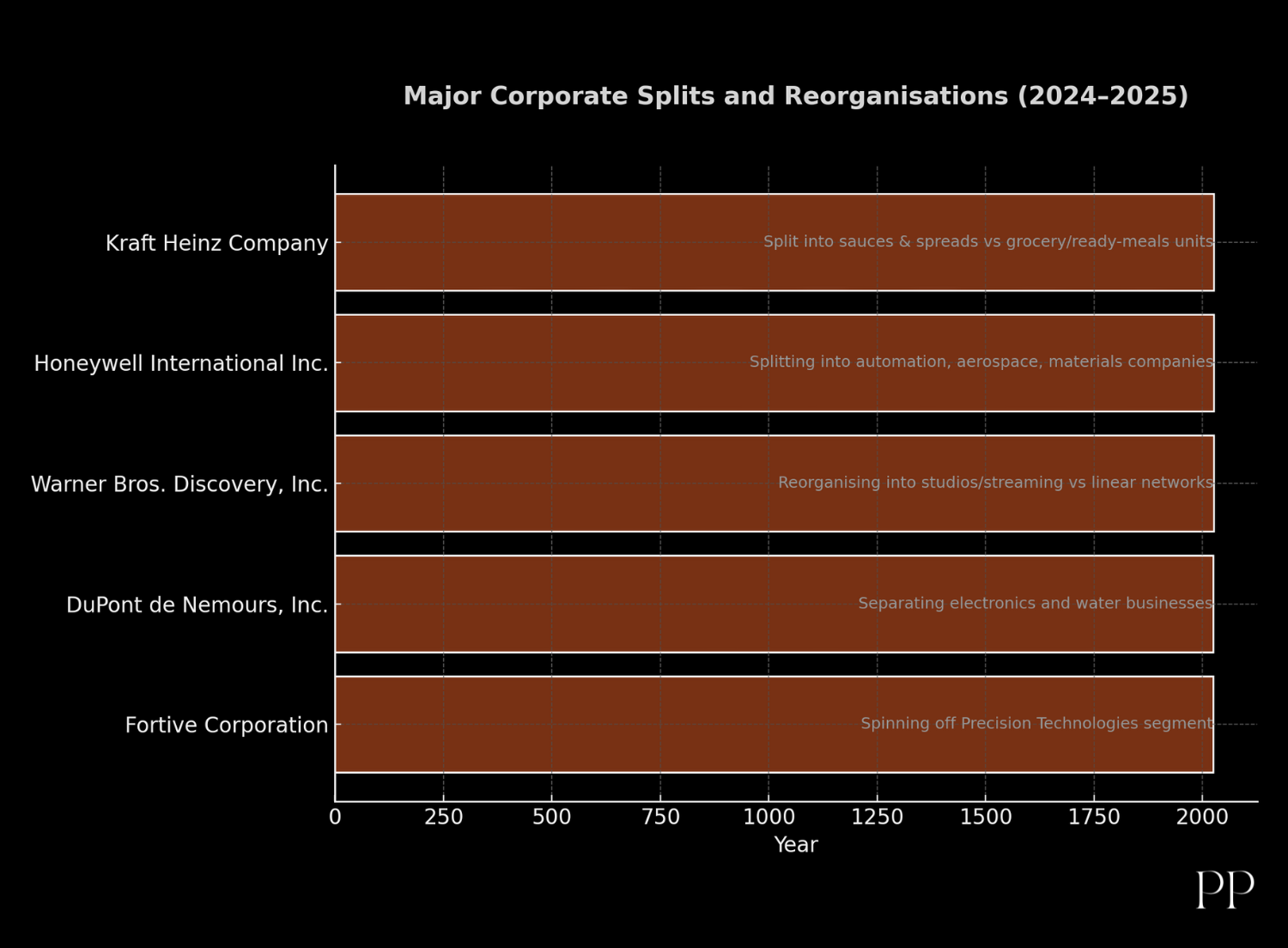

Illustrative examples

Kraft Heinz

In September 2025, Kraft Heinz announced it will split its grocery business (e.g., Oscar Mayer, Lunchables) from its sauces & spreads business (e.g., Heinz ketchup, Philadelphia cream cheese).

Key motivations: it said its current structure made it challenging to allocate capital and prioritize initiatives. The split is intended to give each business sharper focus, reduce complexity, and unlock value.

Warner Bros. Discovery

WBD announced a plan to split into two companies — one concentrating on studios and streaming assets, the other on linear cable networks — by mid-2026.

Reasoning: The streaming business and the cable networks face very different competitive dynamics; keeping them in the same entity constrained strategic agility. The split enables each to pursue its own model more effectively.

Why now?

The timing of this trend is no coincidence — a mix of external and internal drivers has created fertile ground:

- Global macro and supply-chain pressure: In a world of increasing volatility, diversified large firms may find their internal structures less nimble. For example, consumer goods firms face commodity cost swings and shifting consumer preferences.

- Technology disruption: Digitalisation, streaming, AI are changing business models across industries. Large static firms may struggle to adapt.

- Capital-markets evolution: Investors and analysts demand clearer, more predictable business units. The era of “we do everything” conglomerates is less rewarded.

- Activist investors: They are more vocal and influential, pushing for splits/spin-offs as a lever to unlock value.

- Strategic realignment: Firms increasingly recognise that being smaller and focused may lead to better performance than being huge and unwieldy. As one analysis says: “Bigger isn’t better for some companies.”

Conclusion

The rise in major corporate splits reflects a changing environment: less tolerance for sprawling, unfocused conglomerates, greater demand for agility, and the need for businesses to align more tightly with their core capabilities and market realities. The trend suggests that “go big or go niche” is giving way to “go focused and agile”.

That said, the splitting route is not a guarantee of success — the mechanics, leadership and execution will matter a lot. For investors, employees and stakeholders, the key question will be: after the split, does each business perform better than it would have inside the old structure?