Source Credit : Portfolio Prints

A Milestone Moment

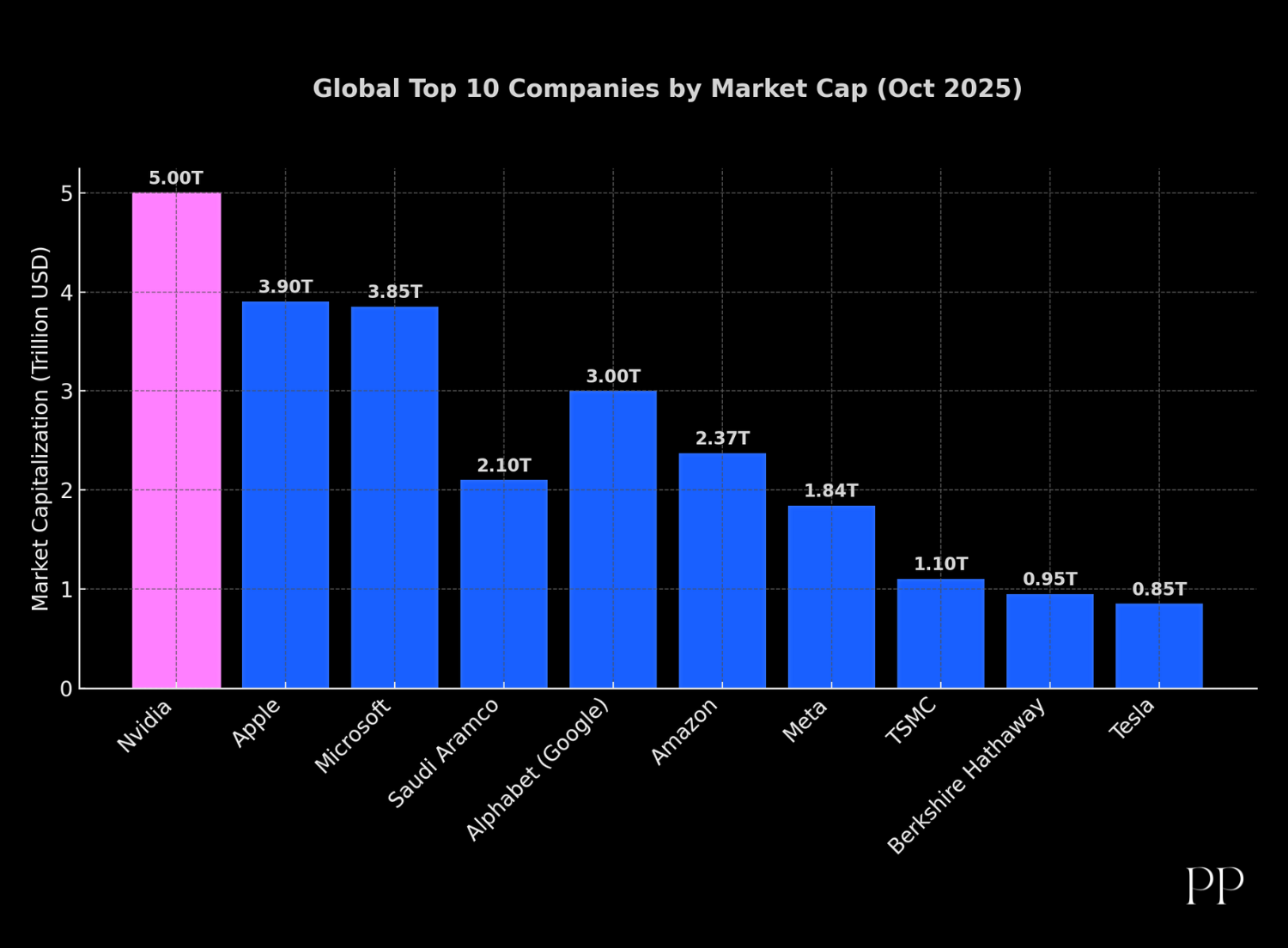

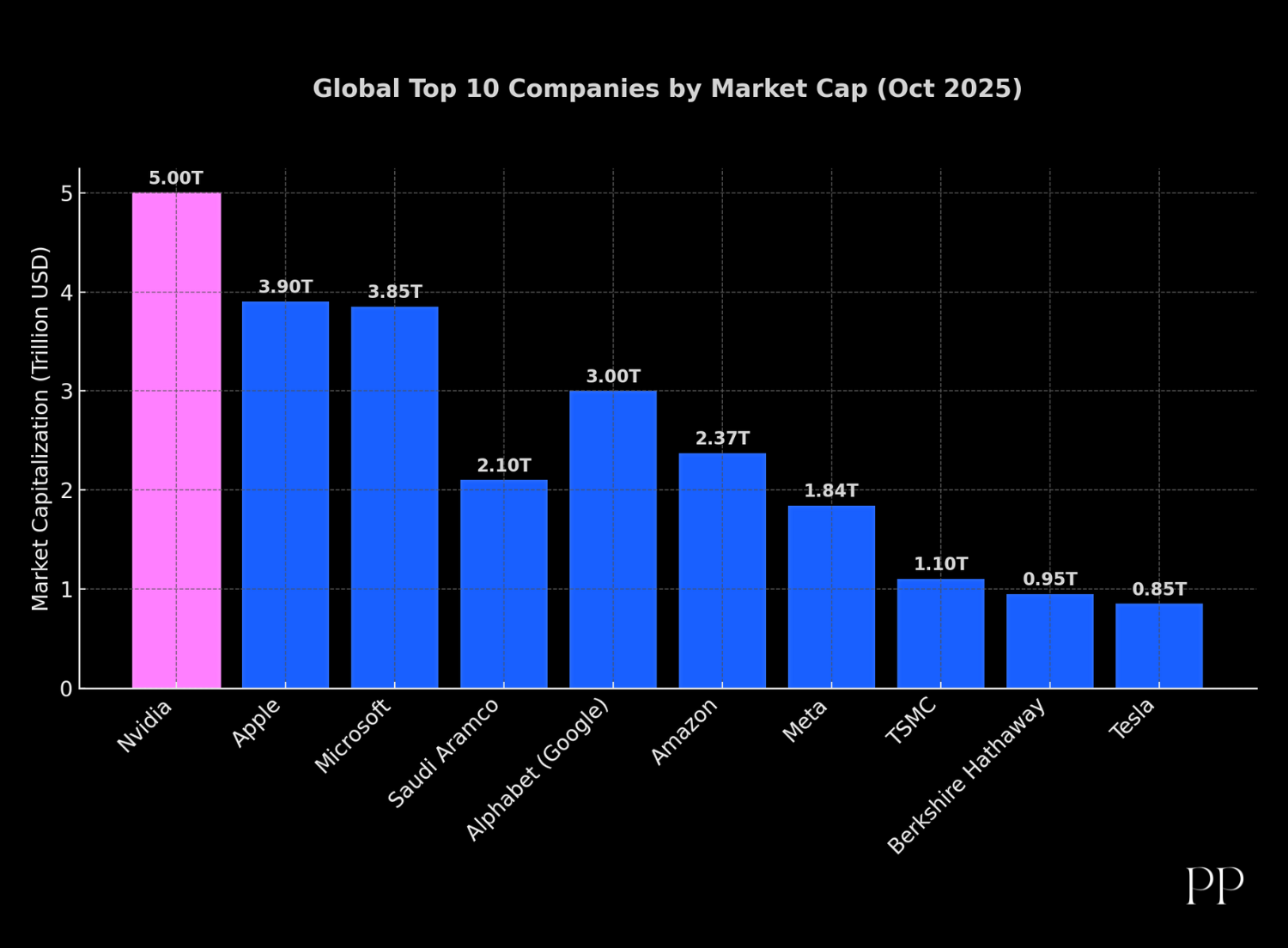

On 29 October 2025, Nvidia became the first publicly traded company ever to achieve a market capitalization of $5 trillion.

- Shares rose to around US $207-211, giving it a valuation of about US $5.05 trillion.

- This comes just months after Nvidia first broke the $4 trillion mark.

This isn’t just a giant number—it signals a tectonic shift in technology, markets, and global industrial power. Let’s unpack what this means.

