Berkshire’s Record Cash Hoard: Strategy or Stalemate?

Image Credit : CNBC

Source Credit : Portfolio Prints

Introduction

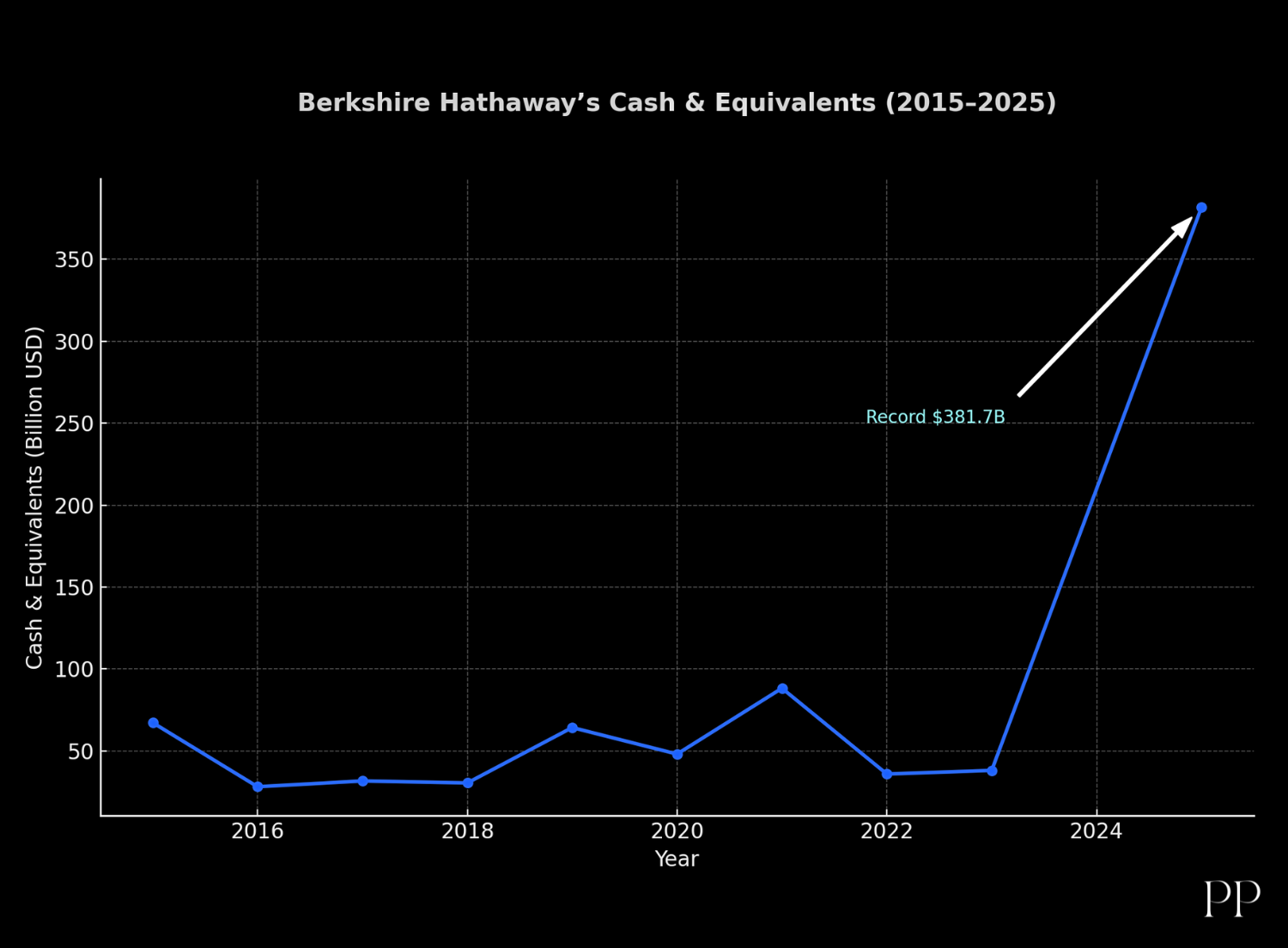

