Indian Stock Market's IPO Boom 2025

Image Credit : Bloomberg

Source Credit : Portfolio Prints

What’s going on

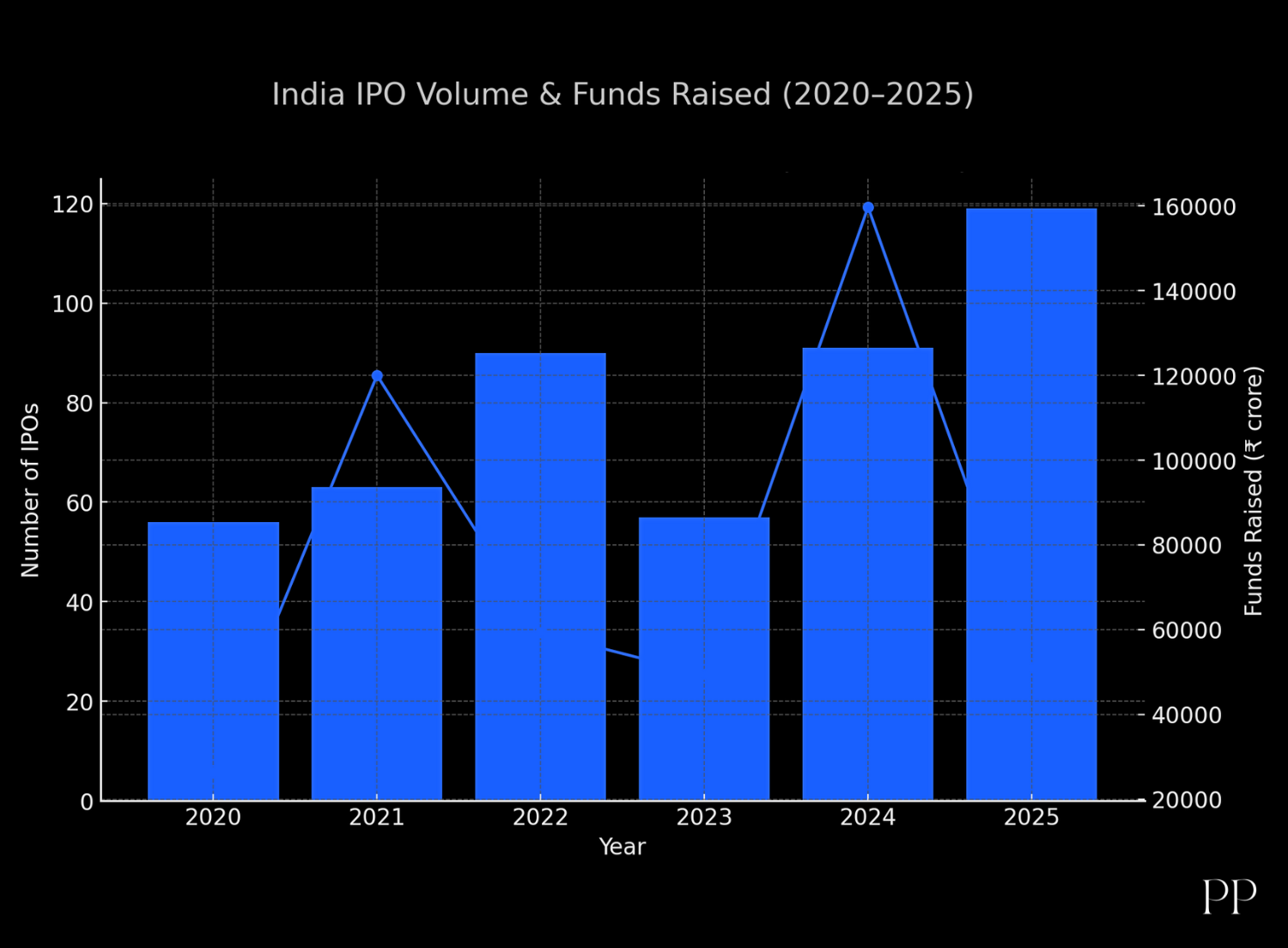

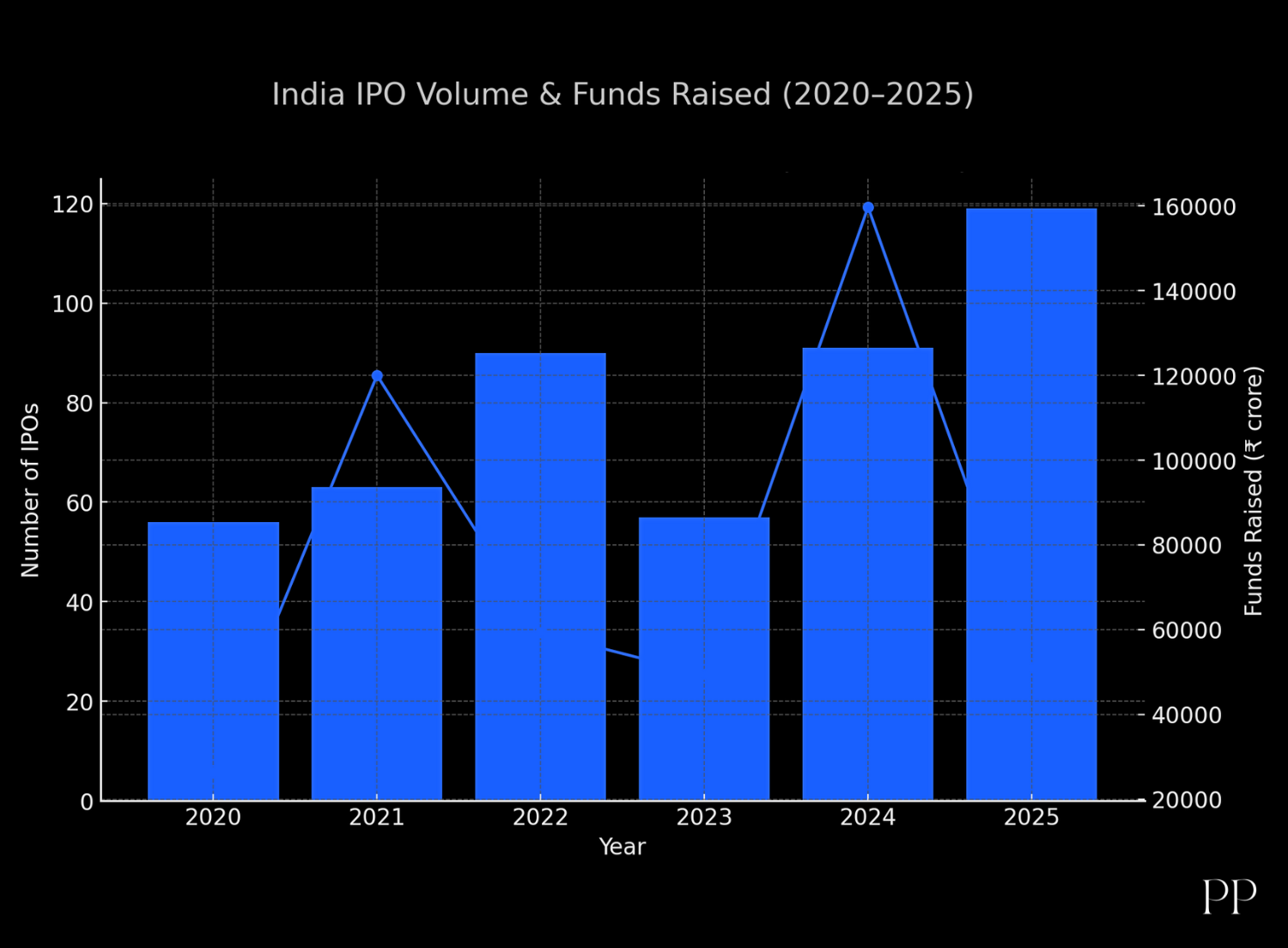

The Indian primary markets are experiencing a significant surge in initial public offerings (IPOs) in 2025. Some of the headline facts:

- More than 300 companies have listed so far this year, raising nearly US $16 billion by one estimate.

