Global Companies Cut Costs as Growth Pressures

Image Credit : Getty Images

Source Credit : Portfolio Prints

Background

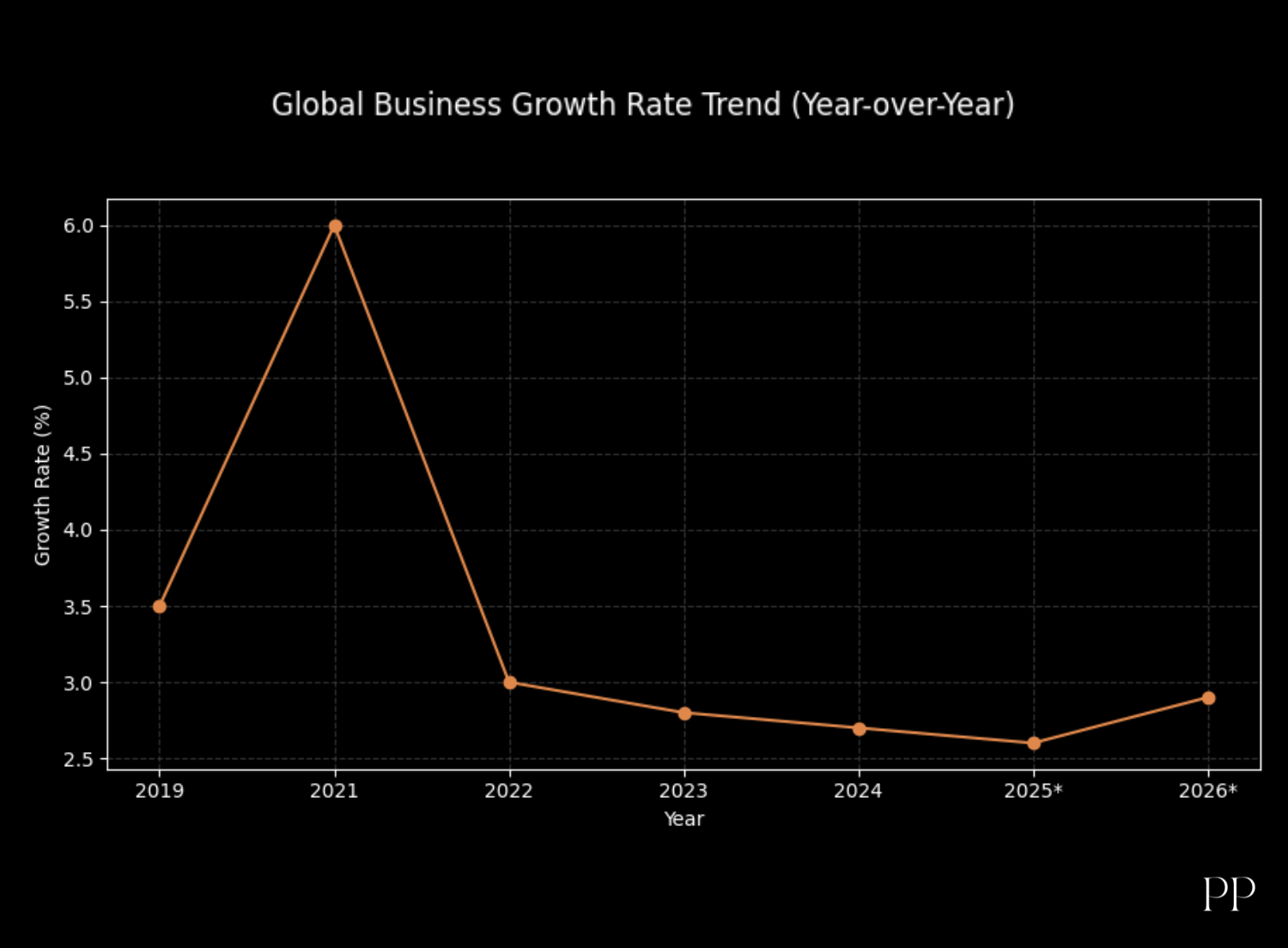

As economic headwinds intensify worldwide, major corporations across sectors are aggressively cutting costs — from workforce reductions to strategic program suspensions — in response to slowing growth, rising input prices, and rising investor scrutiny.