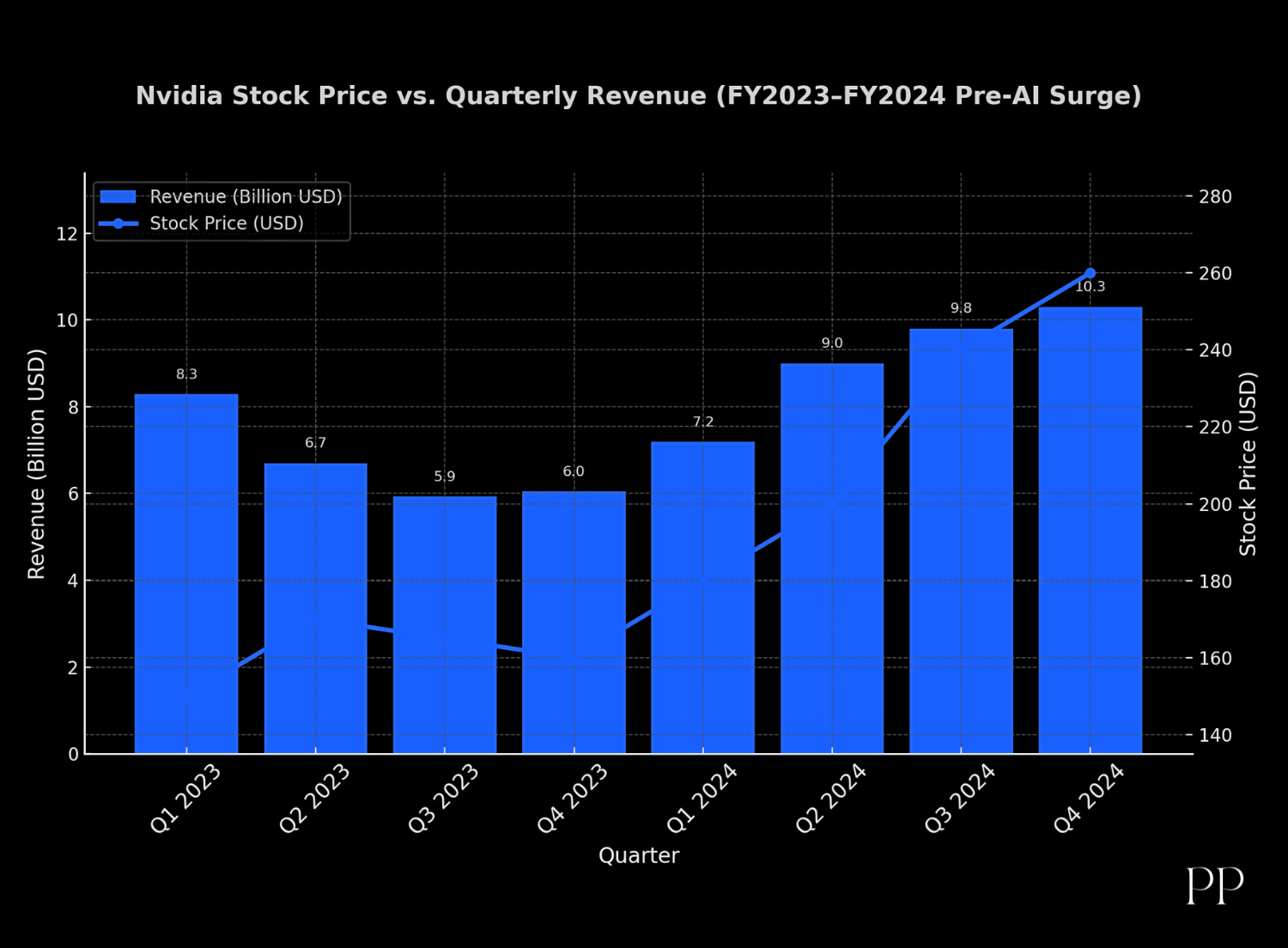

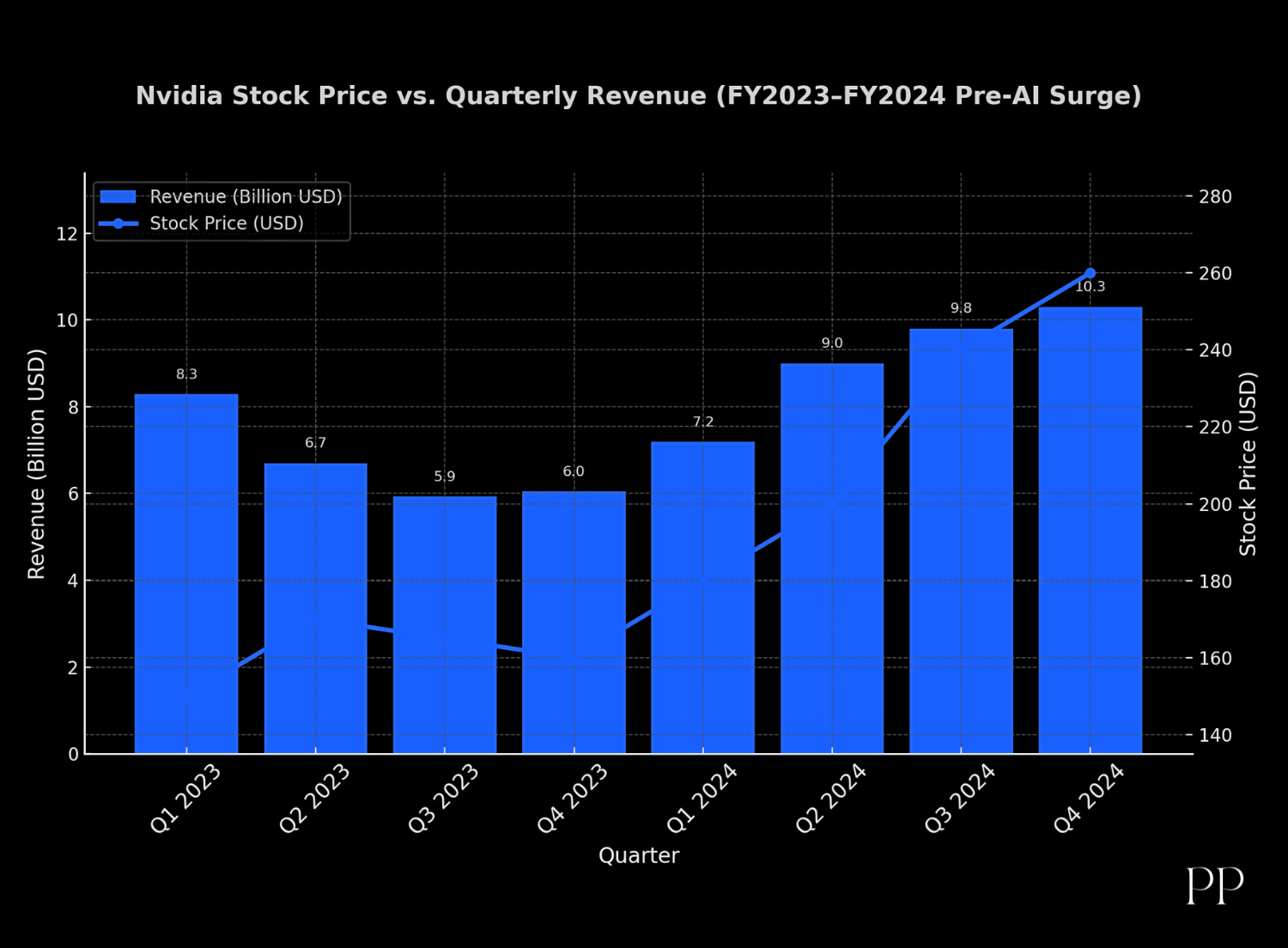

What’s Behind the Surge

AI & chips as the fulcrum

Nvidia isn’t just a graphics-chip maker anymore. It has transformed into the backbone of the AI infrastructure era.

- Its processors power large-language models, generative AI systems, data-centres and supercomputers.

- It reportedly has ~$500 billion in AI-chip bookings.

- It holds a dominant market share in high-end GPUs/training hardware.

Market environment & buy-in

- The broader stock market, especially tech and AI-driven stocks, is at record highs—boosted by optimism about AI’s economic impact.

- Investors are placing big bets on growth, future platforms and transformative tech rather than just current earnings.

Strategic expansions & geopolitics

- Nvidia is extending beyond chips into software, services, supercomputers, and emerging networks (e.g., 5G/6G).

- It’s also in the middle of major geopolitical dynamics: U.S. export controls, China market tensions, global supply-chain shifts.

Why This Matters — “Changing Everything”

Tech & Industry

- Hardware and chips are now platforms, not just components. Nvidia’s valuation signals that infrastructure-level tech is where the future value lies.

- Software + hardware + services: The stack is converging. Nvidia is becoming a full-system company, not just a part.

- The shape of competition changes: New entrants will face very high bars to challenge Nvidia’s ecosystem and scale.

Markets & Valuations

- A $5 trillion market cap raises questions about valuation norms. Investors may ask: Are we in a new era of “mega-cap” tech valuations?

