Kraft Heinz Plans Restructuring and Asset Sales

Image Credit : Bloomberg

Source Credit : Portfolio Prints

The Kraft Heinz Company, one of the world’s largest food and beverage conglomerates, has unveiled a sweeping corporate restructuring plan that could reshape its future and unlock shareholder value after years of stagnating sales and investor pressure.

Breaking Up a Decade‑Old Mega Merger

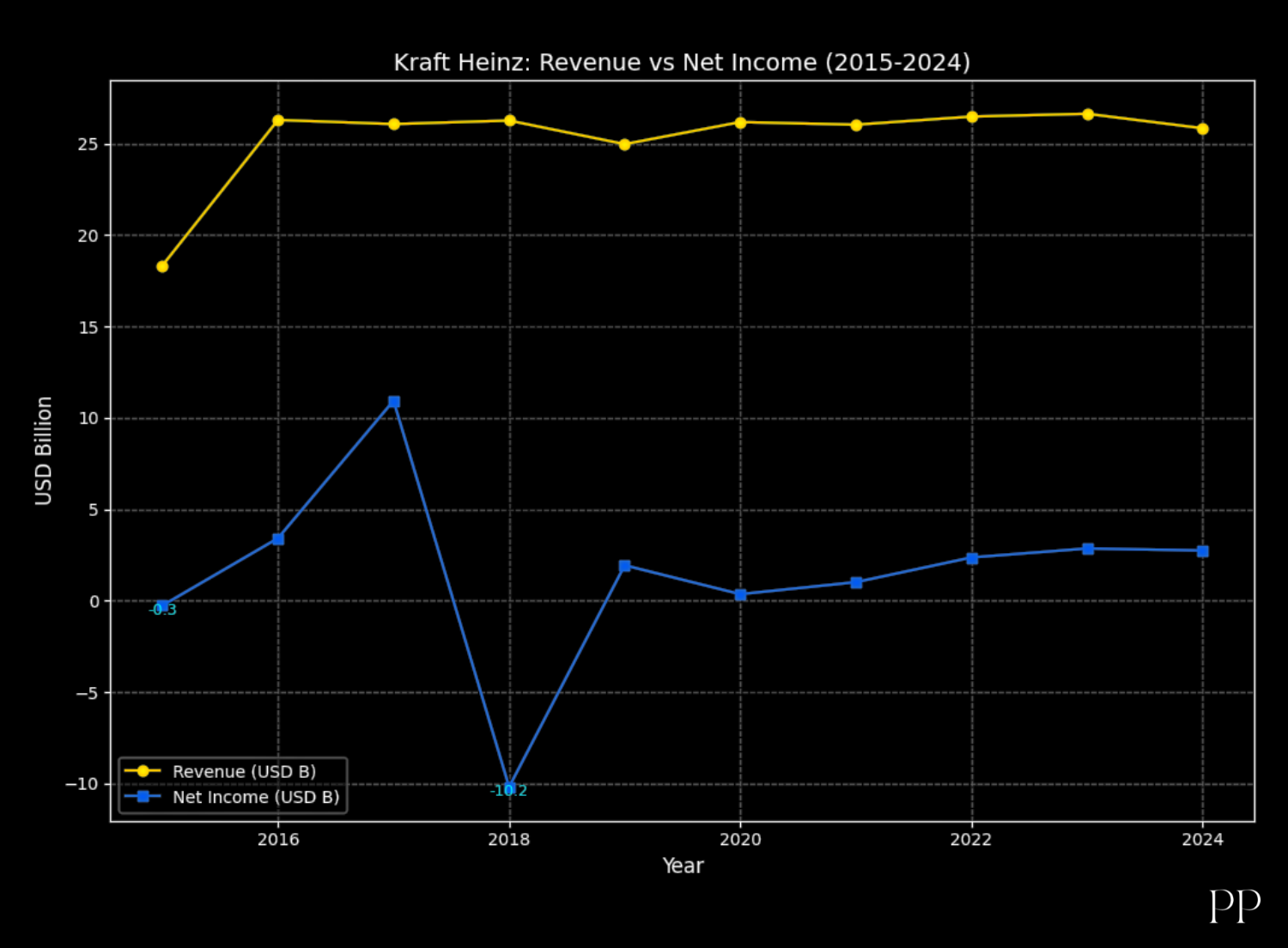

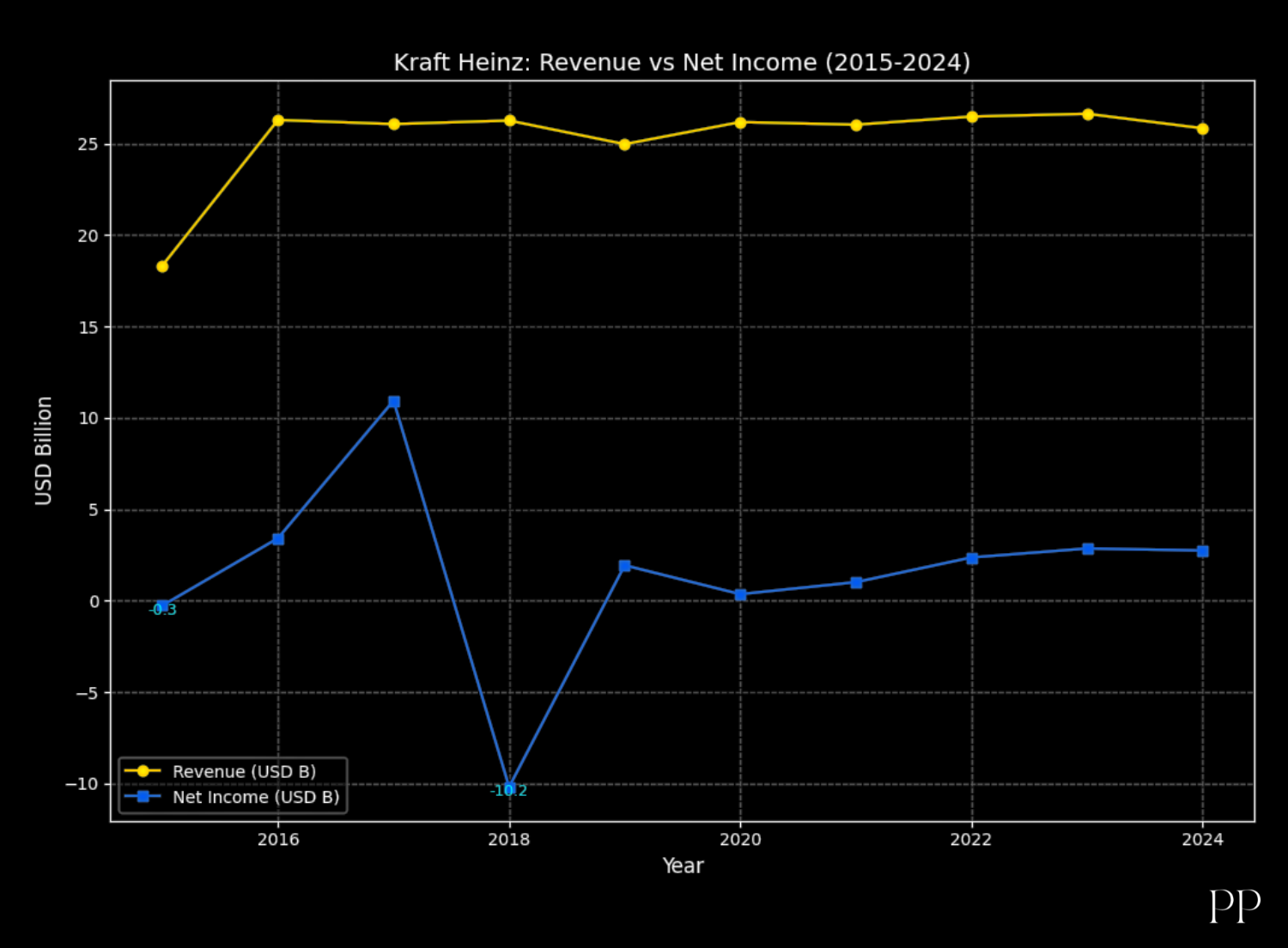

Founded by the iconic 2015 merger between Kraft Foods and H.J. Heinz — a deal backed by Berkshire Hathaway and 3G Capital — Kraft Heinz has struggled with slowing revenue growth and shifting consumer preferences away from traditional processed food products. Recent years have seen underperformance relative to peers in the consumer staples sector.