Recent corporate actions and analyst surveys show that cost optimization is becoming central to corporate planning for 2026, reflecting broader concerns over demand softness and margin erosion.

Surveyed CFOs Brace for Dual Pressures: Growth and Cost Control

A recent survey by Gartner highlights a stark reality for financial leaders: executives are anticipating a “very explicit tension” between the need to drive growth and cut costs next year. CFOs are preparing for slower expansion, rising expenses, and more stringent return targets from investors.

This new corporate mindset marks a shift from previous years where growth — even if modest — was prioritized over structural cost discipline.

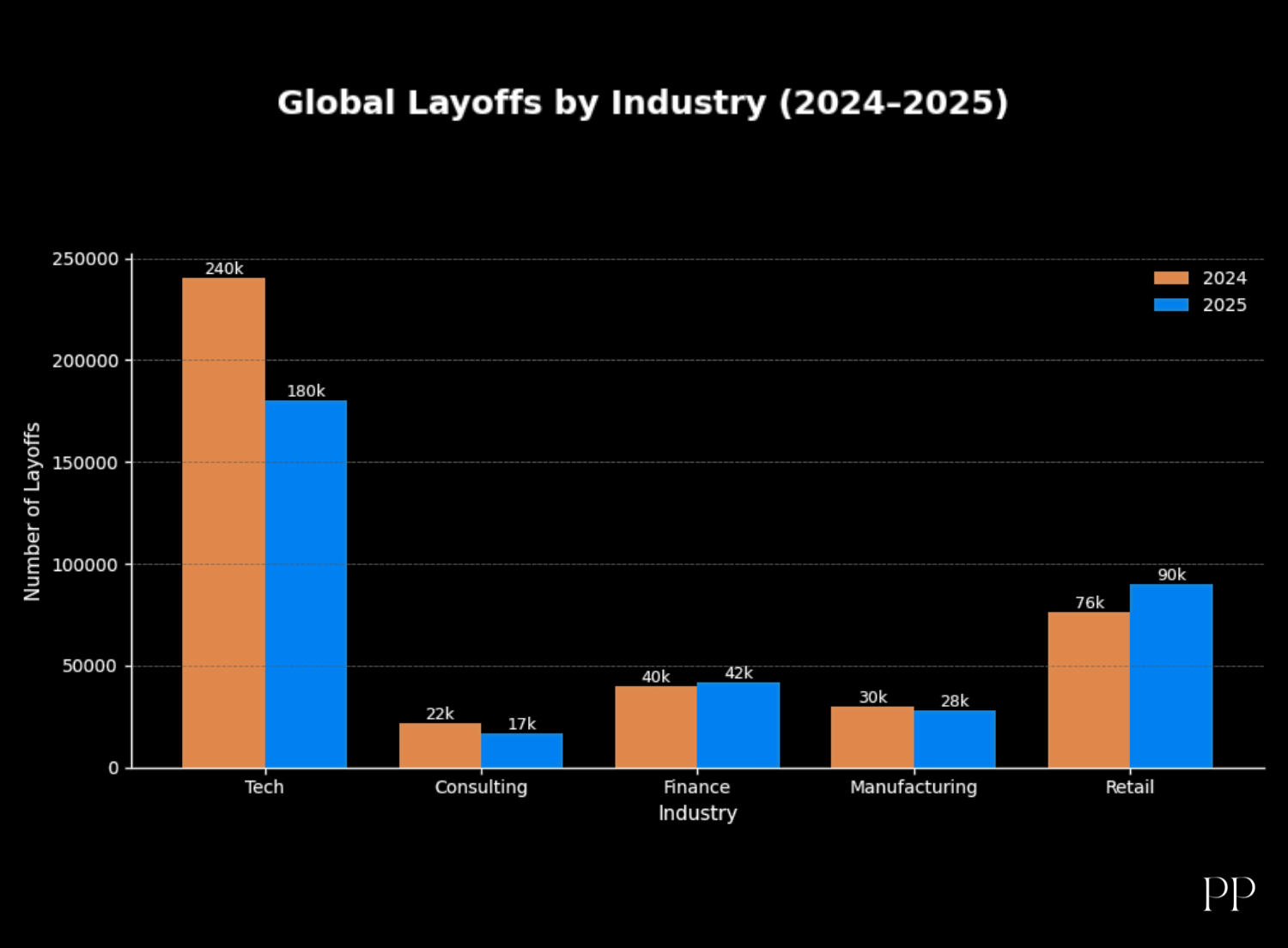

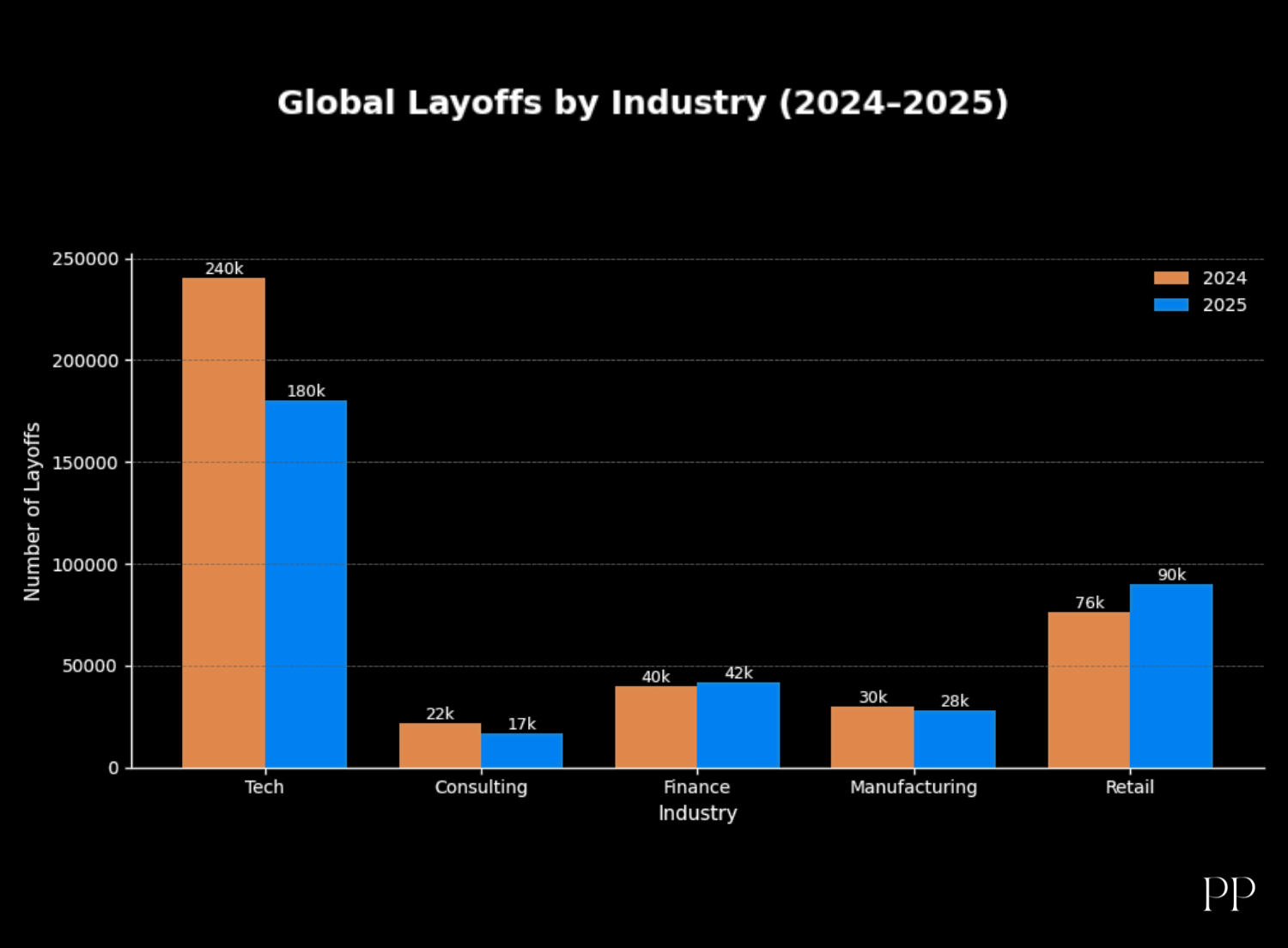

Job Cuts Across Industries: Tech, Consulting, and Beyond

One of the most visible signs of cost containment has been layoffs:

One of the most visible signs of cost containment has been layoffs:

- McKinsey & Company is weighing fresh reductions in support staff, potentially cutting around 10% of roles in non-client-facing functions as it adapts to slower demand and technology integration.