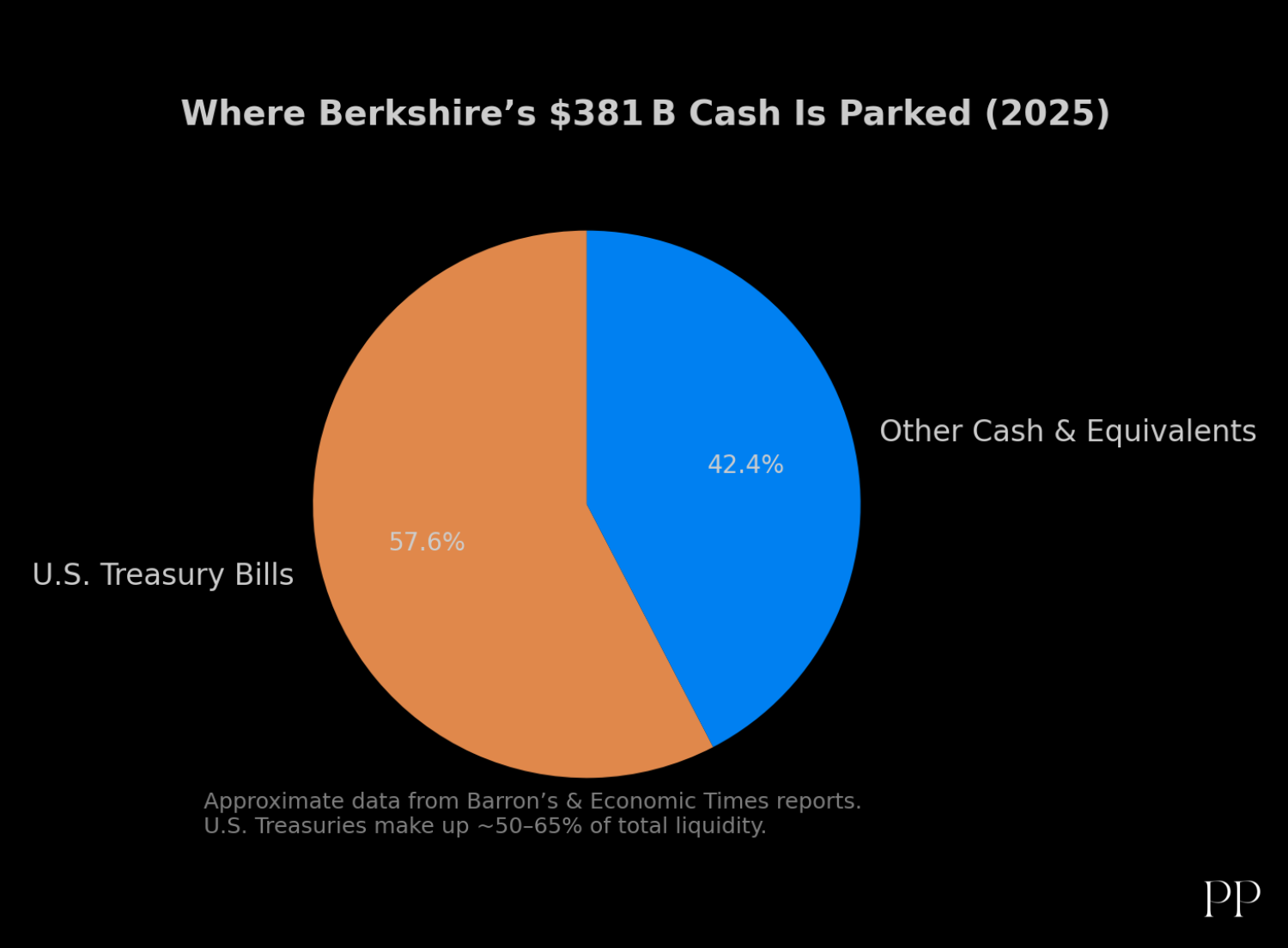

In its Q3-2025 report, Berkshire Hathaway announced that its cash and short-term investments had reached a staggering $381 billion, a new all-time high.

