Source Credit : Portfolio Prints

Background

In recent months, a wave of major UK pension funds — together managing over £200 billion in assets — have begun reducing their holdings in U.S. equities.

The shift is driven mainly by growing concern over what many see as an overconcentration of U.S. markets in a handful of mega-cap tech companies, especially those associated with artificial intelligence (AI).

For some pension schemes, this means reallocating investments away from the U.S. and toward UK, Asian, or other global markets; for others, it involves hedging their U.S. exposure or shifting toward more stable companies and asset classes.

Key Risks Underlying the Move

High Concentration in Tech & AI-Driven Stocks

U.S. stock indices — particularly those heavy in technology firms — have recently been driven up by a relatively small group of companies, sometimes dubbed the “Magnificent Seven.”

This concentration heightens risk: if sentiment turns or valuations drop sharply, funds heavily invested in those companies could suffer disproportionately.

Tariffs, Dollar and Global Uncertainty

Some pension-fund managers cite concerns over unpredictable U.S. trade and tariff policies, along with currency (dollar) volatility, as additional reasons to reduce U.S. equity and dollar-denominated exposure.

Even if U.S. markets have delivered solid returns lately, these macro-risks make long-term global diversification more appealing, especially for retirement-focused portfolios that prioritize stability and resilience.

Long-Term, Conservative Mandates

Pension funds — especially defined-contribution and defined-benefit schemes — typically have long horizons and are required to safeguard retirement savings. When valuations look overheated, and downside risks increase, de-risking becomes a prudent route.

Which Funds Are Changing Course (and How)

