Source Credit : Portfolio Prints

Background

Wall Street’s banking sector is showing resilience in the opening days of 2026, with major financial stocks holding firm—even rising—just as analysts and investors gear up for the critical fourth-quarter earnings season. After a strong performance in 2025, banking shares have continued to attract attention from market participants, serving as a key driver of broader market confidence.

Financial Stocks Showing Strength

Major U.S. bank shares have remained buoyant:

- Bank of America has seen its stock climb roughly 2%, leading a rally in financials as investors position ahead of earnings releases.

- Citigroup is trading near its 52-week high after Barclays lifted its price target ahead of earnings season.

- Broader sector strength was highlighted by Goldman Sachs and other financial firms hitting new highs, underlining sustained investor appetite for bank equities.

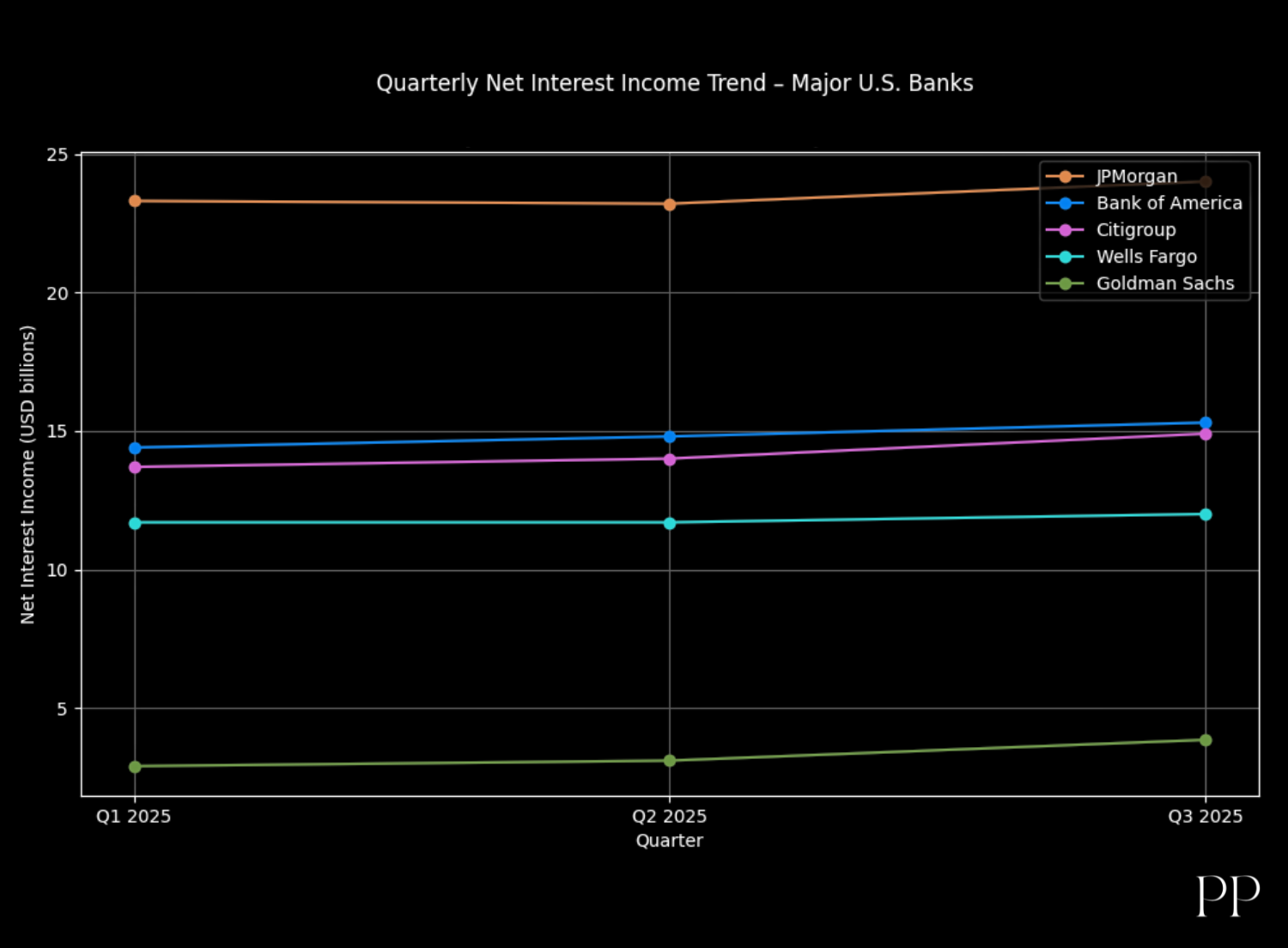

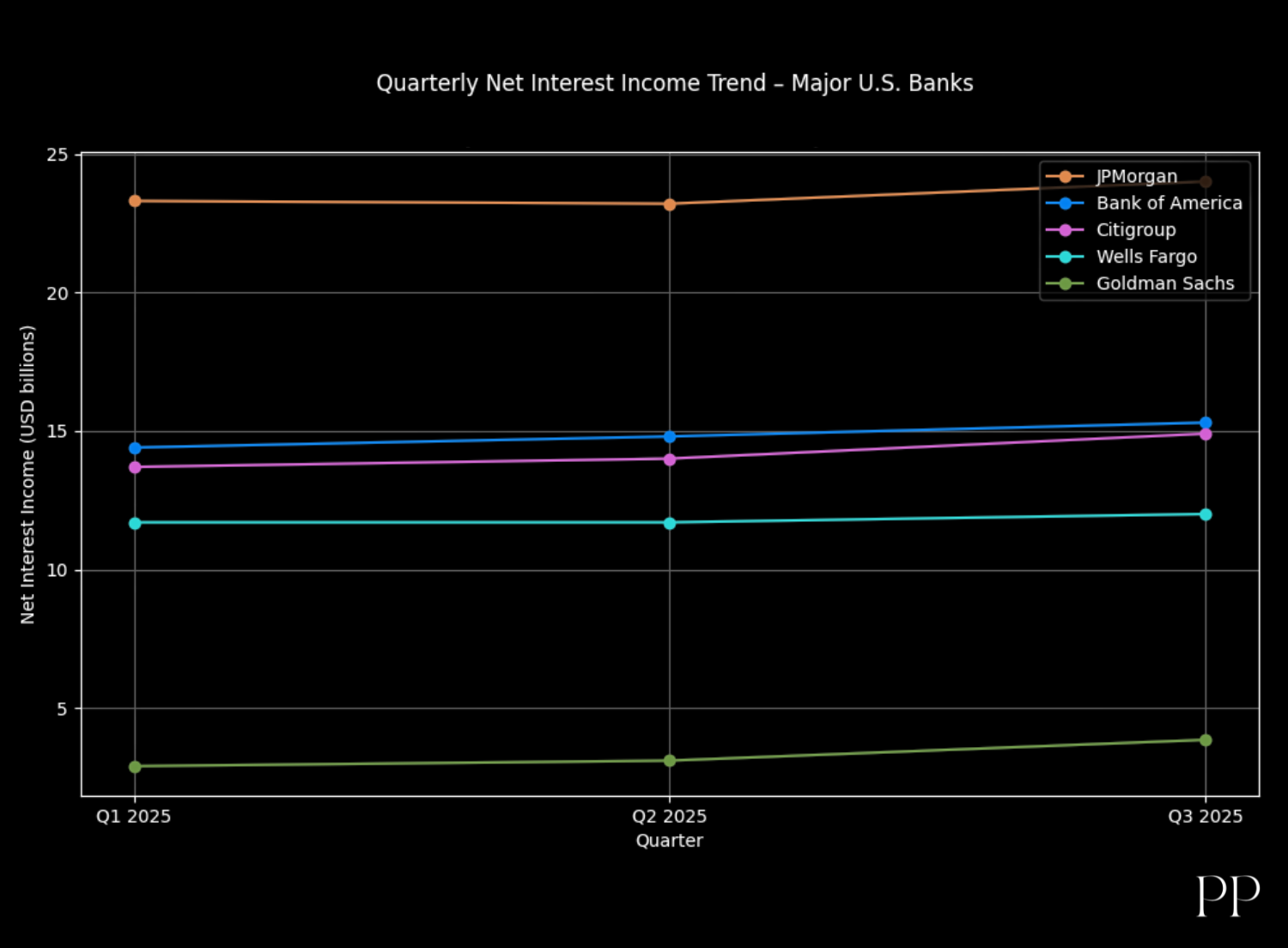

Analysts and money managers point to resilient net interest income trends, strong capital positions, and improving credit conditions as key reasons banks have held up despite macroeconomic uncertainties. Banks’ earnings growth in 2025 helped fuel this momentum, positioning them for further gains if results continue to exceed expectations.

Analysts and money managers point to resilient net interest income trends, strong capital positions, and improving credit conditions as key reasons banks have held up despite macroeconomic uncertainties. Banks’ earnings growth in 2025 helped fuel this momentum, positioning them for further gains if results continue to exceed expectations.

What’s Driving Sector Resilience

Several factors are supporting the banking sector as earnings season approaches:

Interest Rate Environment and Net Interest Income

Even as the Federal Reserve’s stance on rates remains a focal point for markets, banks have benefited from a steepening yield curve and stabilizing net interest margins, which boosts the profitability of core lending businesses. Analysts see this backdrop as favorable for earnings growth in coming quarters.

Upgrades from Wall Street Analysts

