Source Credit : Portfolio Prints

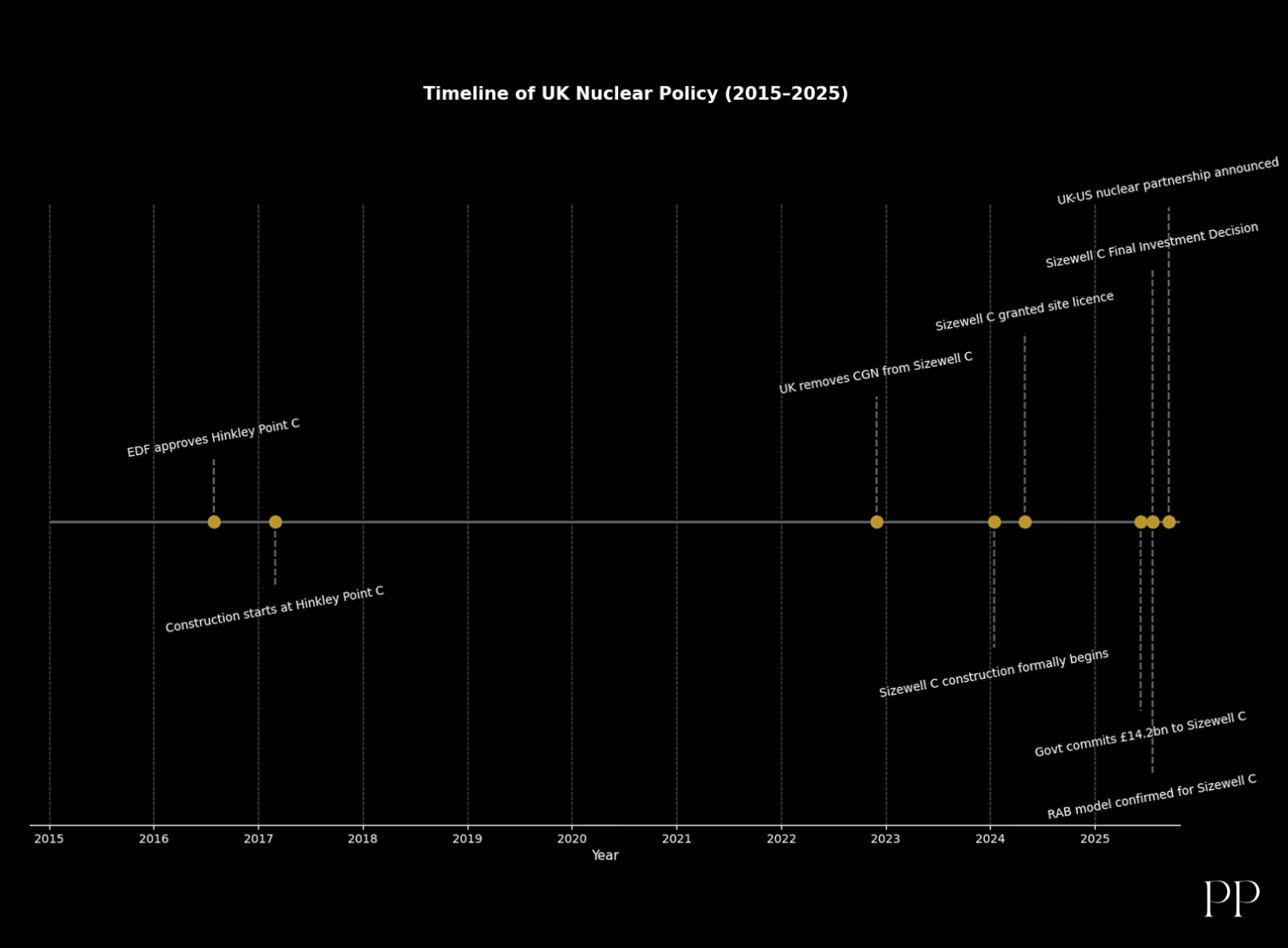

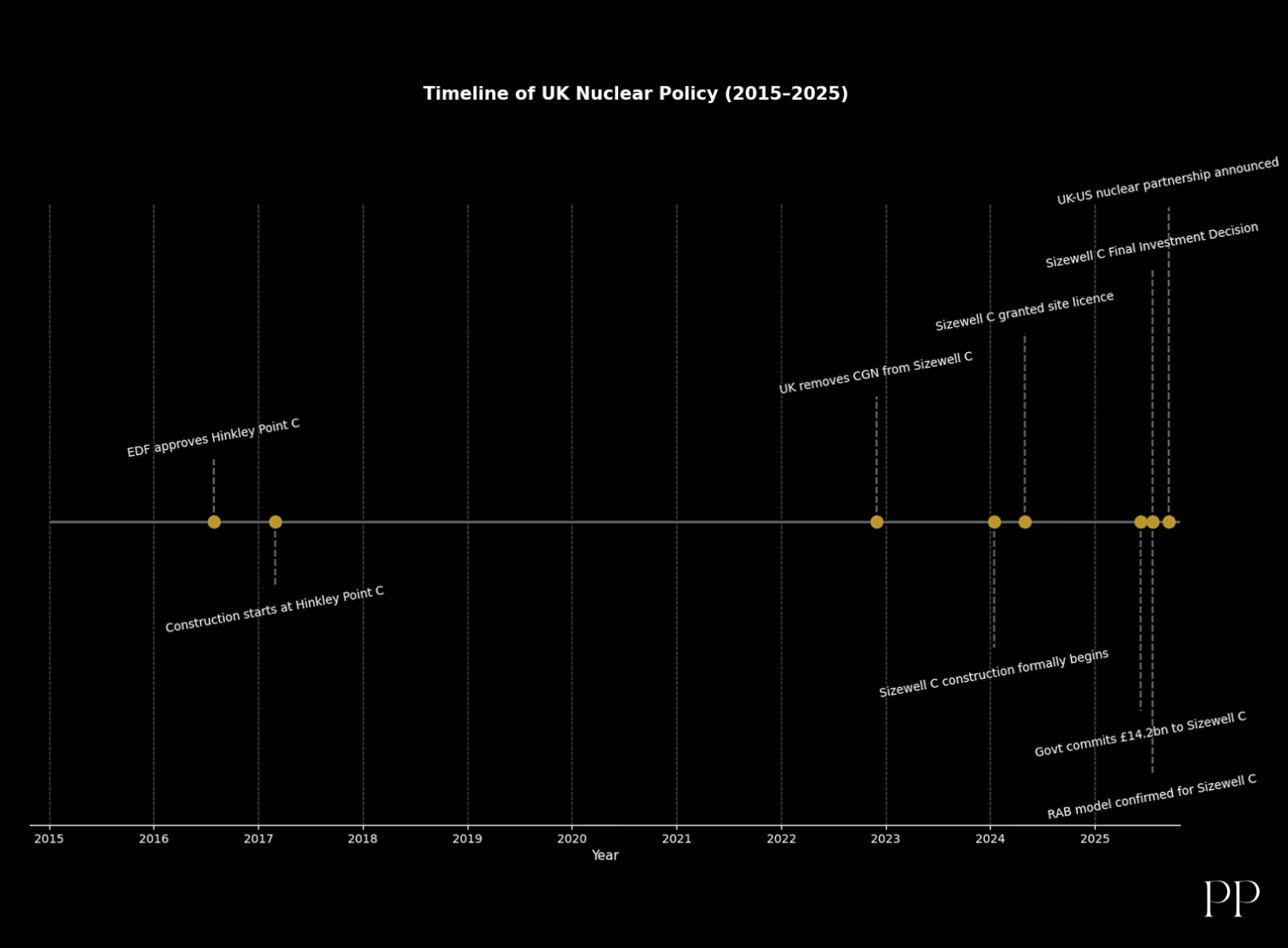

In recent months the United Kingdom has made bold moves to revive its nuclear-power sector. A key milestone came with the agreement to advance the Sizewell C project and a trans-Atlantic partnership to build next-generation reactors. Below is a breakdown of how the UK got there — what the mechanisms, drivers and lessons are.

