Source Credit : Portfolio Prints

Background

The global luxury retail industry — long seen as resilient and immune to mainstream economic pressures — is undergoing a period of intense strategic stress. At the heart of the turmoil are leadership upheavals at marquee companies and persistent sales headwinds that are forcing brands and retailers to rethink long-standing business models.

Leadership Shakeups Signal Strategic Reassessment

One of the most visible indicators of strain has been the resignation of Marc Metrick, CEO of Saks Global Enterprises, the U.S. luxury department store operator behind brands like Saks Fifth Avenue and Neiman Marcus. Metrick’s departure comes as the company grapples with heavy debt taken on from its ambitious $2.7 billion merger and mounting financial losses — including missed debt payments — that have pushed the business toward potential bankruptcy proceedings.

Executive Chairman Richard Baker has stepped into the CEO role to steer the company through restructuring, highlighting how leadership changes are now closely tied to survival strategies rather than purely growth agendas.

| Year |

Company / Brand |

CEO Who Exited |

Reason / Context |

| 2025 (Aug) |

Valentino |

Jacopo Venturini |

Stepped down as CEO amid company restructuring and personal reasons |

| 2025 (June) |

Prada |

Gianfranco D’Attis |

Stepped down by mutual agreement in mid-2025. |

| 2025 (Sept) |

Gucci |

Stefano Cantino |

Brief tenure as CEO, replaced amid broader leadership restructuring. |

| 2025 (end) |

Stella McCartney |

Amandine Ohayon |

Exited as CEO ahead of leadership change (Tom Mendenhall incoming). |

| 2026 (Jan) |

Saks Global Enterprises |

Marc Metrick |

Stepped down as CEO as the company faces financial stress and potential bankruptcy. |

| 2026 (Jan) |

Givenchy (LVMH) |

Alessandro Valenti |

Replaced by Amandine Ohayon in a broader LVMH leadership reshuffle. |

These executive exits aren’t isolated. Across luxury groups, leadership realignment continues as brands seek fresh strategic direction amidst slowing growth. Even iconic houses like Gucci have seen creative and management transitions amid sliding sale figures, underscoring that leadership continuity is increasingly tied to competitive performance. (See related reports on broader industry leadership changes.)