Bullish signals, such as Barclays raising price targets for major lenders like Bank of America, reflect confidence in both earnings trends and the sector’s fundamental strength. These upgrades often influence investor positioning ahead of earnings reports.

Strength in Loan Growth and Balance Sheets

Banks have reported continued expansion in lending volumes and solid balance sheet metrics, which help sustain profitability even in a competitive environment for deposits and funding.

Earnings Season: What to Watch

The upcoming earnings season—beginning in mid-January—is expected to offer the first real test of how sustained this banking strength truly is. Key points of focus include:

- Net interest income (NII) trends: Will margin pressure from rate cuts weigh on earnings, or will improved loan demand offset this?

- Credit quality: With broader economic growth moderating, the level of loan defaults (or lack thereof) will be closely monitored.

- Capital deployment strategies: Share buybacks and dividends could signal management confidence and help support bank valuations.

- Investment banking fees: A rebound in M&A and capital markets activity would provide an added earnings tailwind.

Major U.S. banks such as JPMorgan Chase, Wells Fargo, Citigroup, and Bank of America are among the first to report, and investors will be listening closely to management commentary for guidance on 2026 outlooks.

Global Banking Sentiment

The strengthening trend isn’t confined to the U.S.— European bank stocks have reached highs not seen since 2008, driven by expectations of net interest income rebound and structural improvements across loan markets. Meanwhile, global banking indices underscore renewed confidence among investors in financials broadly.

Bottom Line

As the earnings season looms, the banking sector’s resilience is a standout story in global markets. After a strong run in 2025 and positive early trading in 2026, banking stocks are holding up well. The upcoming earnings reports will be pivotal in confirming whether this strength reflects sustainable earnings momentum or simply market optimism heading into the reporting cycle.

Investors will be paying close attention to earnings beats/misses, insight on interest income trends, and broader economic commentary from bank executives—factors that could set the tone for market direction in 2026.