Source Credit : Portfolio Prints

Introduction

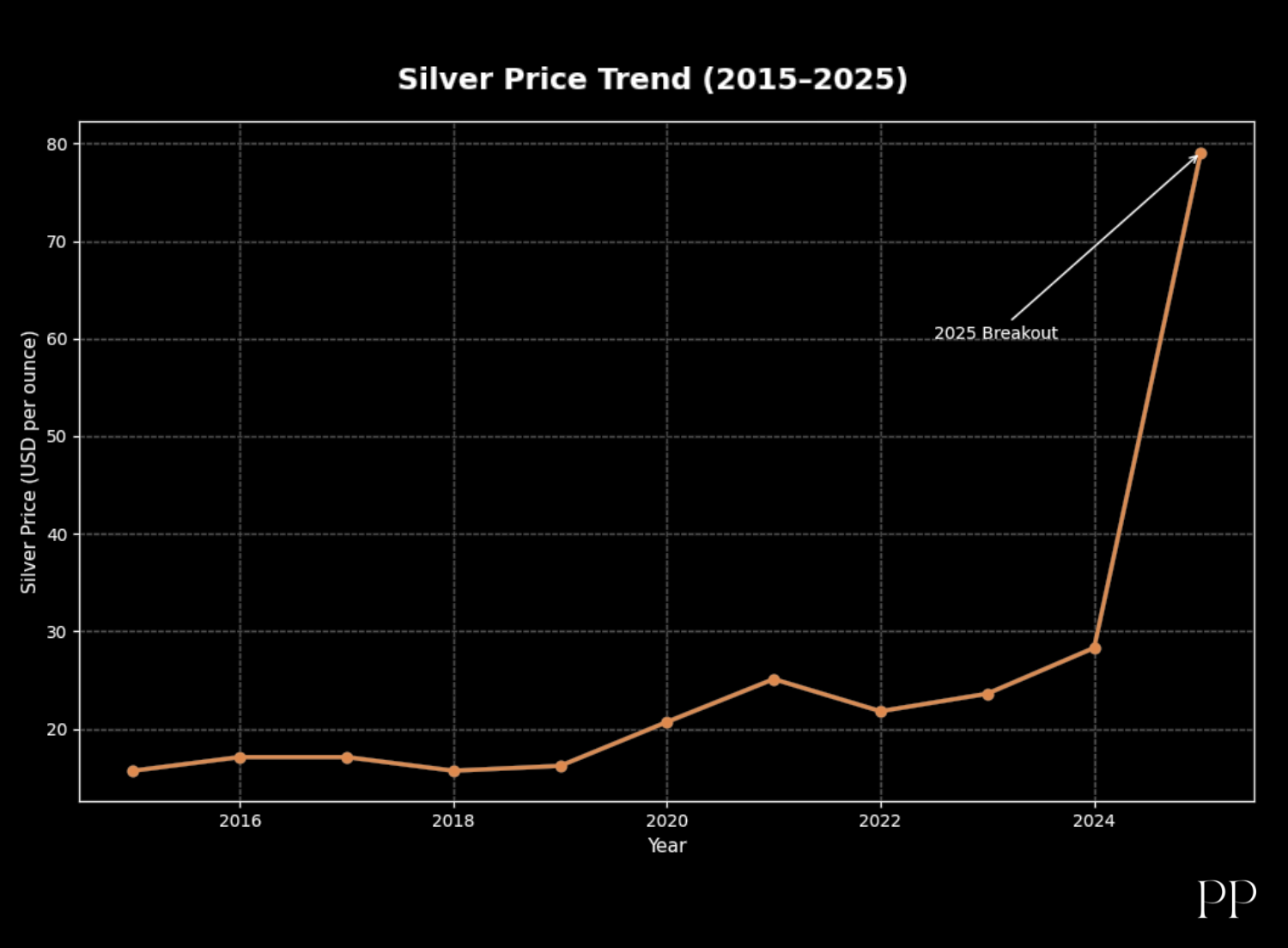

Silver traditionally viewed as both a precious metal and a key industrial metal — has recently experienced one of the most dramatic rallies in decades, with prices breaking multiple records and investor attention intensifying across global markets.

As of late December 2025, silver prices have surged to unprecedented highs — crossing the $80 per ounce mark and outperforming many other commodities. This ascent is not merely a short-term spike but reflects deep structural shifts in supply and demand dynamics, with industrial consumption emerging as a major force shaping the price trajectory.