Sales Pressures and Market Shifts

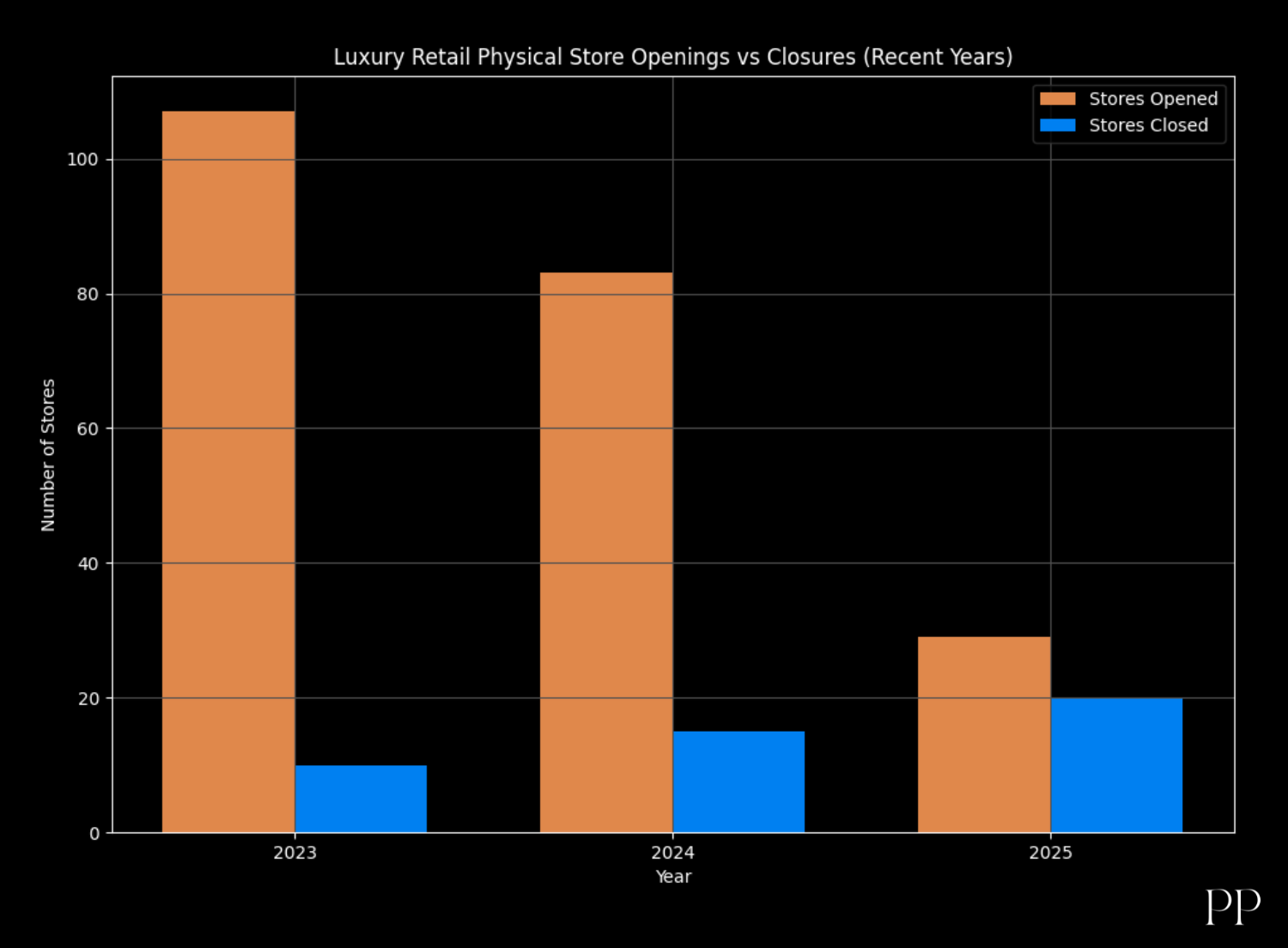

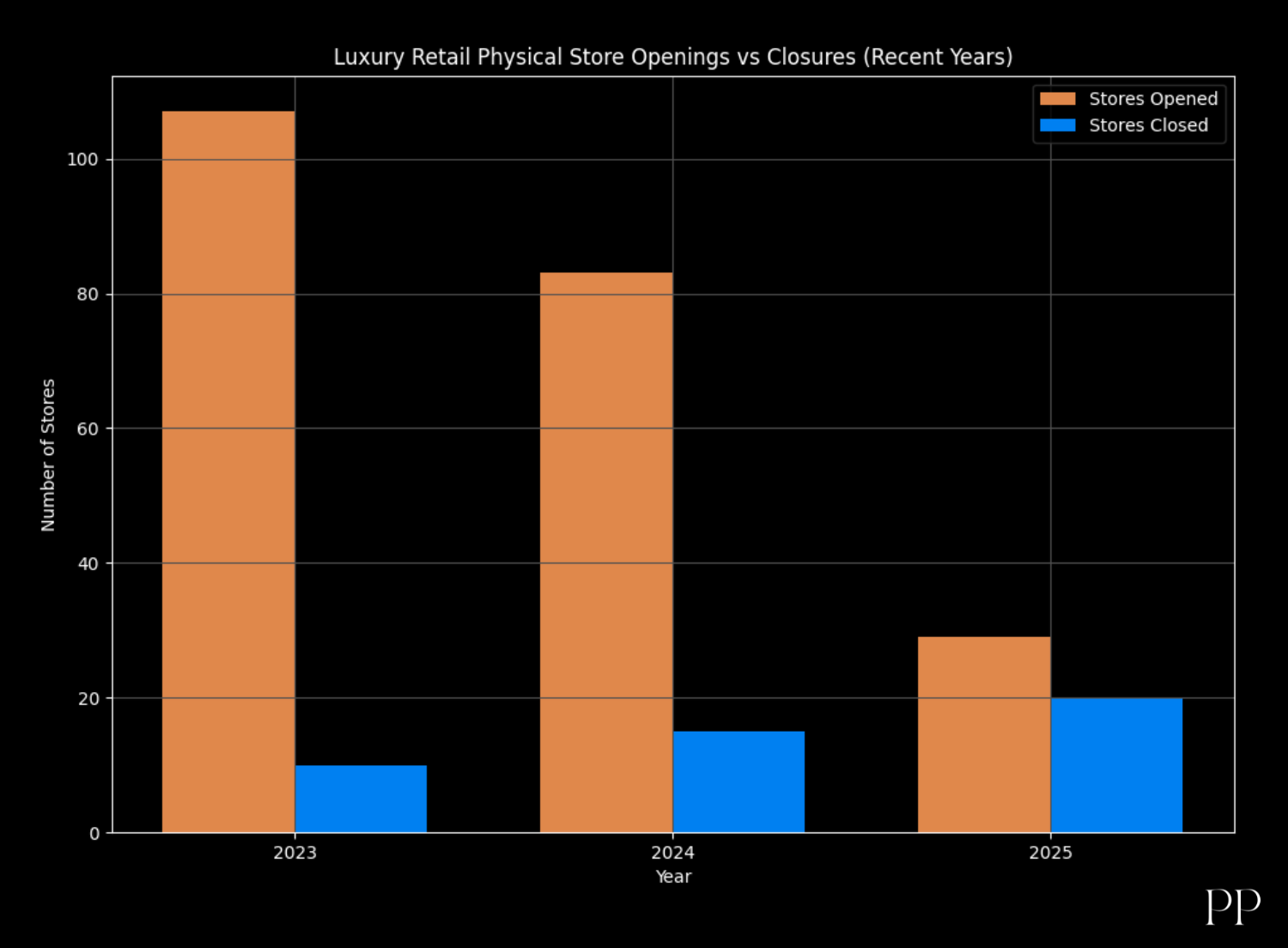

Luxury retail’s sales environment has shifted dramatically. Department stores like Saks are coping with declining foot traffic, weakening demand for high-value personal goods, and an acceleration toward direct-to-consumer and online channels. In reaction, retailers are experimenting with immersive in-store experiences, themed events, and architectural renovations aimed at driving engagement — but results have been mixed.

International data suggests the broader sector is also grappling with:

International data suggests the broader sector is also grappling with:

- Eroding customer bases: Luxury brands have lost millions of customers in recent years as higher prices push aspirational buyers out of the market. Consumers are more price-sensitive and increasingly turning to second-hand or accessible alternatives.

- Retail transformation pressures: Traditional multibrand department stores are under pressure from branded boutiques and digitally native retailers that capture younger, more tech-savvy shoppers.

- Economic headwinds: Global slowdowns in key luxury markets such as China and the U.S. have compounded the slowdown in discretionary spending.

Strategic Responses Taking Shape

Reinventing the In-Store Experience

With traditional foot traffic down, luxury department stores are leaning into curated experiences — from designer showcases to live events — intended to make bricks-and-mortar destinations more compelling. However, analysts warn that experiential investments need to be matched with compelling brand narratives and streamlined consumer journeys to be effective.

Direct-to-Consumer and Digital Channels

Leading fashion houses have accelerated their shift toward direct sales through flagship boutiques and digital platforms to improve margins and maintain tighter control over customer relationships. This trend has intensified competitive pressure on multibrand retailers whose reach historically rested on curated inventories and physical presence.