The backdrop: Why nuclear now?

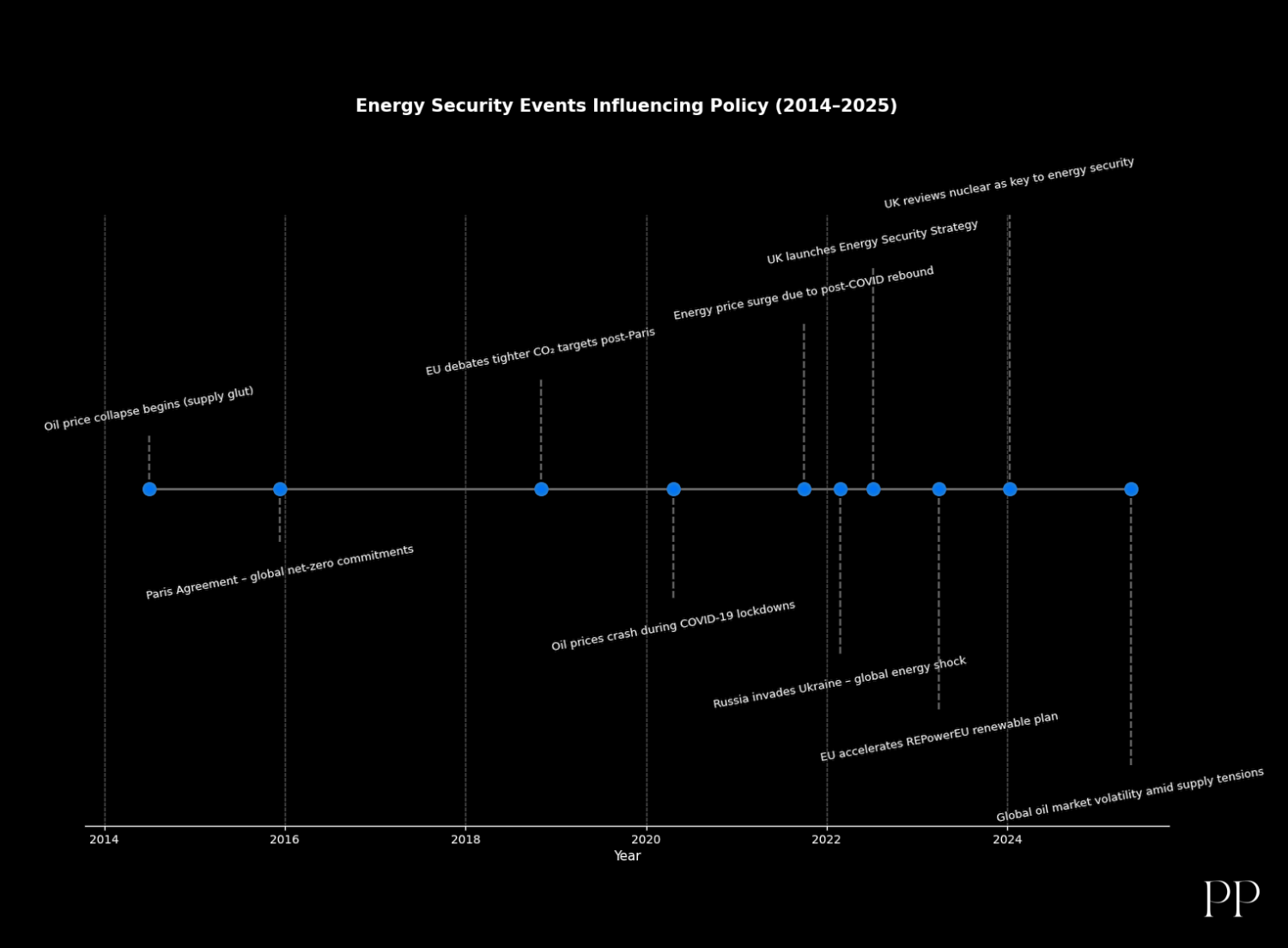

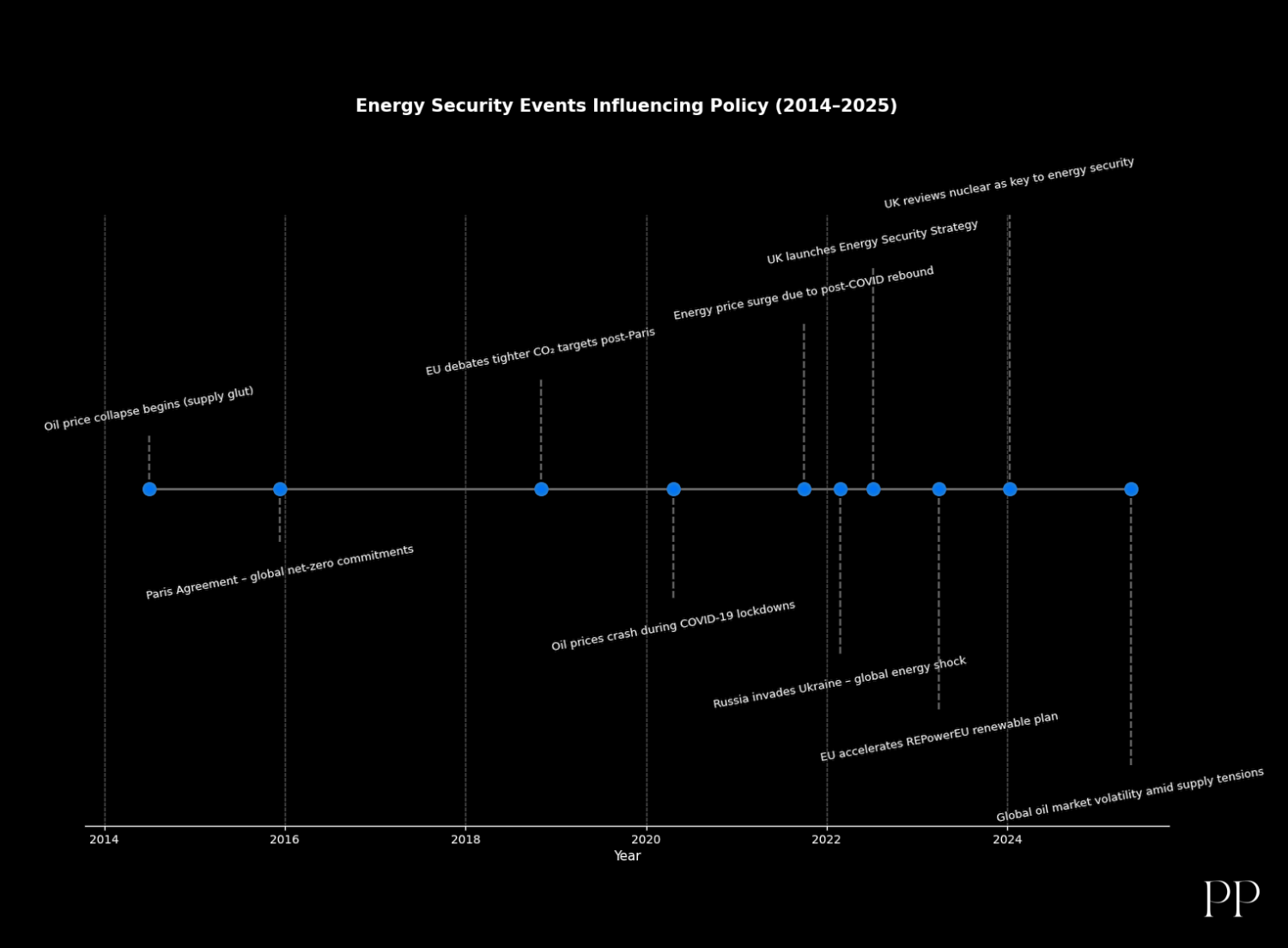

After decades in which new nuclear builds in the UK were stalled, the government concluded that nuclear energy must play a major role again in the country’s energy strategy. For example:

- The UK last opened a new conventional nuclear plant in the 1990s; many of its older reactors are slated for retirement in the early 2030s.