- Broader industry data shows a significant uptick in job cuts globally, including big names in technology, consulting, logistics, and finance, as AI automation and efficiencies reshape workforce structures.

These workforce changes aren’t limited to one geography — companies in the U.S., Europe, and Asia are all adjusting headcounts to align expenses with revenue prospects.

Strategic Program and Budget Reductions

Beyond layoffs, corporations are trimming non-core initiatives:

- Meta recently halted its third-party VR headset program, part of a broader push to tighten budgets and refocus investment on priority areas.

Program suspensions like this show that even growth-oriented segments — such as metaverse hardware — are not immune to cost scrutiny when near-term returns are uncertain.

Macro Pressures: Prices, Slowing Demand, and Market Sentiment

Underlying these corporate decisions are broader economic challenges:

- U.S. business activity has slowed to its lowest pace in months, with rising input prices squeezing margins — a dynamic that pressures firms to manage costs more tightly.

- Weak consumer and business sentiment globally is creating a more cautious spending environment, reducing the confidence firms have in forecasting robust growth.

These conditions are prompting companies to act pre-emptively, rather than waiting for deeper downturn signals.

Cost Cuts as Competitive Strategy

In many cases, cost cutting has become more than a defensive move — it’s a strategic necessity:

- Firms facing investor pressure are prioritizing efficiency and profitability over expanding workforce or broad venture spending.

- Emphasis on technologies such as AI and automation is being framed as both a cost solution and a competitive differentiator.

Rather than viewing these changes as temporary belt-tightening, many companies see them as essential to reposition for future market dynamics.

Looking Ahead: Strategy and Stability

Despite the immediate cost pressures, the shift toward leaner operations doesn’t necessarily spell recession. Instead, many companies are recalibrating for sustainable growth in a more challenging global economy.

Organizations that balance cost discipline with strategic investments — especially in innovation and digital transformation — are likely to navigate this period more successfully than those relying solely on cuts.