- It sets a benchmark: Other tech companies might now be measured qualitatively differently (growth-oriented, platform play vs. incremental earnings).

- But also: It triggers bubble risk commentary. Some analysts warn that the AI hype is outpacing realisable returns.

Economy & Society

- The fact that one company is worth more than the GDP of several large nations underscores the concentration of value in tech.

- AI, data-centres, chip manufacturing, cloud services—all these become critical infrastructure. Nvidia’s rise points to where global economic growth may pivot.

- Supply chains, export policies, education/training, and workforce skills will increasingly revolve around this tech axis.

Risks & Challenges Ahead

- Dependence on key customers: Many large cloud or AI companies are big buyers—if demand slows, Nvidia’s growth could falter.

- Geopolitical/regulatory exposure: With U.S. export controls and China as a huge market, Nvidia sits in the crosshairs.

- Execution risk: Scaling manufacturing, managing chip shortages, providing software and services at this scale is hard.

- Valuation risk: While growth is priced in, if revenue or margins don’t meet lofty expectations, the market could adjust rapidly.

Summary

Nvidia hitting $5 trillion is more than a headline—it’s emblematic of a fundamental transformation: from chips to AI-driven entire systems; from incremental upgrade cycles to platform leaps; from national-scale value to global-tech value.

It tells us the era of AI infrastructure is here, and whichever companies, countries and ecosystems win in that space may define the next decade.