What’s happening?

- Berkshire’s cash hoard has grown considerably: At the end of March 2025 the company reported ~$347.7 billion in cash and equivalents.

- For Q3 the figure rose to ~$381 billion.

- Meanwhile, operating profits dipped in some segments (e.g., insurance underwriting), even as core businesses like railroads and energy held up.

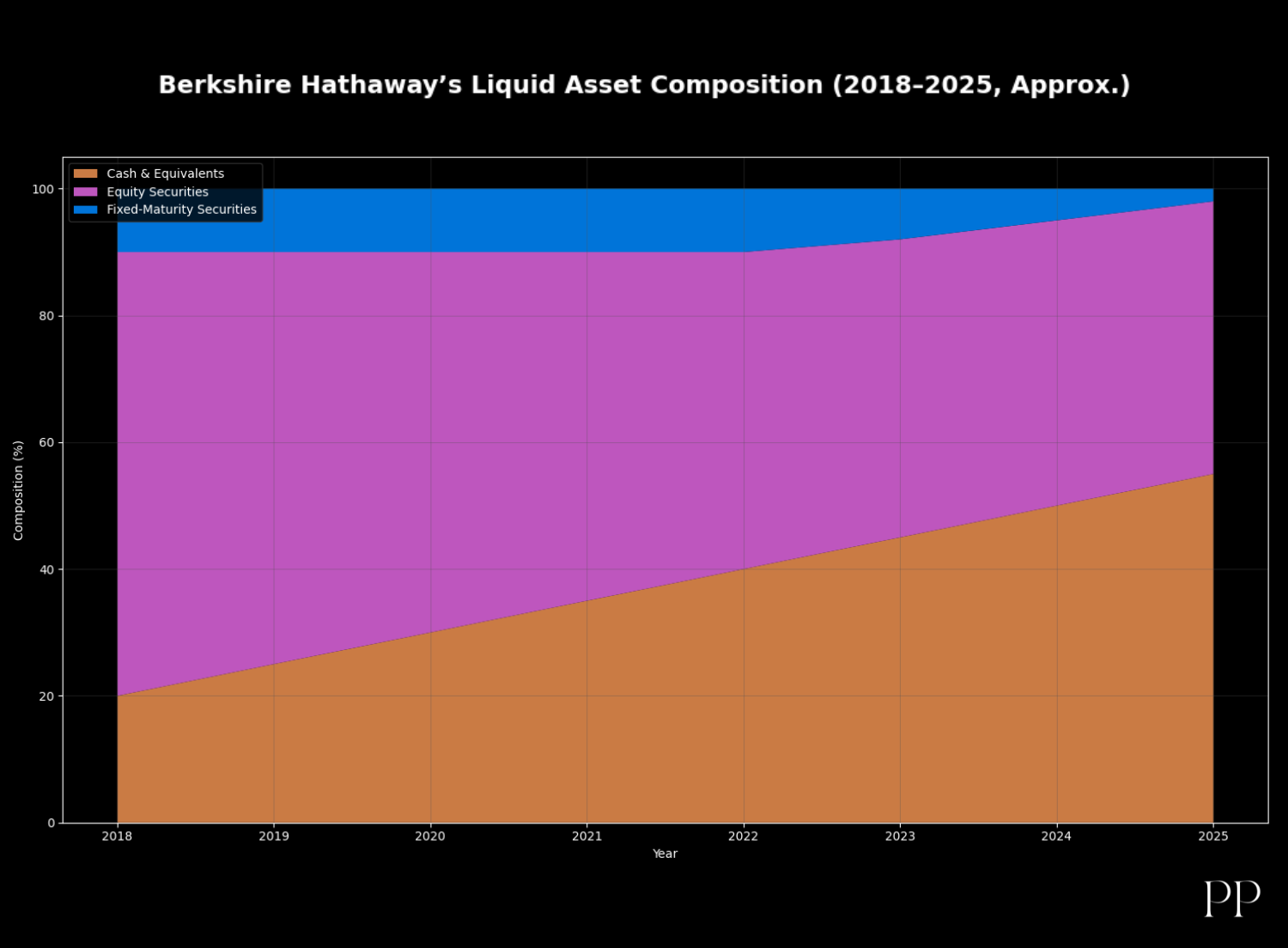

- Berkshire has been selling stocks or trimming holdings rather than aggressively buying. One report: “selling stocks for the tenth consecutive quarter.”