Leadership and Governance Overhauls

Luxury companies are accelerating leadership transitions not just as replacements but as strategic recalibrations. New CEOs are being tasked with reinvigorating brands, sharpening operational efficiency, and navigating volatile market conditions.

For example, Gucci’s appointment of a new CEO with a strong brand turnaround track record reflects this priority, while Saks’s executive shift places crisis management at the center of leadership goals.

Stabilization or Reinvention?

Industry consultancies forecast modest recovery in luxury sales in 2026, with uneven growth tied to consumer confidence and demand in key regions. But the path forward will likely hinge on how effectively luxury firms balance exclusivity with affordability perceptions, navigate shifting customer expectations, and leverage leadership talent to redefine growth strategies in a world where old paradigms of conspicuous consumption are fading.

Summary

The luxury retail sector is entering a period of uncertainty as several high-profile CEOs step down amid weakening sales momentum. Once driven by strong post-pandemic demand, the industry is now grappling with slower consumer spending, especially in key markets such as China and the US. Brands are facing pricing fatigue, softer tourism flows, and increased competition from resale and affordable luxury segments. Investor pressure has intensified as revenue growth cools, leading boards to reassess leadership strategies. The recent wave of CEO exits reflects broader concerns about how to adapt to changing customer preferences, digital transformation needs, and profitability challenges. Companies are expected to focus on streamlining operations, strengthening brand relevance, and investing in e-commerce and experiential retail to regain growth stability.