Source Credit : Portfolio Prints

The Big Picture

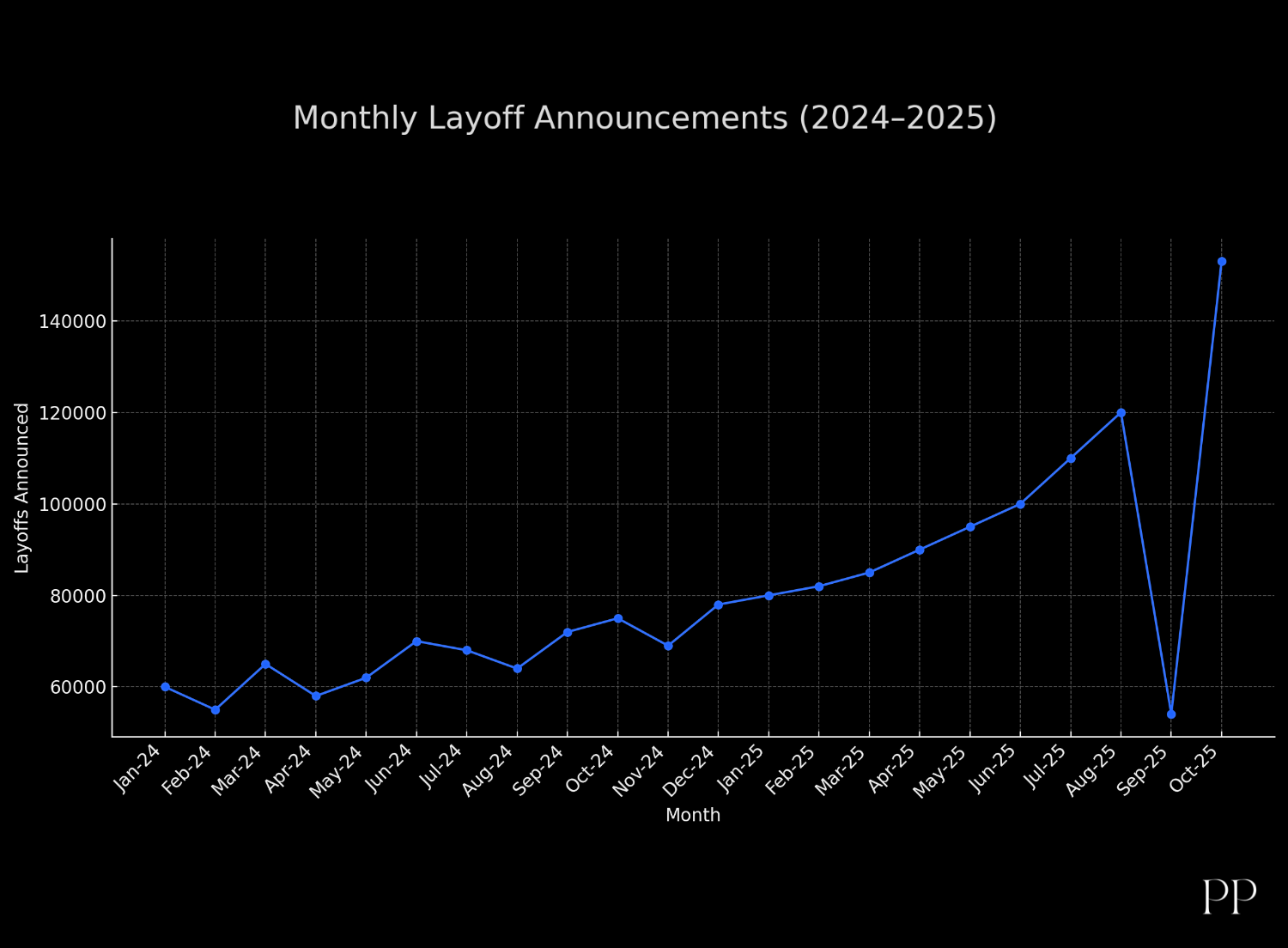

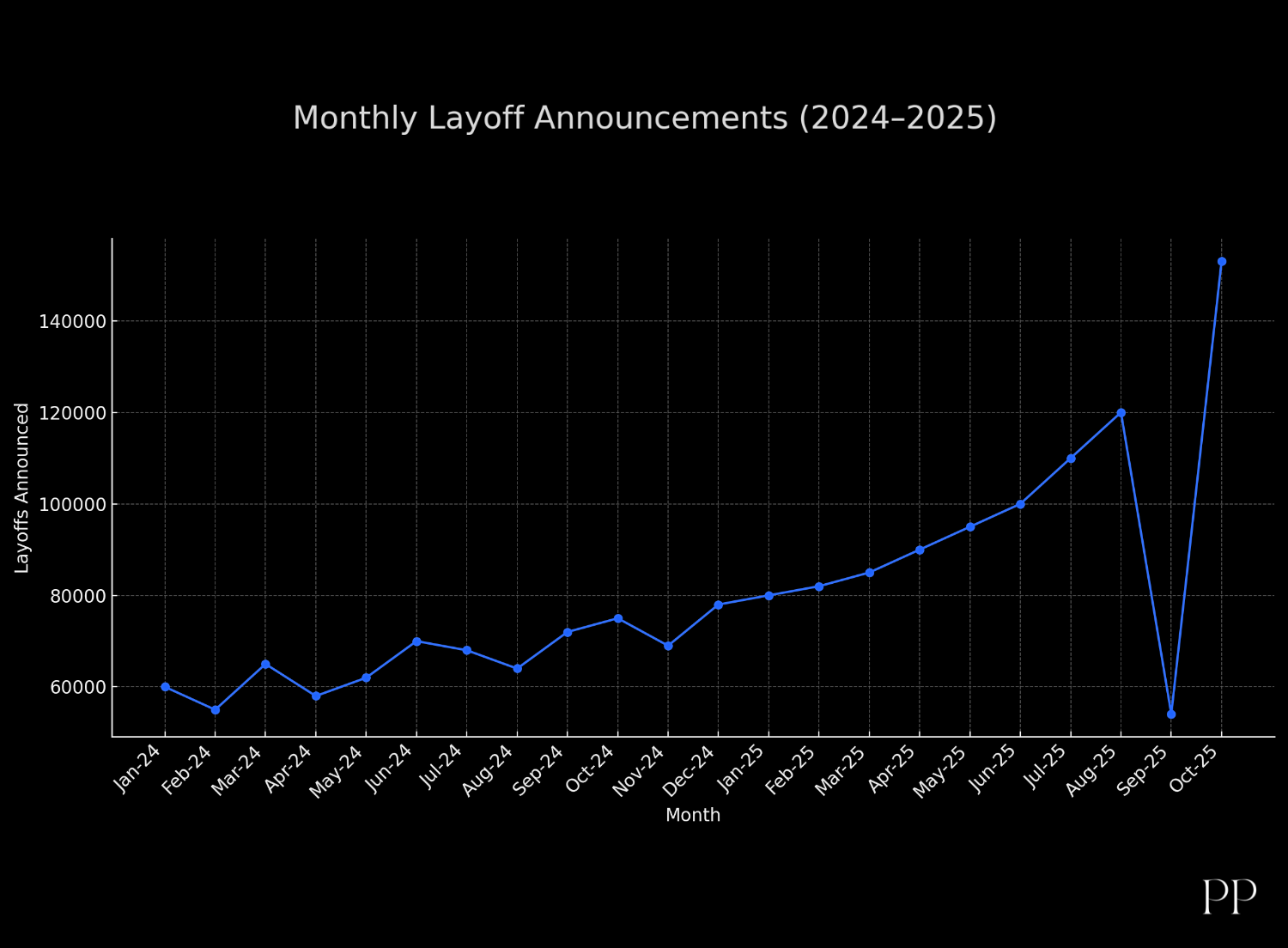

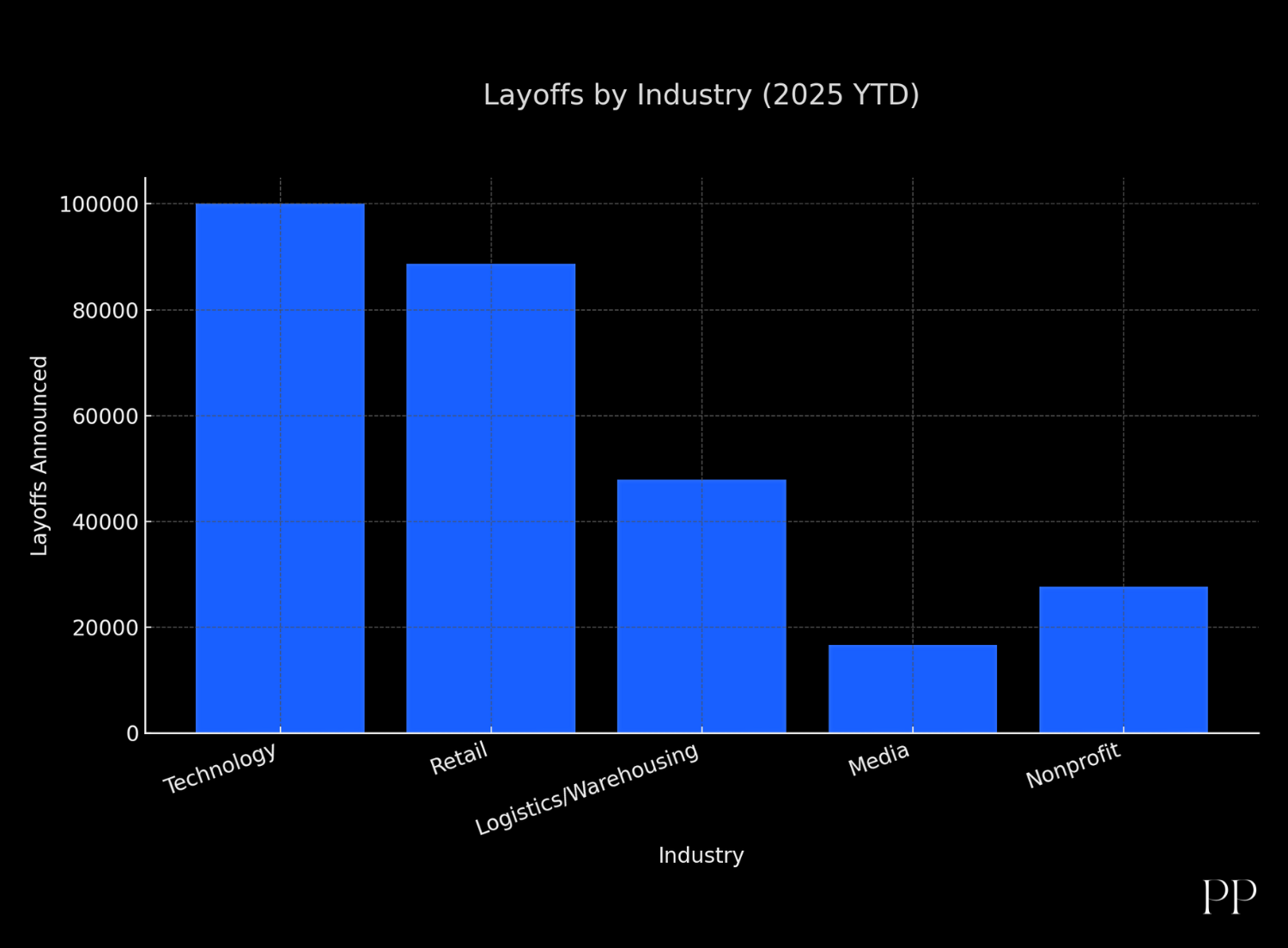

In recent months, job‐cut announcements from large firms have surged to levels not seen in years. For example:

- In October 2025, U.S. employers announced about 153,074 layoffs, the worst single‐month total for October since 2003.

- For the year to date, over 1 million job cuts have been announced in the U.S., marking a ~60-65 % increase over the same period in 2024.

- Major tech firms like IBM are cutting jobs as part of transitions to AI and newer business models.