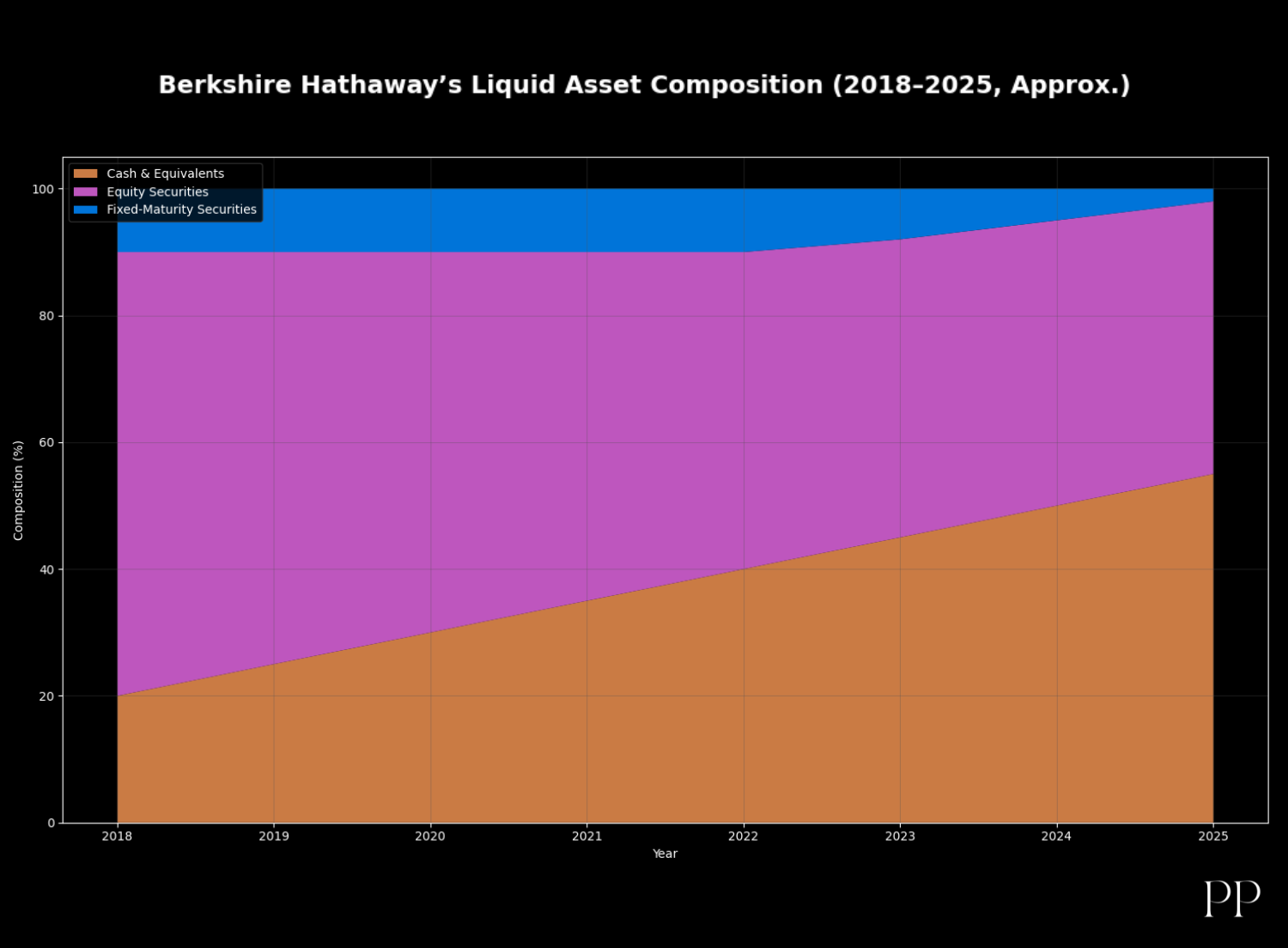

- Buffett emphasised that “the great majority of your money remains in equities… We will never prefer ownership of cash‐equivalent assets over the ownership of good businesses.”

Why is Berkshire doing this?

- Valuation caution: Buffett has long emphasised buying at the right price. With market valuations high, he appears to be holding off for better opportunities.

-

Liquidity as optionality: Having huge cash gives Berkshire the flexibility to pounce when favourable opportunities arise (large acquisition, distressed asset, etc.).