- India has emerged as the fourth-largest IPO market globally in 2025.

- Several big-ticket listings are in motion: for instance, PhysicsWallah set a price band targeting a ~US $3.19 billion valuation.

- Even in a somewhat muted broader equity market, companies are keen to tap public investors.

Why it’s happening

Several structural and market forces are aligning to fuel this IPO boom:

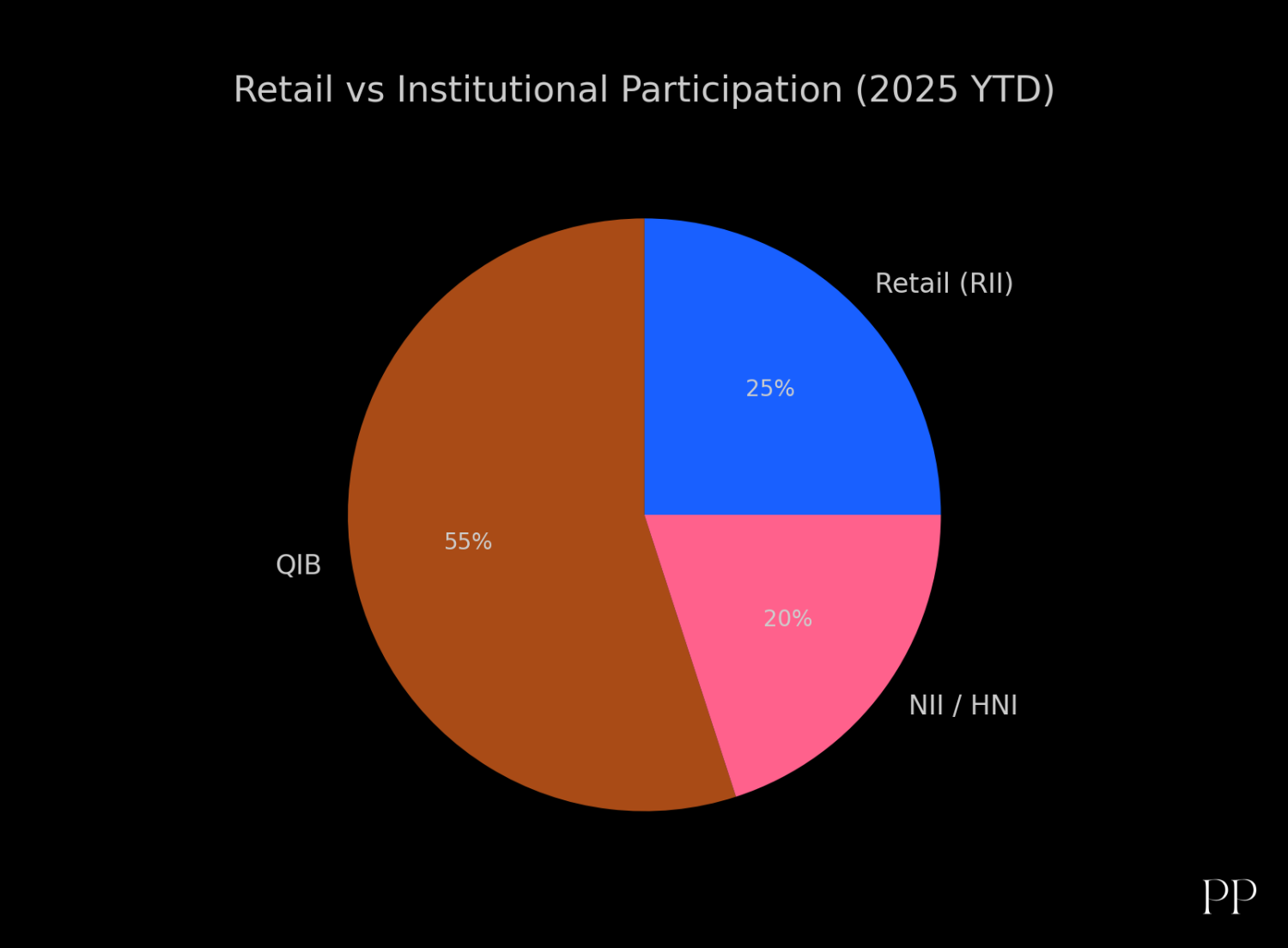

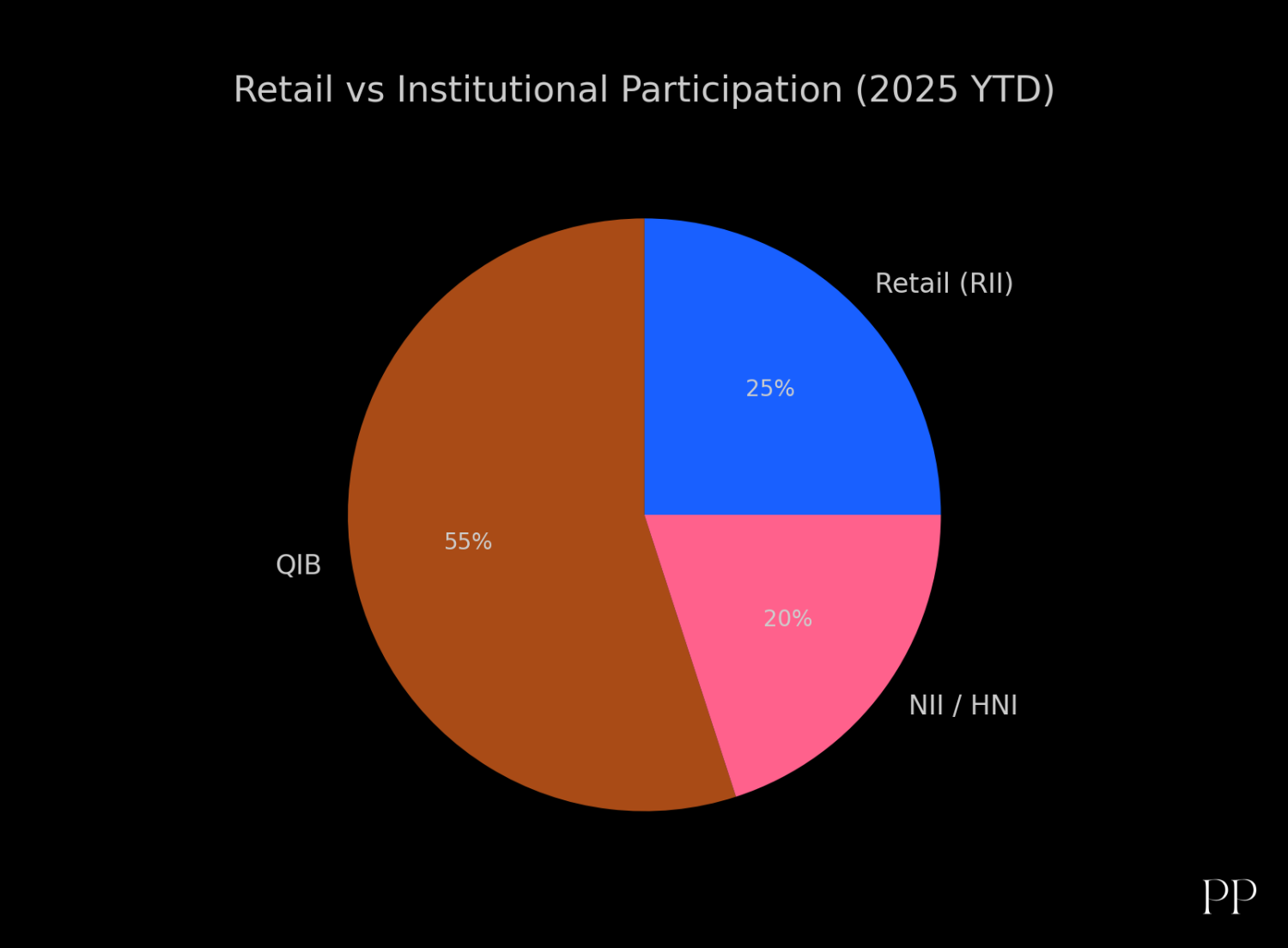

- Strong domestic liquidity: Mutual funds, insurance companies and other domestic institutional investors have sizeable flows. That gives issuers confidence there will be demand.

