Warren Buffett Steps Down as Berkshire Hathaway CEO

Image Credit : Drew Angerer | Getty Images

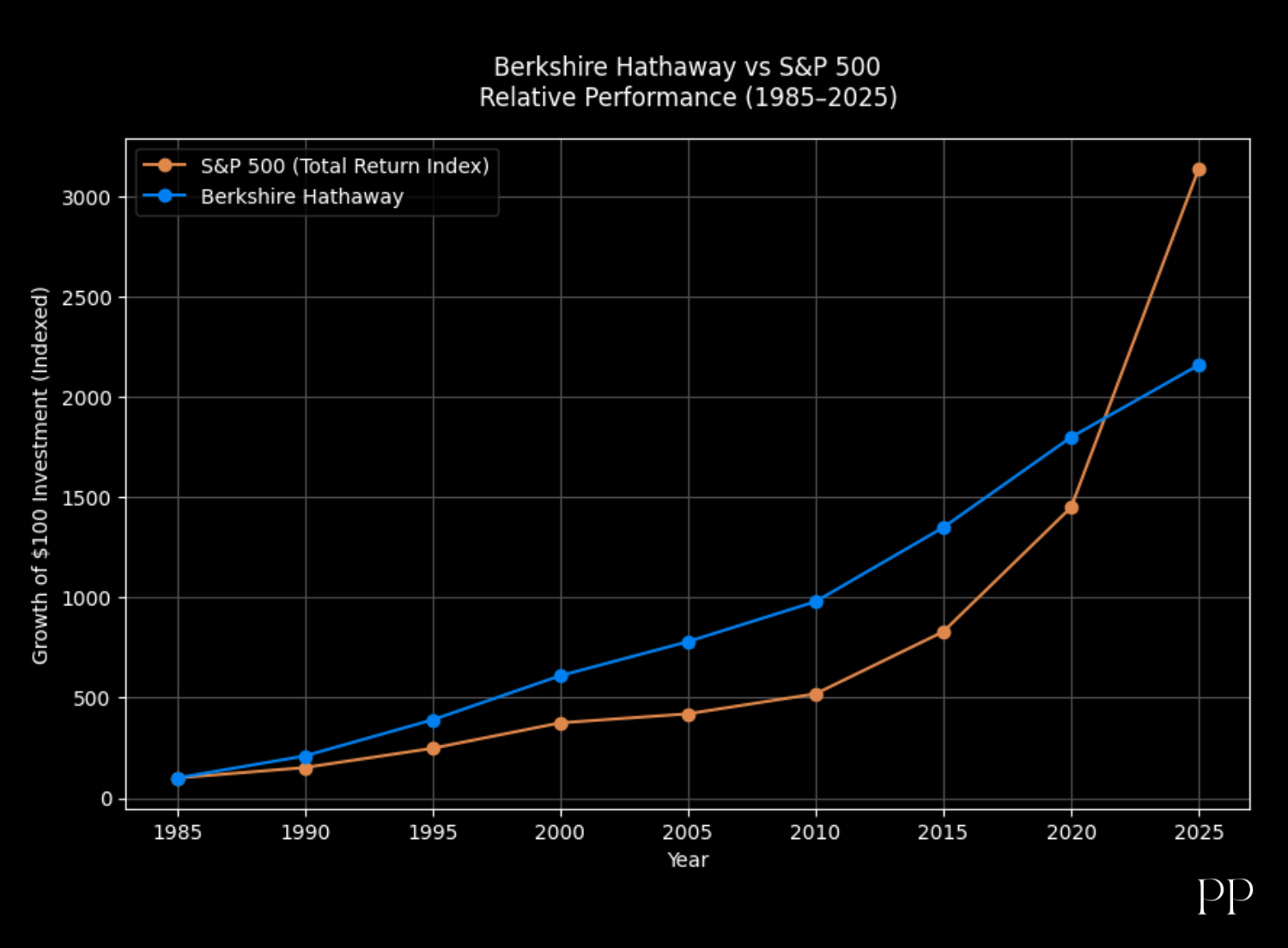

Source Credit : Portfolio Prints

Introduction

In a historic shift for one of the world’s most influential companies, Warren Buffett, has officially stepped down as the Chief Executive Officer of Berkshire Hathaway, drawing to a close an extraordinary leadership tenure that lasted nearly 60 years. The announcement marks a monumental transition for investors, businesses, and financial markets worldwide.