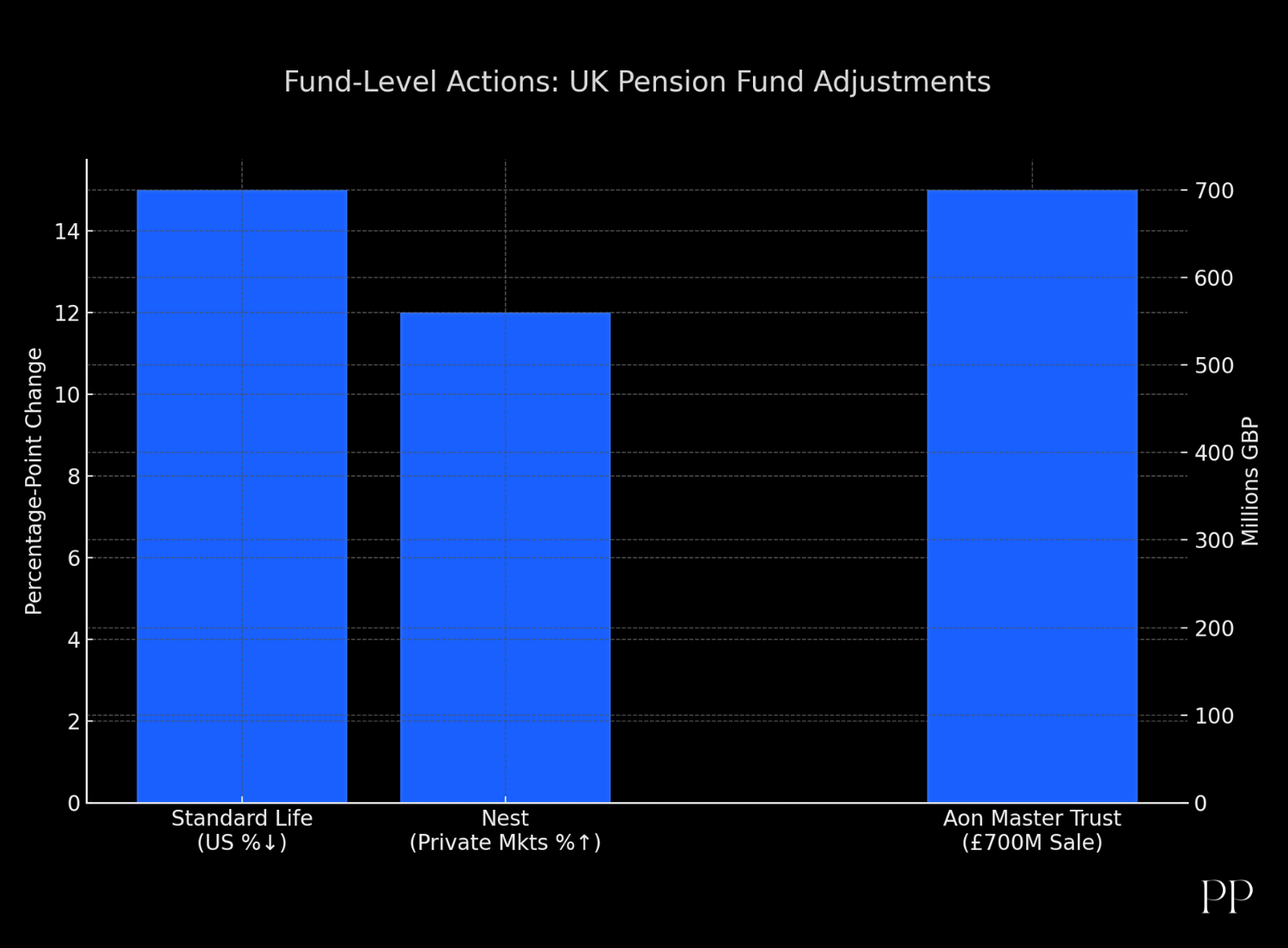

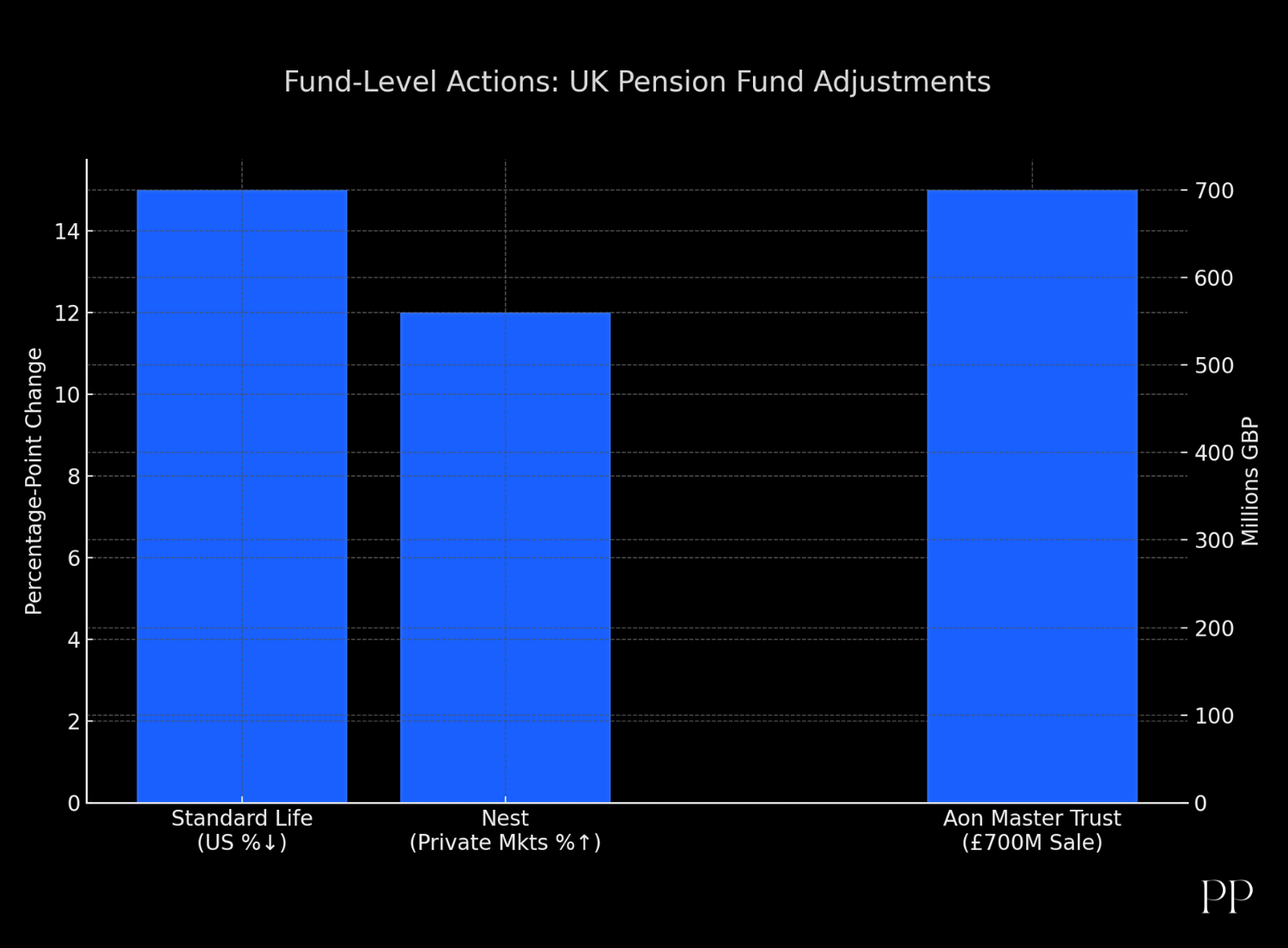

Standard Life

Part of the Phoenix Group: reportedly cutting U.S. equity holdings in its multi-asset funds, shifting toward UK and Asian markets to reduce risk.

Aon Master Trust

A major defined-contribution pension provider: sold roughly £700 million of its global equity portfolio over the summer, much of it U.S.–based equities.

Nest

A large state-backed workplace pension fund: isn’t aggressively dumping existing U.S. equities, but new contributions are being directed toward private markets rather than U.S. stocks.

| Fund |

Data Used for Charting (Before → After) |

| Standard Life (Phoenix Group) |

US equities: 60% → 45% |

| Aon MasterTrust |

Equity sale: £700m (≈ 5.6% of £12bn AUM or 2.8% of £25bn AUM) |

| Nest |

Private markets: 18% → 30%<br>**US equities: 45% → 35% |

Other funds are using hedging strategies, tilting toward more diversified global equity portfolios, or increasing allocations outside the U.S. to maintain balance.

In aggregate, these moves reflect a broad-based reassessment of U.S. equity risk among long-term investors rather than isolated or tactical shifts.

Implications: For Pensioners, Markets, and Global Flows

For Pension Savers

For long-term savers — especially younger members whose pension pots are mostly invested in equities — this pivot may protect retirement savings from a steep correction. Diversified portfolios are likely to be more resilient in the face of extreme volatility or an abrupt drop in tech valuations.

For Global Stock Markets

The move could signal a broader capital rotation away from U.S.-heavy tech equities into under-weighted markets like the UK, Europe, or Asia. That may boost opportunities in those regions, even as U.S. indices face increased selling pressure. It also reflects a growing discomfort with concentration risk.