Key Drivers Behind the Cuts

Technological Shift & Automation/AI

One major reason is the acceleration of artificial intelligence (AI), automation, and more efficient workflows. Companies are redirecting budgets from headcount to tech infrastructure.

- For example: “The 2025 layoff wave reflects structural shifts, not mere cost‐cutting. Companies… are automating tasks and redesigning workflows.”

- On the other hand, firms citing AI as the reason for layoffs is something some analysts feel is partly a narrative or “buzzword” used to justify workforce reductions.

Cost Pressures & Softening Demand

Even though many companies remain profitable, they are under pressure: rising operational/capital costs, weaker consumer spending, slower business growth.

- Labor is a major cost, and cutting it remains one straightforward lever.

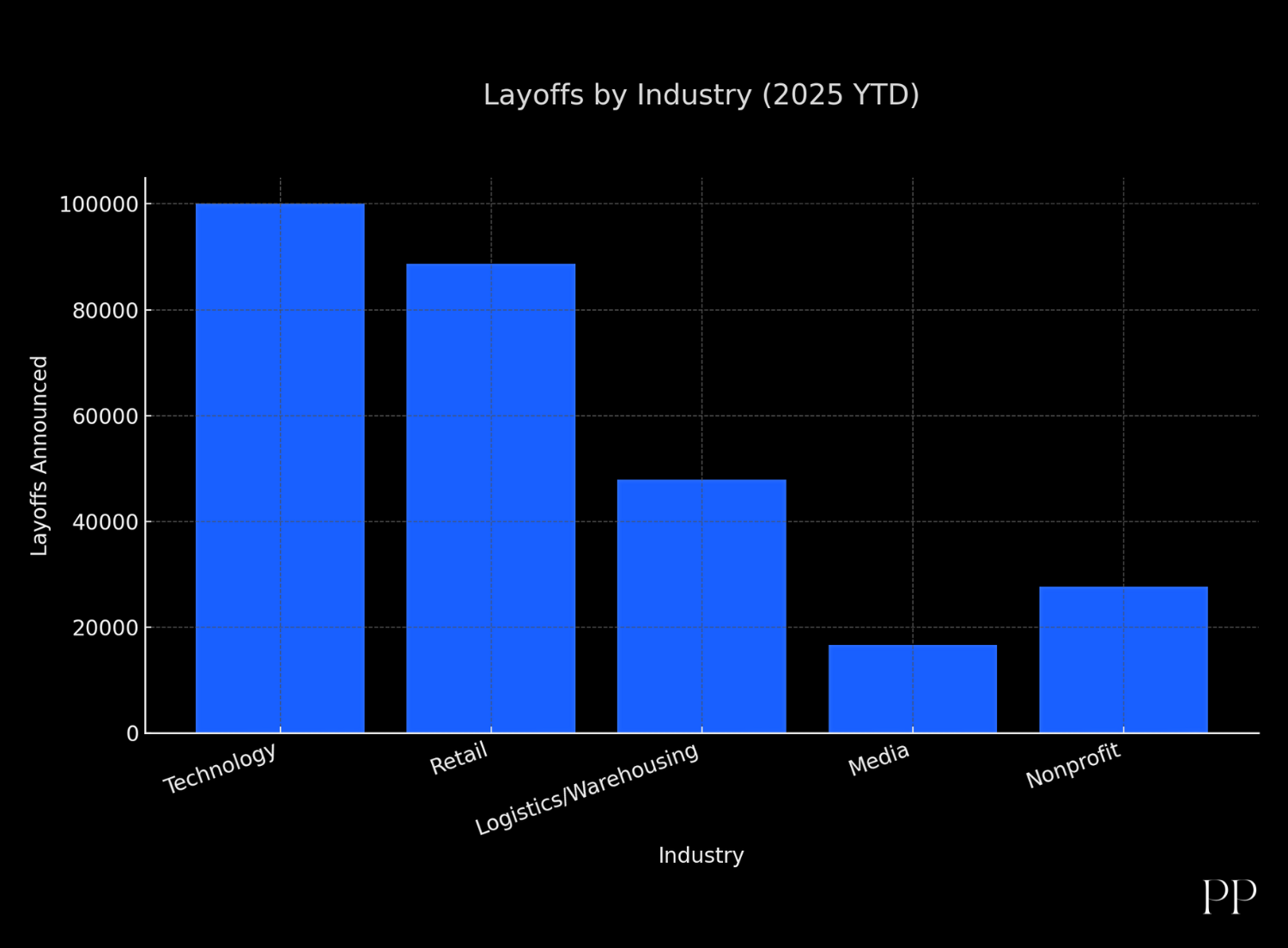

- Retail, warehousing, and service sectors have reported large job cuts as demand softens.

Over‐Hiring / Excess Capacity After the Pandemic

Many companies ramped up hiring during/after the pandemic in anticipation of growth; now they are recalibrating.

- An article notes: “Beginning in 2022, tech layoffs increased steadily … the rapid rise of artificial intelligence adoption has fuelled some of the most recent layoffs.”

- The cycle: high hiring during boom + slower growth later + technology enabling fewer workers = workforce trimming.

Strategic Realignment / Focus on Growth Areas

Some firms are redirecting their business model: e.g., moving from hardware to software, from legacy business lines to newer ones.

- IBM’s case: cutting thousands as it pivots toward AI and software.

- Companies are using layoffs to free up resources for “future growth” areas instead of sustaining older ones.

Market & Investor Pressure

Layoffs often lead to positive investor reactions (lower cost base, improved margins). Some experts call this a “perverse incentive”.

- “Companies feel more emboldened to cut workers now because it’s easier to find new talent than during the pandemic…”

- Announcing job cuts can signal discipline to investors.

Implications & What It Means

For Employees

- Job insecurity is rising: Especially in sectors hit hardest (tech, warehousing, retail) the risk of layoffs is uniformizing across income levels, not just lower wages.

- Reskilling and upskilling remain important, but may not fully insulate workers. In many cases the roles being cut are “surplus after pandemic boom” rather than mis‐skills.