- Facing pressures of energy security, rising fossil-fuel prices, and the drive to decarbonise, nuclear offers dispatchable, low-carbon baseload power.

- The UK government has spoken of a “golden age of nuclear” as part of its clean-energy and industrial strategy.

So the stage was set: the policy impetus, the energy need, and the recognition that new nuclear was required. The challenge: getting large-scale investment to make it happen.

The key deal: Sizewell C and the investment model

The turning point was the financing and investment agreement for Sizewell C. Key features:

- On 22 July 2025 the UK government announced a “final investment decision” for Sizewell C (costing around £38 billion) after a long 15-year journey to get funding lined up.

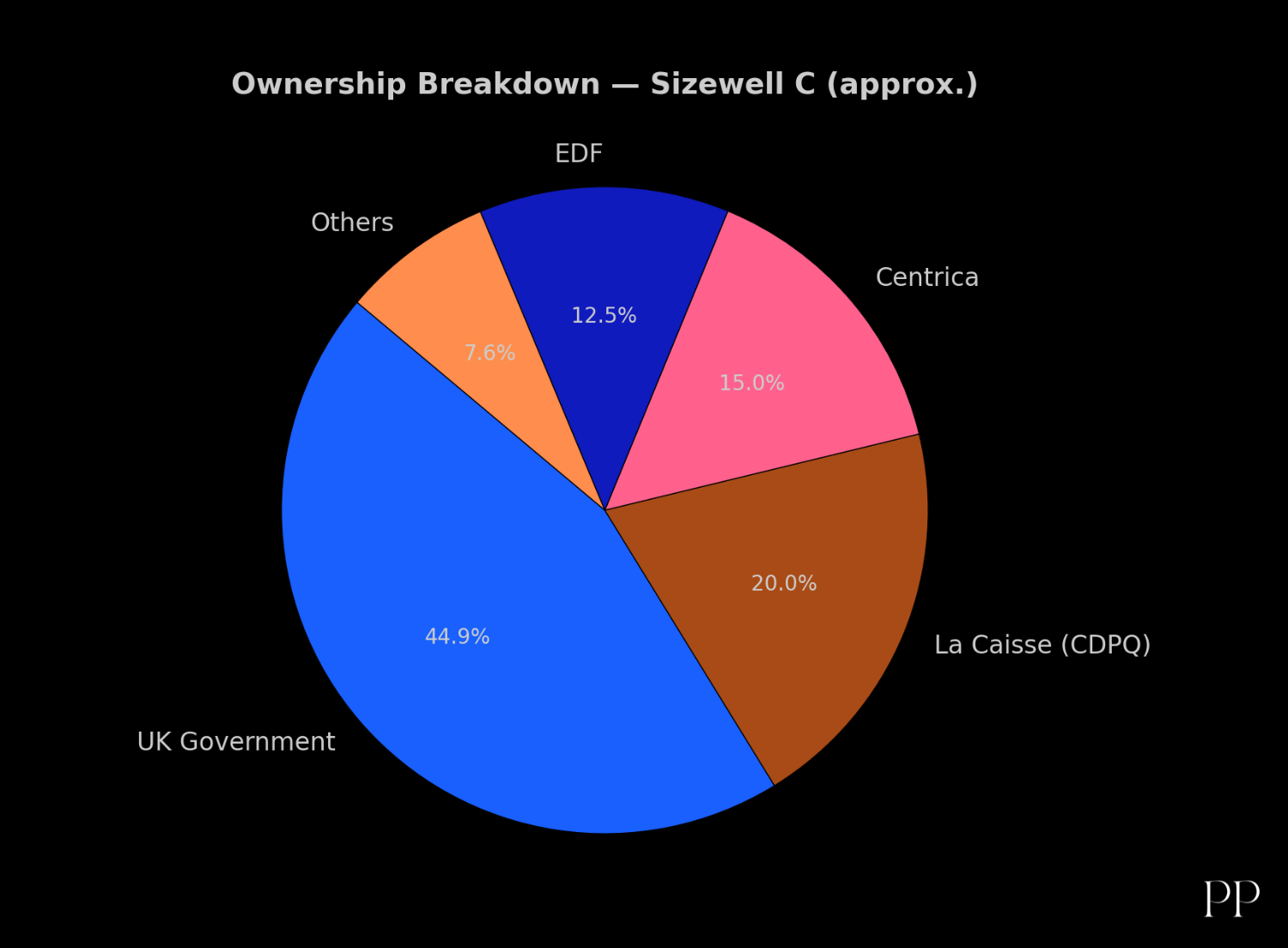

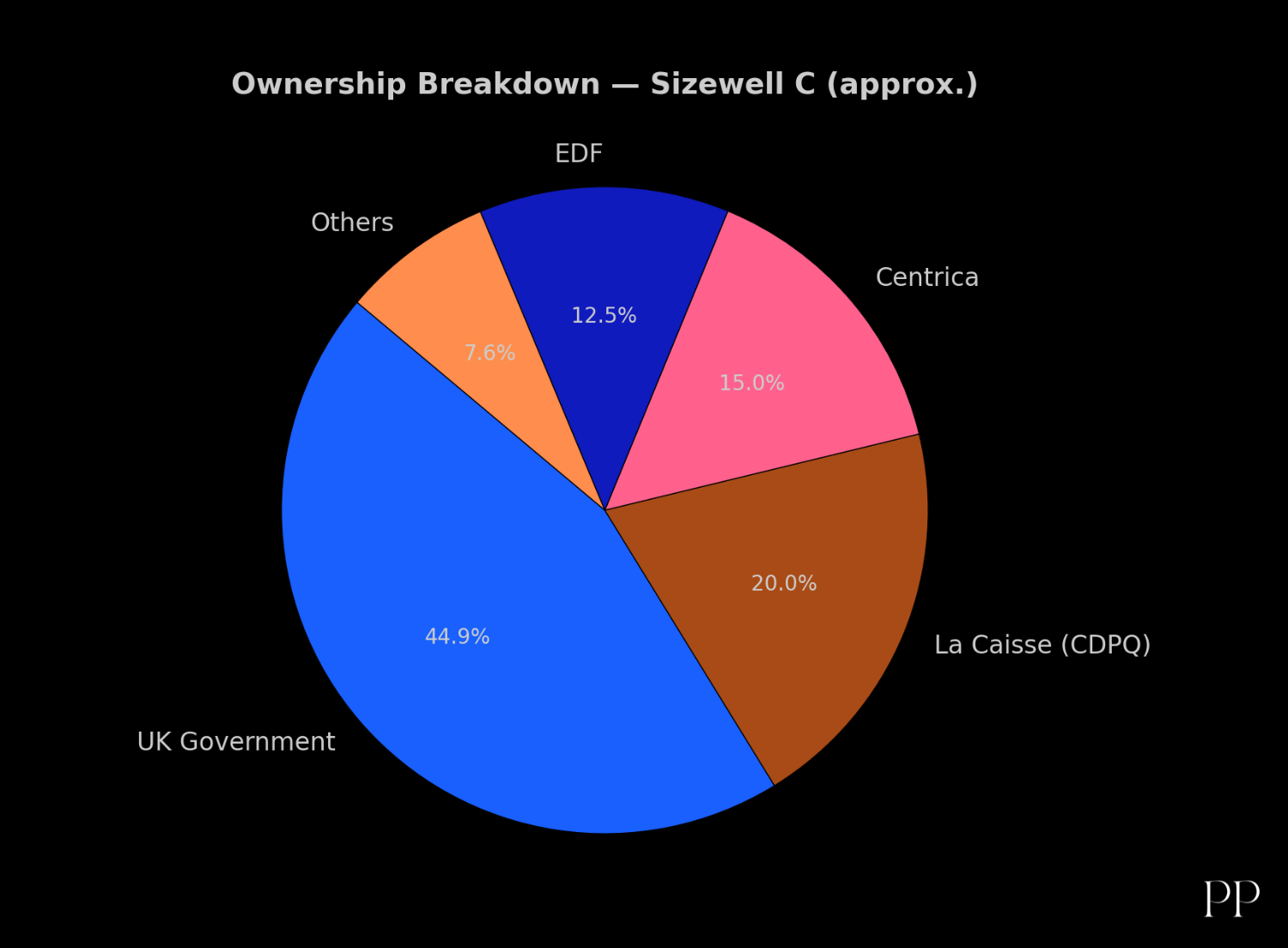

- The project’s financing structure is notable: the government will take a 44.9% stake (making it the largest shareholder) while private/institutional investors will hold the rest. For example, the Canadian investment fund La Caisse de dépôt et placement du Québec took ~20%; Centrica PLC about 15%; and Électricité de France (EDF) ~12.5%.