Summmary

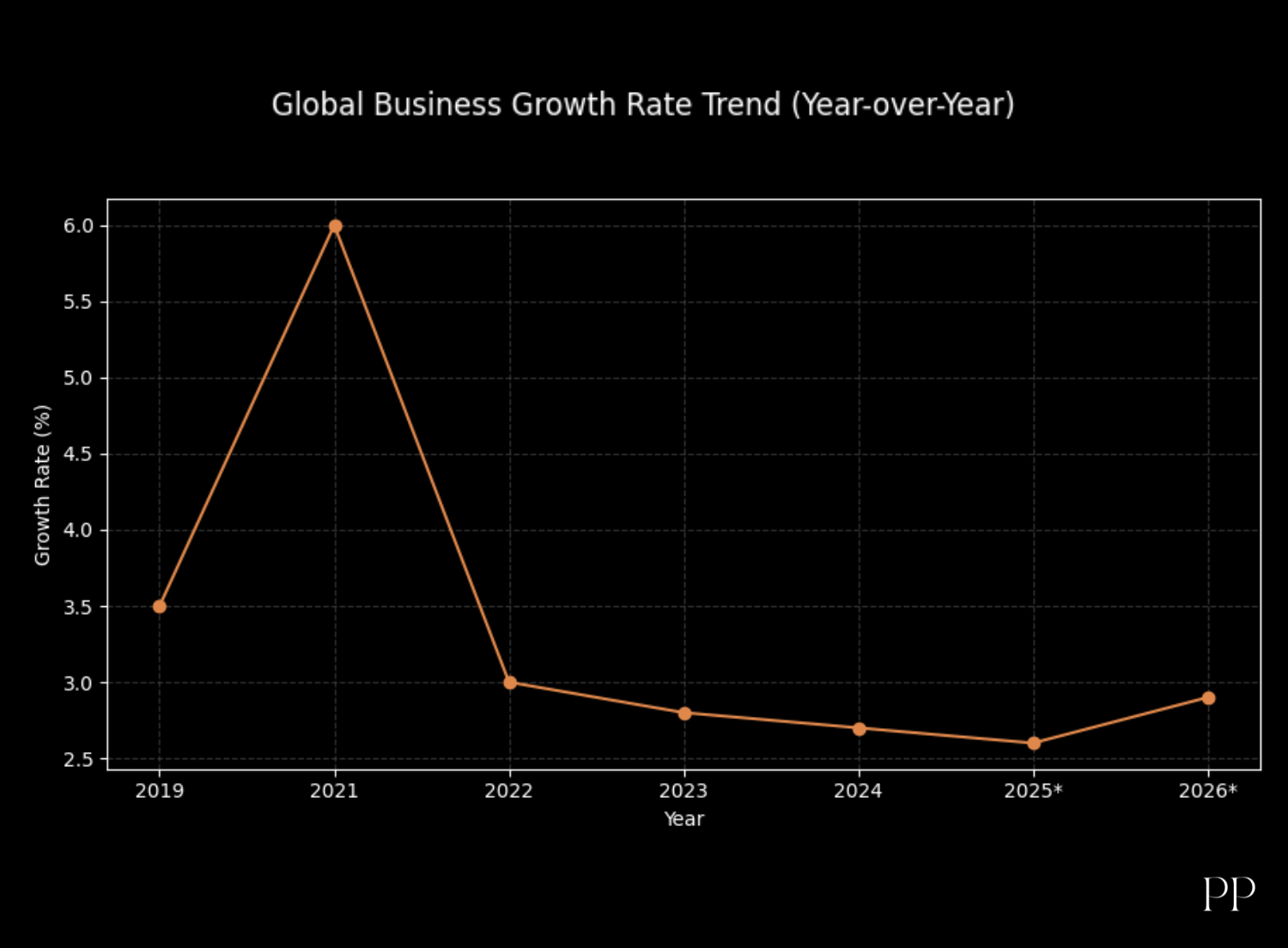

Global companies are increasingly tightening their belts as economic growth slows and cost pressures intensify. After a brief post-pandemic rebound, weaker demand, higher input costs, and elevated interest rates have forced firms across sectors to prioritize efficiency over expansion.