- Regulatory/market reforms: The Securities and Exchange Board of India (SEBI) along with other regulators have eased some listing rules and process-friction, making it slightly easier for private companies to come public.

- Diverse sectors coming in: Not just classic industrial or financial firms — newer economy businesses (consumer tech, fintech, ed-tech) are also listing. For example, PhysicsWallah in ed-tech.

- Market maturity and depth: Some analysts believe this boom reflects a maturing capital market in India — more companies institutionalising, promoters seeking broader ownership, etc.

| Rank |

Company |

Issue Size (₹ crore) |

| 1 |

Tata Capital |

15,511.87 |

| 2 |

HDB Financial Services |

12,500.00 |

| 3 |

LG Electronics India |

11,604.73 |

| 4 |

Hexaware Technologies |

8,750.00 |

| 5 |

NSDL (National Securities Depository Ltd) |

4,011.60 |

| 6 |

JSW Cement |

3,600.00 |

| 7 |

Schloss Bangalore (Leela Hotels) |

3,500.00 |

| 8 |

Anthem Biosciences |

3,395.00 |

| 9 |

Dr. Agarwal’s Health Care |

3,027.26 |

| 10 |

WeWork India |

2,999.64 |

What are the upsides

- Capital-raising for growth: Firms are getting access to public capital, which can fuel expansion, investments in technology, manufacturing, etc.

- Broader investor participation: Retail and institutional investors get more choices.

- Signal of market confidence: Despite global headwinds, the fact that many firms are going public suggests confidence in Indian growth/domestic demand.

- Opportunity for early-stage investors: In certain companies, listing early may give first-mover benefits if the business scales well.

The risks & caveats

Despite India’s buoyant IPO pipeline, investors should tread carefully. Several 2025 listings have carried aggressive valuations, often priced for perfection. Global uncertainty, interest-rate swings, and potential slowdown in domestic consumption could pressure post-listing performance. Liquidity-driven oversubscription does not always translate into sustained returns; many recent IPOs have seen early volatility once anchor lock-ins expired. Regulatory changes, geopolitical tensions, and uneven financial disclosures among new-age firms also add to the risk landscape.

Sectors & Companies to Watch

2025 continues to highlight India’s shift toward tech-led and consumer-centric growth. AI, semiconductor design, specialty chemicals, and financial services appear well-positioned, boosted by supportive policy and investment flows. Renewables, EV components, and manufacturing (especially capital goods) are expected to maintain strong pipelines, backed by domestic capex and government incentives. Market watchers are particularly focused on large-ticket listings in digital finance, data infrastructure, and healthcare platforms, which may shape valuations for the year ahead.

What This Means for Investors

For investors, 2025 offers opportunity — but selectivity is crucial. Strong balance sheets, profitability visibility, and market leadership matter more than hype. Long-term buyers may benefit from disciplined entry points rather than chasing oversubscription premiums. Sectoral tailwinds—particularly in finance, renewables, and electronics—could provide sustained compounding, while speculative new-age business models may require caution. A differentiated strategy of mixing anchor-strength IPOs with selective growth bets can help navigate an otherwise enthusiasm-driven market.

Outlook: What’s next

- 2025 looks set to be a record or near-record year in IPO volumes. Some estimates foresee proceeds exceeding even 2024.

- 2026 may also be strong, provided global headwinds (interest rates, inflation, capital flows) remain manageable.

- But the window may be limited: As more companies list and valuations become stretched, the room for exceptional returns may shrink unless the underlying business is very strong.

- Regulatory/structural factors may evolve — e.g., free float rules, price discovery mechanisms might be revised to ensure sustainable listing ecosystems.

Conclusion

The IPO boom in India in 2025 is real and meaningful. It reflects deeper capital markets, strong domestic investor flows, and a wave of companies ready to raise public capital. For India as a growth story, that’s a positive signal.

But for investors, it’s not a free lunch. The rush of listings means some companies will be winners, others will disappoint. Discipline, research, and realistic expectations matter more than ever.