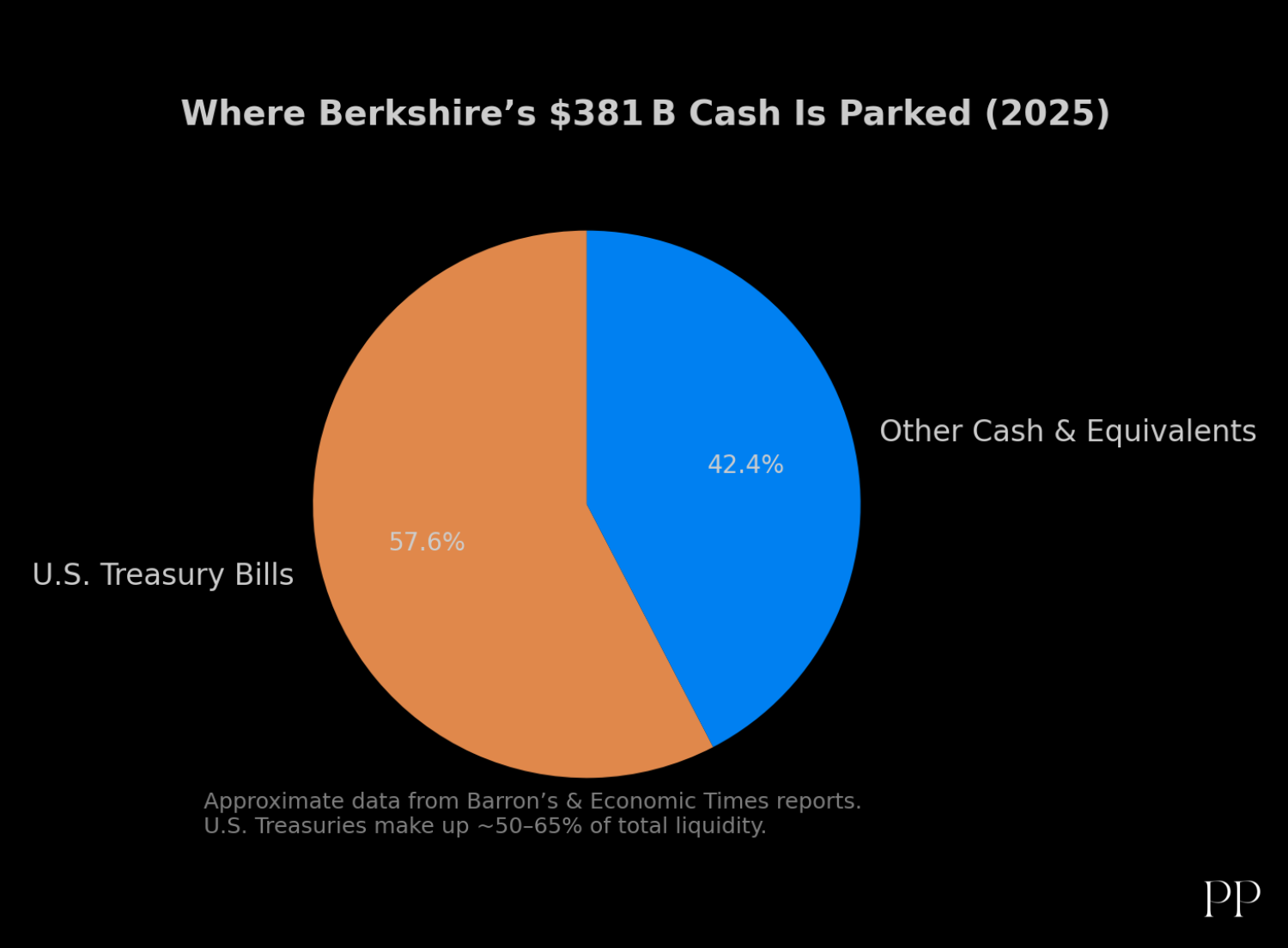

- For example: a portion of the cash is held in U.S. Treasury bills — very liquid, very safe — so Berkshire can move quickly.

- Defensive posture / macro uncertainty: With inflation, interest‐rates, geopolitics (tariffs, trade tensions) all being unsettled, cash provides a buffer against volatility.

- Succession / strategic transition: Berkshire is eventually going to transition leadership (Buffett → successor). A large cash reserve might help smooth that transition and give the incoming team optionality.

But what are the risks / criticisms?

- Opportunity cost: Sitting on such a large cash pile means lost returns. Cash and equivalents yield much less than high‐quality businesses over long time periods. So critics argue Berkshire may be under‐utilising its firepower.

- Signal of caution-or-fear? A massive cash holding may be interpreted as a warning sign: Buffett might believe the market is overvalued or that a downturn is coming.

- Lack of major deals: For a firm of Berkshire’s size, with such liquidity, the absence of large acquisitions raises questions: is Berkshire being too patient, or is it stuck because no deal meets its standards?

- Shareholder expectations: Many shareholders look for capital deployment (either via buybacks, dividends, acquisitions) rather than simply hoarding cash. If Berkshire remains inactive too long, it may frustrate investors.

Our view: Strategy and stalemate

I believe the truth is nuanced: Berkshire’s cash hoard is both a purposeful strategic reserve and a symptom of a market where few compelling opportunities exist.

- On the strategic side, this approach is consistent with Buffett’s value-oriented investment philosophy: buy great businesses when they are undervalued, otherwise wait. He is clearly waiting.