Historic Rally: Record Highs and Market Moves

Silver’s recent rally has been remarkable:

- Spot silver has traded above $80 per ounce, hitting new all-time nominal highs.

- Prices climbed as much as approximately 181% year-to-date in 2025 — far outpacing gold’s gains.

- Investments in silver-related assets, including futures and exchange-traded products, have surged alongside physical market demand.

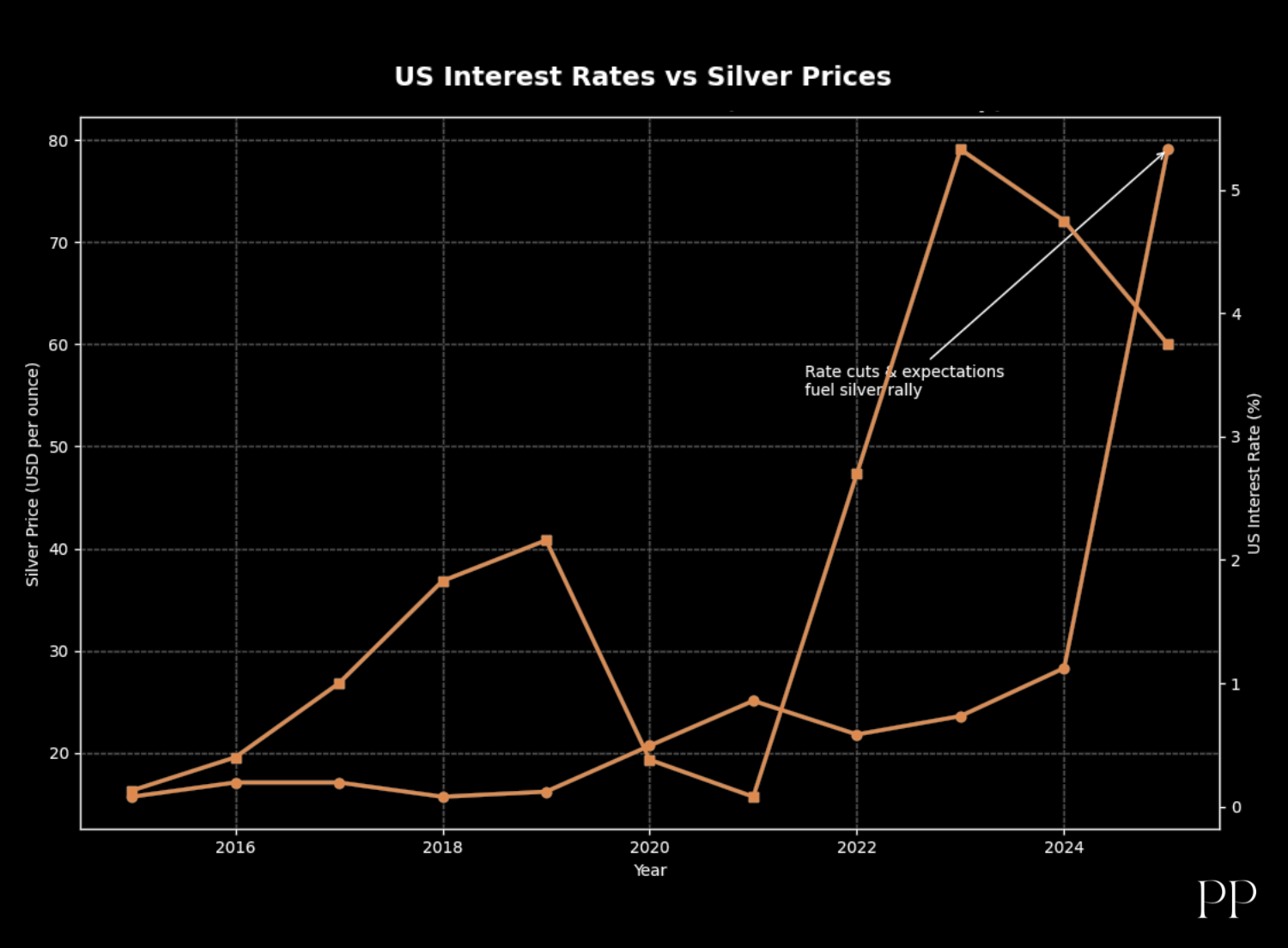