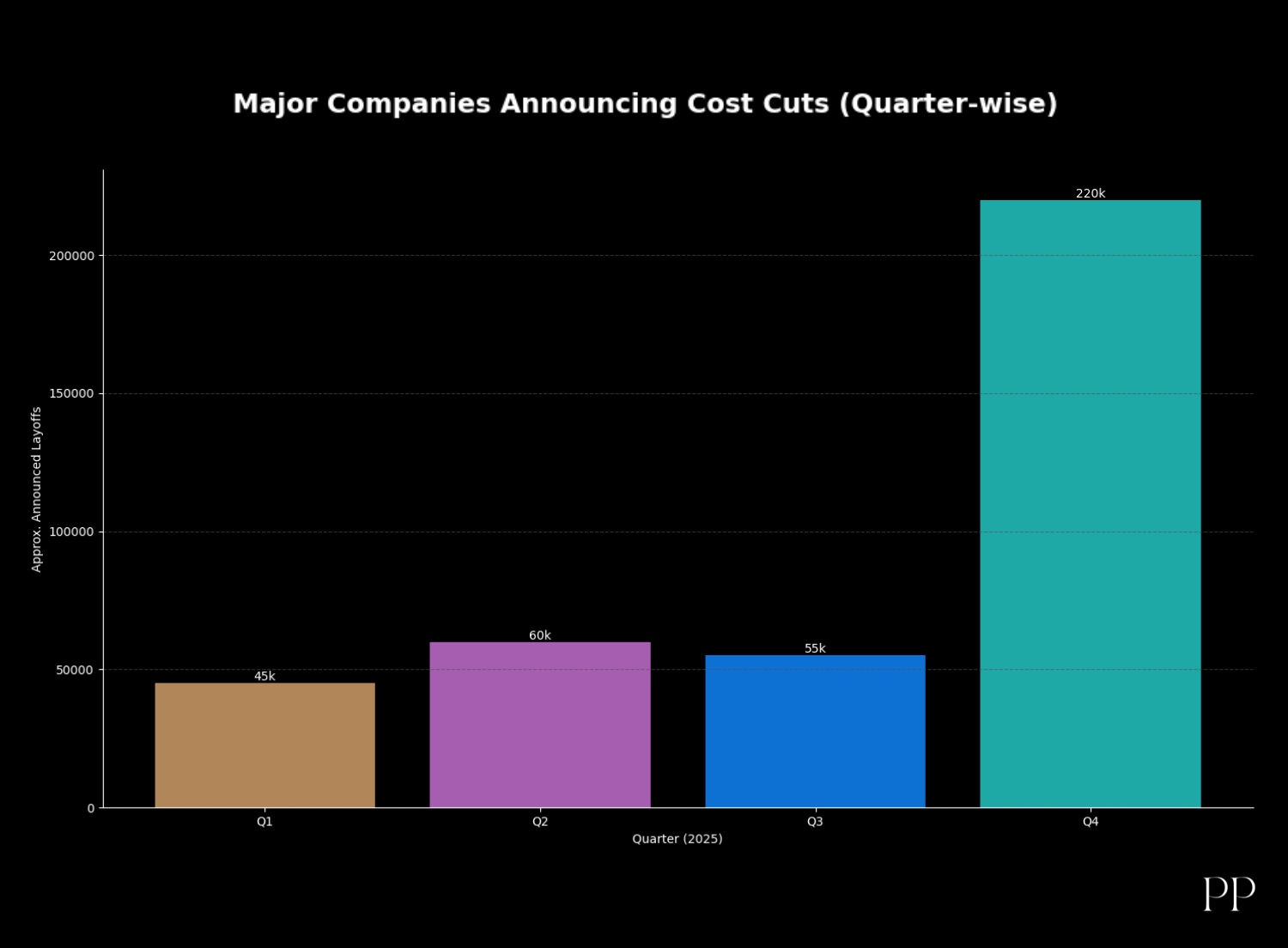

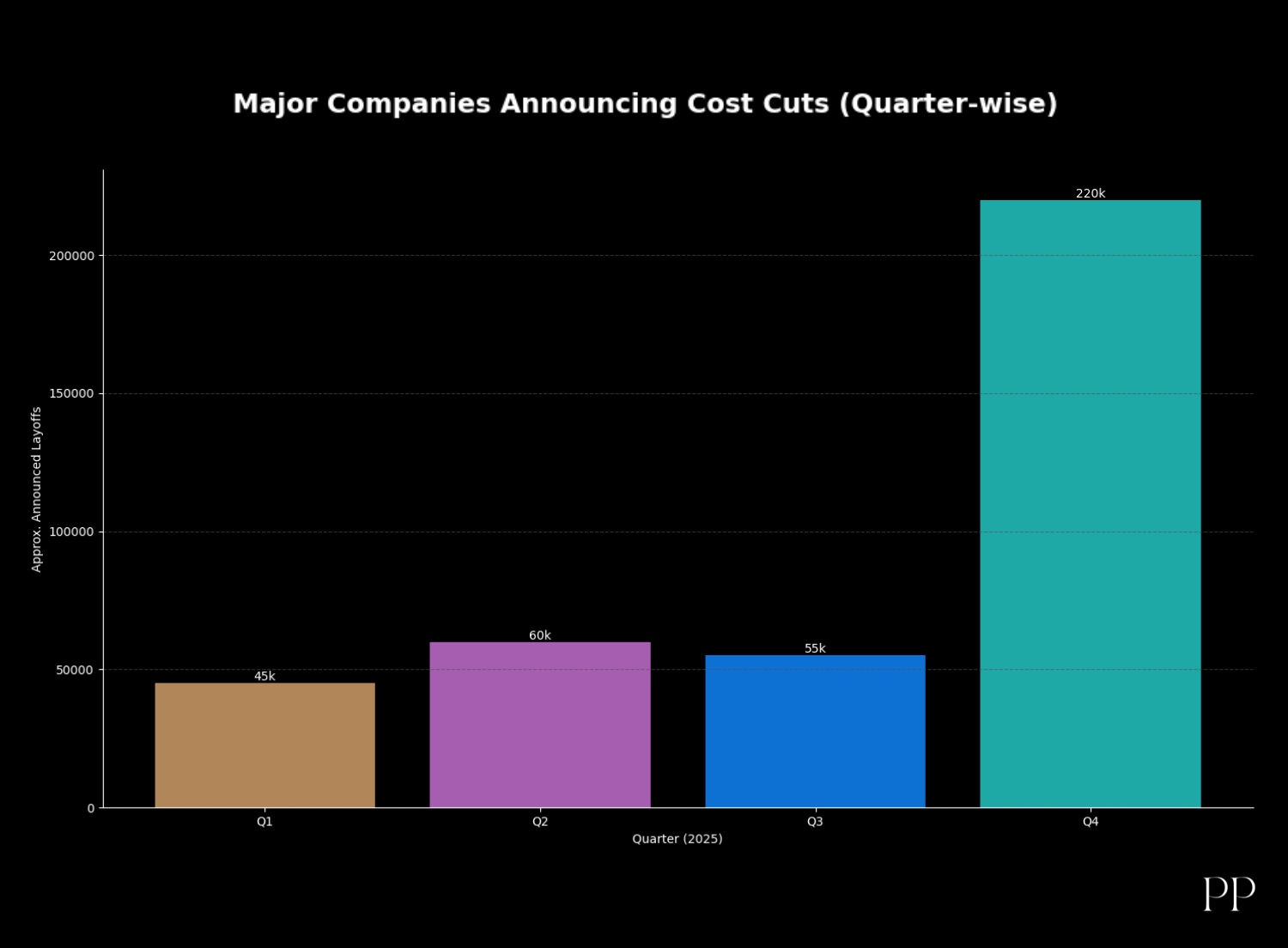

Many large corporations—particularly in technology, finance, consulting, manufacturing, and retail—have responded with layoffs, hiring freezes, and the scaling back of non-core projects. Cost-cutting announcements have accelerated through the year, peaking in later quarters as companies adjust forecasts and protect profit margins.

Overall, the trend reflects a strategic reset: companies are shifting from growth-at-any-cost to disciplined operations, aiming to stay resilient in a more challenging and uneven global economic environment.