A Legendary Career Comes to an End

Warren Buffett took the helm of Berkshire Hathaway in the mid-1960s, transforming it from a struggling textile mill into a highly diversified powerhouse with holdings in insurance, railroads, energy, consumer products, and major stock investments. Over decades, Buffett’s value-oriented investing and capital allocation strategies made Berkshire one of the world’s most admired companies and made him one of the wealthiest people on the planet.

Despite stepping down as CEO, Buffett will remain as Chairman of the Board and plans to continue coming into the office regularly, providing guidance and continuity during the leadership transition.

Despite stepping down as CEO, Buffett will remain as Chairman of the Board and plans to continue coming into the office regularly, providing guidance and continuity during the leadership transition.

Greg Abel: The New CEO

Buffett’s chosen successor, Greg Abel, formally took over as CEO on January 1, 2026. Greg Abel, has been with Berkshire since 2000 and most recently served as Vice Chairman overseeing the company’s non-insurance operations — including energy, manufacturing, transportation, and consumer businesses.

Abel’s leadership marks a new chapter. While his style may be more traditional and hands-on than Buffett’s, analysts note he is committed to preserving Berkshire’s decentralized structure and long-term investment philosophy that Buffett championed.

| Year |

Milestone |

Notes |

| 1999 |

Joined Berkshire Hathaway through MidAmerican acquisition |

Abel came into the Berkshire orbit when Buffett’s company bought a controlling stake in MidAmerican Energy. He was already an executive at MidAmerican. |

| 2008 |

Named CEO of MidAmerican Energy |

Elevation to chief executive of Berkshire Hathaway Energy. |

| 2013 |

NV Energy acquisition (~$5.6B) |

Expanded BHE into Nevada utilities. |

| 2018 |

Vice Chairman, Non-Insurance Operations at Berkshire |

Expanded role to oversee most Berkshire businesses outside insurance. |

| 2020 |

Dominion Energy natural gas acquisition (~$8B) |

Major energy infrastructure expansion. |

| 2026 |

Greg Abel becomes CEO of Berkshire Hathaway |

Official leadership transition at the end of Buffett’s six-decade tenure. |

Market Reaction and Investor Sentiment

The transition has already influenced the markets. Berkshire Hathaway’s share price fell modestly shortly after Buffett’s departure, reflecting investor uncertainty about the post-Buffett era. Some analysts say the company faces challenges such as finding large acquisition targets and managing an enormous cash reserve — tasks Buffett often approached with legendary patience.

What Doesn’t Change

Despite leadership shifts, several core elements of Berkshire’s strategy remain intact:

- Buffett’s oversight as Chairman continues to reassure many long-term shareholders

- The decentralized corporate culture, which gives autonomy to subsidiary leaders, is expected to be preserved.

- The company’s long-held investing principles, favoring value and patience, are likely to continue under Abel’s tenure.

Legacy and the Road Ahead

Warren Buffett’s departure as CEO ends an era that defined modern value investing. His leadership turned Berkshire Hathaway into a nearly $1-trillion conglomerate and helped reshape how generations of investors think about capital allocation, patience, and market opportunities.

Greg Abel now shoulders the responsibility to navigate a post-Buffett Berkshire, balance tradition with innovation, and earn the confidence of investors who long equated the company’s success with Buffett’s stewardship. His success will likely be measured not by dramatic shifts, but by maintaining Berkshire’s resilience and competitive edge in the decades to come.

Conclusion

Greg Abel’s rise to CEO marks a carefully planned transition at Berkshire Hathaway rather than a break from the past. With decades of experience overseeing energy, utilities, and non-insurance operations, Abel brings strong operational discipline and continuity to the conglomerate. While the post-Buffett era presents challenges—especially capital allocation and maintaining investor confidence—Berkshire’s long-term philosophy and decentralized culture remain firmly intact under his leadership.