- One of the novel features: the use of the Regulated Asset Base (RAB) funding model. Under that model, costs can be partly recovered from consumers (via bills) during construction, reducing the risk borne purely by investors and making the project more bankable.

- The government emphasised that lessons from the earlier Hinkley Point C build would be applied, aiming for cost savings (about 20% lower for Sizewell C) through factory-replication, supply-chain lessons, and a “fleet-approach”.

What these elements combine to deliver is a structure that is more investor-friendly: lower risk (via government backing, RAB model), clearer blueprint (repeat of earlier design), and a mix of public and private capital.

What these elements combine to deliver is a structure that is more investor-friendly: lower risk (via government backing, RAB model), clearer blueprint (repeat of earlier design), and a mix of public and private capital.

Broader strategy: Partnerships & next-generation tech

Beyond just one plant, the UK has also signalled a larger strategy to attract investment by linking into next-generation nuclear technologies and international partnerships:

- In September 2025 the UK and the United States signed a major deal to build up to 12 advanced reactors in north-east England, including small modular reactors (SMRs) or advanced modular reactors (AMRs).

- For example, Centrica and US firm X‑Energy Reactor Company entered a joint development agreement to deploy the Xe-100 advanced modular reactor in the UK, with the first site being the Hartlepool region.

- The government emphasised that by creating a credible pipeline of projects, the UK is signalling to investors that nuclear is not a one-off deal but the start of a long-term programme — which helps mobilise large scale capital.

Why investors lined up: Key incentives & signals

Government backing and clarity of purpose

The fact that the government stepped in as major shareholder, signalled policy certainty, and adopted structures (RAB) to mitigate risk made the proposition much more credible.

Reduced risk for private investors

With a large portion of the risk related to major up-front capital borne partly by the government (and via mechanisms like RAB), the private investor’s exposure is more manageable.

Scale and repeatability

The use of a proven design (replica of Hinkley) means lower technological/engineering risk, and the promise of further similar projects means a pathway to scale and predictable returns.

Industrial supply-chain and regional growth angle

The project promises large job creation, supply-chain opportunity, and domestic manufacturing content (the UK emphasises that ~70% of construction spend will go to UK businesses).

International partnerships and technology leadership

By linking with US firms, advanced reactor tech, and creating export opportunities, the UK offers not just a project but a platform for growth and investment returns beyond mere operation.

Economic and policy signals

The announcements themselves send a strong signal: e.g., the UK’s Energy Secretary said “this government is making the investment needed to deliver a new golden age of nuclear”.

What to Watch

While the investment deal has been struck, the proof will be in delivery. Some key questions going forward:

- Will the project hit cost and schedule targets? If not, how will over-runs be managed?

- How well will the RAB model work in practice and what precedent does this set for future nuclear projects?

- How quickly can SMRs/AMRs be deployed at scale and how well will they attract investors compared to big traditional plants?

- How will supply-chain bottlenecks, inflation, labour issues, and regulatory delays play out in the UK nuclear build-programme?

- How will the UK leverage export markets (and supply-chain scale) to reduce costs, generate returns and build a sustainable nuclear industry beyond domestic projects?

Conclusion

the UK has managed to get investors to line up for nuclear power by combining strong government backing, innovative financing models, a credible project pipeline, industrial strategy alignment, and risk-sharing mechanisms. The deal around Sizewell C and the UK-US partnership to deploy advanced reactors clearly illustrate this shift. If delivery follows the ambition, this could mark the beginning of a new nuclear-era in the UK — one that other countries and sectors may study closely.