In response, the company’s board has approved a plan to separate Kraft Heinz into two independent, publicly traded companies through a tax‑free spin‑off, aiming for completion by late 2026.

What the New Structure Will Look Like

Under the planned split:

Global Taste Elevation Co.

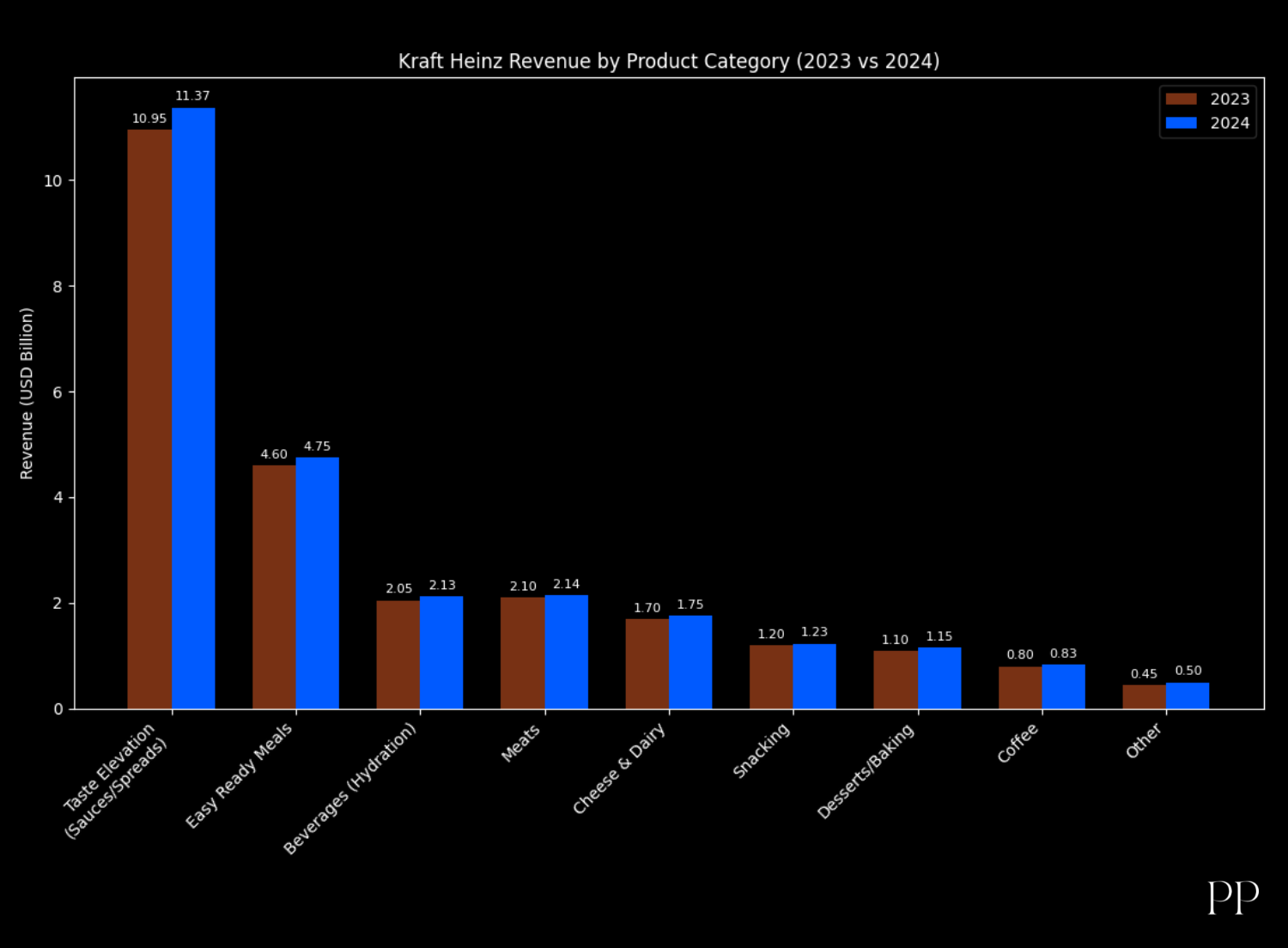

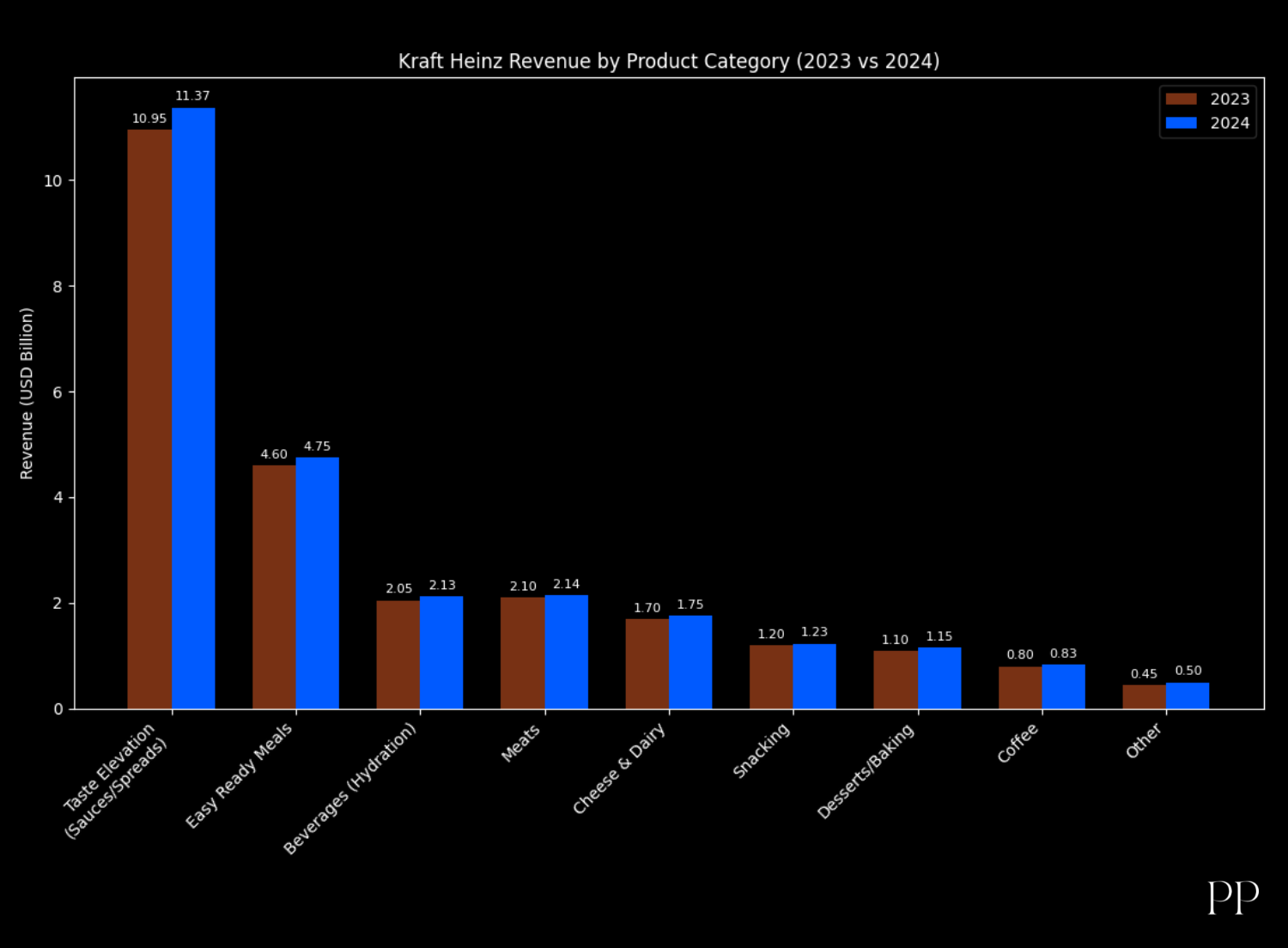

This new company will focus on high‑growth, high‑margin categories such as sauces, spreads, and seasonings. It will house iconic brands including Heinz ketchup, Philadelphia cream cheese, and Kraft Mac & Cheese.