- On the stalemate side: the market environment — high valuations, rising rates, macro uncertainty — means that doing “nothing” may currently seem the best option, hence the inactivity. But inactivity can only go so far before pressure builds.

What to watch going forward

If you are watching Berkshire (or using it as a proxy for Buffett’s view), here are key indicators:

- Acquisition action: Does Berkshire announce a large acquisition? That would signal the cash is moving from idle to active.

- Change in buyback policy: If Berkshire resumes stock repurchases, that would show confidence in valuation and capital deployment.

- Disclosure on why the cash is so large: If Buffett or management give clearer explanations (in letters, meetings) about their thinking, that will reduce uncertainty.

- Market valuations and macro shifts: If valuations drop or a downturn occurs, Berkshire’s cash could become the advantage it’s positioned to be — and the timing of that will matter.

- Performance of core businesses: While cash builds up, Berkshire’s operating segments still need to perform; if they weaken materially then holding cash won’t compensate.

Conclusion

The record cash hoard at Berkshire Hathaway is not simply passive. It reflects a deliberate philosophy of patience, liquidity, and optionality in the face of elevated valuations and uncertain markets. At the same time, a company with $380 billion in cash inevitably invites the question: when will it act? Until it does, the cash remains both a hedge and a placeholder.

Whether this becomes a masterstroke (deploying cash at the right moment) or a missed opportunity (cash gathering dust) will depend largely on what happens next in the markets — and how willing Buffett’s team is to strike when it does.