- The psychological and financial impact is real: even employed workers may feel less secure; hiring freezes and slower job growth add to the tension.

For the Economy

- A sharp rise in layoffs can be a leading indicator of economic slowdown (though not always). Some analysts warn that the high level of job cuts is “recession‐like”.

- Yet, the broader unemployment rate remains relatively low for now — meaning the labour market may have some resilience.

- For policymakers (e.g., the Federal Reserve) rising layoffs complicate decisions about interest rates: weak labour market may incline them to ease, but inflation concerns push the opposite.

For Companies

- Firms are facing a balancing act: cutting costs versus retaining talent; investing in automation versus maintaining human flexibility; staying competitive without undermining morale.

- While layoffs may improve short‐term financial metrics, they carry risks: loss of institutional knowledge, damage to employer brand, lower employee engagement.

- Some sectors/economies will benefit from the technological transition (jobs in AI, data, new services), but there’s a timing gap: job cuts now + slower job creation later = friction.

What to Watch

- Will the pace of job cuts slow down, or will it accelerate further? If demand remains weak and automation keeps rising, cuts may continue.

- What happens to job creation? Layoffs alone don’t tell the whole story — if companies hire in other areas (AI, data, services), the net employment effect may differ.

- How will governments and labour regulators respond? If job cuts become more frequent and widespread, policy debate may intensify around worker protection, reskilling, unemployment safety nets.

- Impact on emerging economies / off‐shoring: Some companies may shift tasks or workforce to lower‐cost geographies; or conversely, increase automation globally.

- For individuals: Staying adaptive, monitoring industries in flux, and being ready to pivot skills will likely pay off more than ever.

Conclusion

The wave of job‐cuts among major companies in 2025 reflects more than just cyclical weakness. It is indicative of deeper transitions: technological change (especially AI/automation), strategic realignment of business models, cost pressures, and shifting labour‐market dynamics.

For employees, companies, and economies alike, this means adaptation is no longer optional — it’s central. Workers may need to re‐think their skill sets and career paths; companies need to balance cost, innovation and human capital; and policymakers must navigate the fine line between encouraging growth and safeguarding livelihoods.