For U.S. Markets — and Risk Sentiment

If more pension providers worldwide follow suit, U.S. markets — especially mega-cap tech stocks — could face downward pressure. The strategy also underscores shifting investor sentiment: growth-at-all-costs is being reevaluated, and risk-aware investing is gaining ground.

Why This Matters — and What to Watch Next

- The trend isn’t just tactical — it reflects deep concerns about valuations, concentration risk, and macro-economic uncertainty. For retirement-focused funds, preserving capital may be more important than chasing high returns.

- As funds shift away from U.S. equities, other markets — especially UK, Asian and emerging markets — may attract more capital. This could rebalance the global equity landscape over time.

- It’s worth watching whether other large pension systems (in Europe, Asia, etc.) follow the same path. If a wave of de-risking spreads, it could have systemic implications for global equity flows, valuations, and volatility.

In short: the recent moves by UK pension funds mark a significant rethinking of the long-standing dominance of the U.S. equity market in global retirement investing. The emphasis is shifting toward diversification, risk management, and balance — potentially reshaping where long-term capital flows in the years ahead.

Summary

Several major UK pension funds have begun cutting their exposure to U.S. equities, citing stretched valuations in the American market—especially among large technology stocks. Funds such as Standard Life, Aon Master Trust, and Nest have shifted portions of their portfolios away from the U.S., reallocating capital toward UK equities, European markets, Asia-Pacific regions, and private market assets.