North American Grocery Co.

This unit will encompass the company’s traditional grocery staples, such as Oscar Mayer meats, Kraft Singles, and Lunchables — brands deeply rooted in U.S. supermarket aisles.

The rationale: by simplifying the business and creating focused strategic priorities, Kraft Heinz hopes each company can pursue tailored growth initiatives, better allocate capital, and improve operational performance.

Leadership Shakeup Signals New Direction

As part of this shift, Kraft Heinz has appointed Steve Cahillane as its new CEO, effective January 1, 2026. Cahillane — the former CEO of Kellogg — is tasked with steering the transformation and will go on to lead the sauces‑focused Global Taste Elevation Co. after the split. His hiring reflects confidence in his ability to manage complex restructurings and unlock latent value in heritage food brands.

Outgoing CEO Carlos Abrams‑Rivera will remain involved through early 2026 before taking leadership of the North American Grocery unit, though the company has also launched an external search for a new CEO for that entity.

| Period |

CEO |

Notes |

| Jan 1, 2024 – Dec 31, 2025 |

Carlos Abrams‑Rivera |

Served as CEO after being appointed effective January 1, 2024. |

| Jan 1, 2026 – (planned) |

Steve Cahillane |

Appointed as CEO effective January 1, 2026; will lead the Global Taste Elevation Co. following the planned split. |

| Jan 1, 2026 – Mar 6, 2026 |

Carlos Abrams‑Rivera (Advisor) |

After stepping down, Abrams‑Rivera will continue as an advisor through March 6, 2026 during the transition. |

Why Now? Economic & Strategic Pressures

Several factors have converged to prompt this major reorganization:

- Weakening financial performance: Despite a recent quarterly earnings beat, Kraft Heinz reported weaker revenue and revised lower full‑year guidance, highlighting ongoing demand challenges.

- Shifting consumer trends: Many shoppers are turning toward healthier, fresh, or private‑label alternatives, squeezing traditional packaged food categories.

- Investor expectations: Longtime shareholders, including influential market players, have pressed for moves to improve valuation and streamline operations.

Industry analysts see the breakup as an effort to tailor strategies and make each business more agile in responding to evolving market conditions. However, skepticism remains — particularly about whether the combined valuation post‑split will truly outpace the standalone firm’s performance.

Industry analysts see the breakup as an effort to tailor strategies and make each business more agile in responding to evolving market conditions. However, skepticism remains — particularly about whether the combined valuation post‑split will truly outpace the standalone firm’s performance.

Asset Sales and Market Impact

While the spin‑off constitutes the centerpiece of Kraft Heinz’s strategy, analysts also expect potential divestitures of non‑core assets — particularly within slower‑growth segments — as part of streamlining initiatives. Such asset sales, if pursued, could finance growth initiatives or be used to pay down debt, though deals (like previous attempts with Oscar Mayer and Maxwell House) have attracted cautious interest.

The restructuring has had immediate market impacts: Kraft Heinz’s share price experienced volatility following the split announcement, underscoring mixed investor response.

Outlook

Kraft Heinz’s transformation represents one of the boldest moves in its recent history — essentially undoing a decade‑old merger to create two leaner, more focused giants. The success of the plan hinges on execution quality, leadership effectiveness, and the ability to navigate evolving consumer preferences in a competitive global food market.

If successful, the breakup could reenergize once‑stagnant brands and unlock long‑dormant shareholder value — but it also raises risks tied to execution challenges and market sentiment. Analysts believe the next 12–18 months will be crucial in determining whether this bold restructuring pays off.