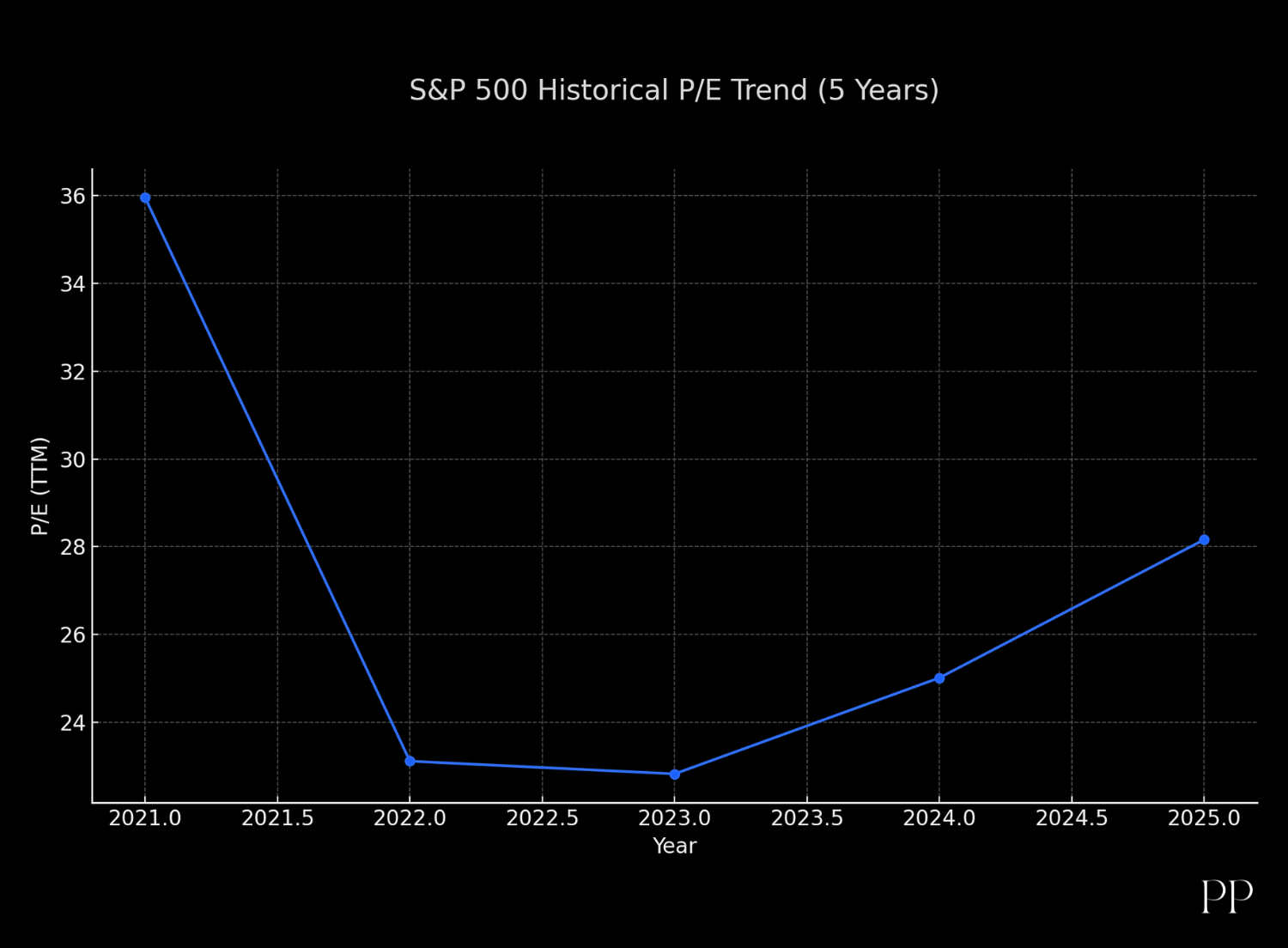

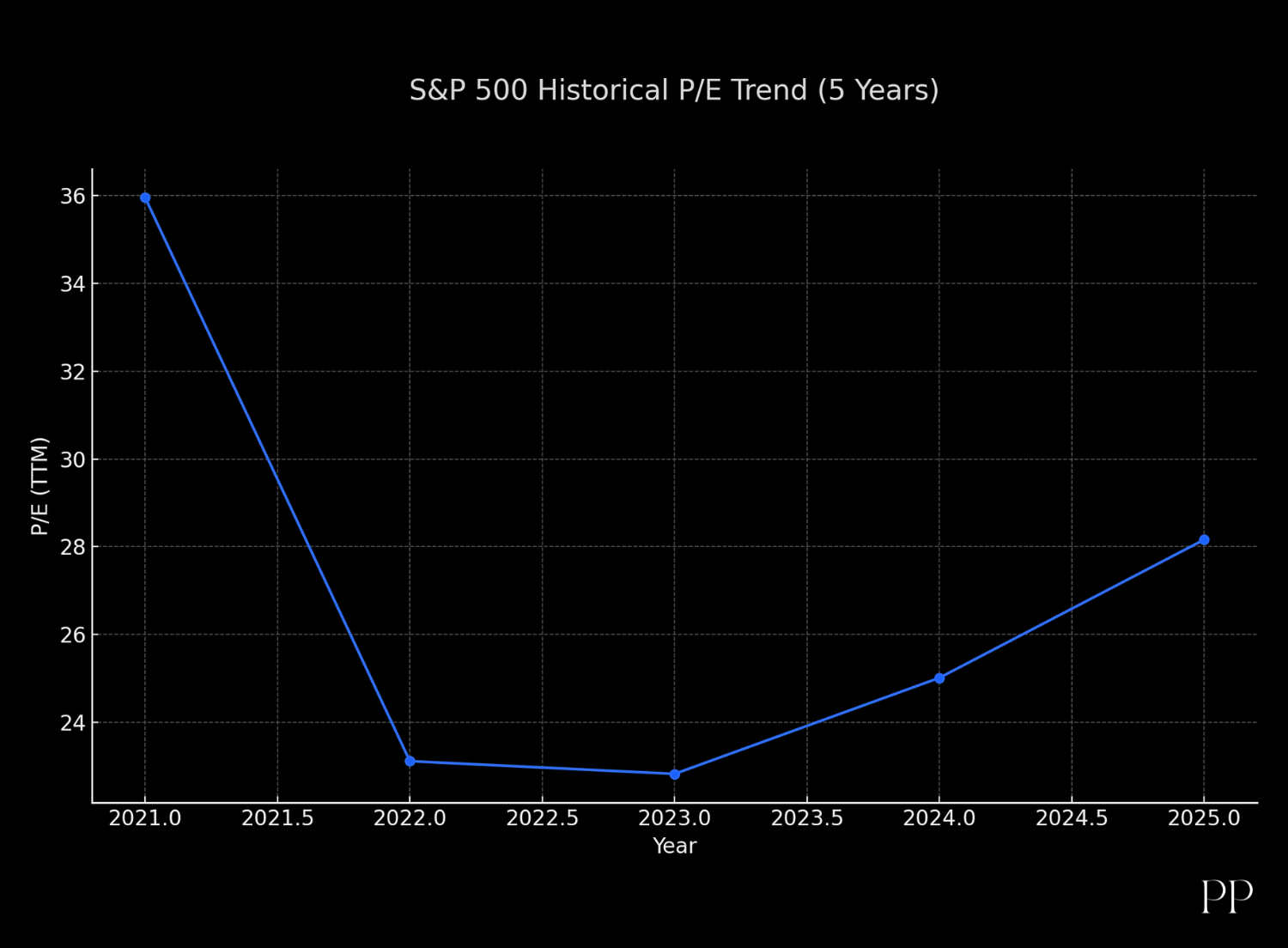

The move reflects growing concern that U.S. tech valuations—measured by elevated P/E ratios—are significantly above long-term averages and out of line with other global markets. At the same time, geopolitical risks, interest rate uncertainty, and concentration in a handful of mega-cap stocks have increased the perceived imbalance in the U.S. market.

This trend signals a broader rebalancing among institutional investors seeking diversification, better value opportunities, and more stable long-term returns outside the U.S. market.