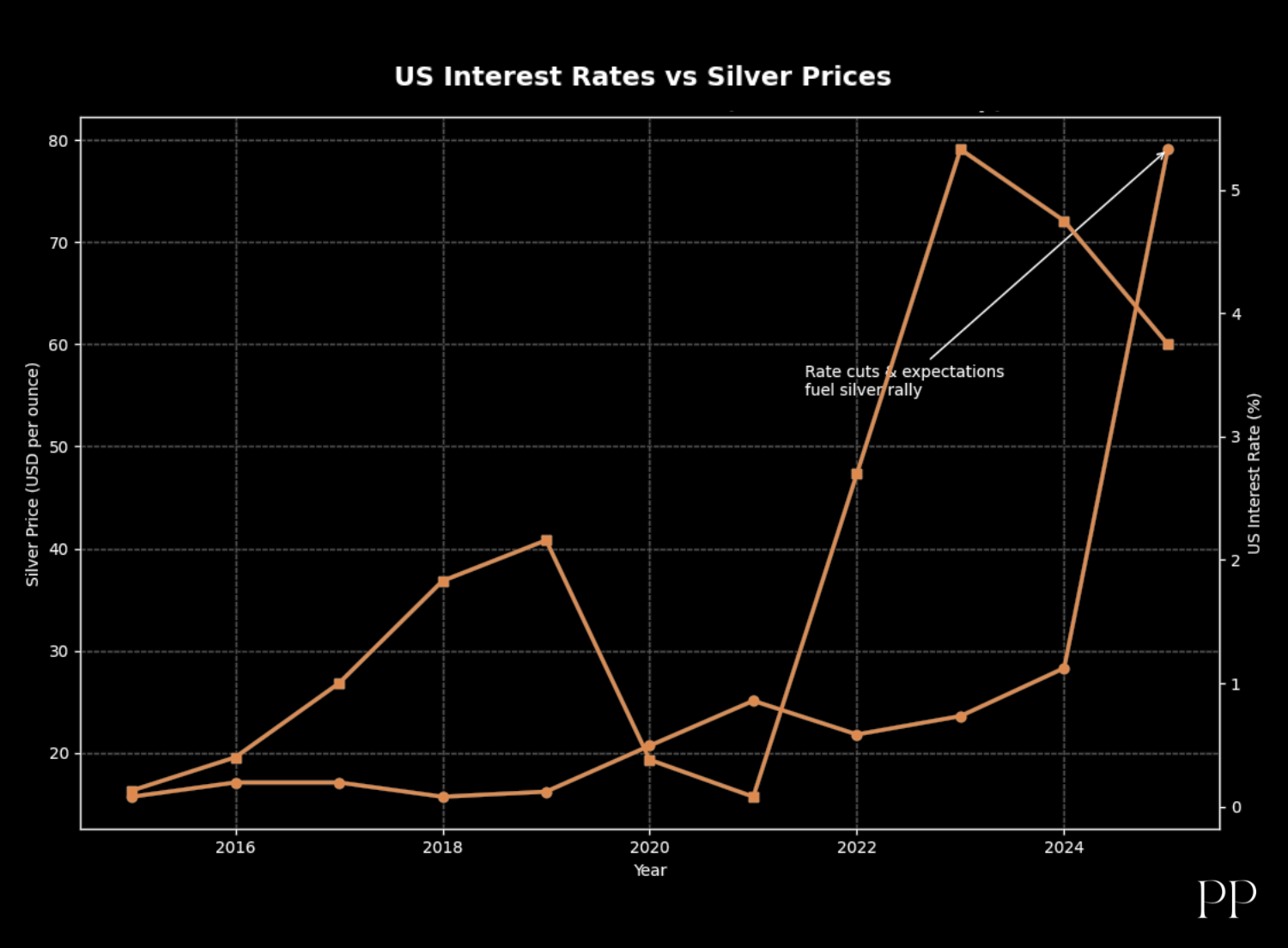

In Asian markets, precious metals rallied in tandem with equities, driven by expectations of future U.S. Federal Reserve interest rate cuts and geopolitical uncertainty — factors that traditionally buoy hard assets like silver.

In Asian markets, precious metals rallied in tandem with equities, driven by expectations of future U.S. Federal Reserve interest rate cuts and geopolitical uncertainty — factors that traditionally buoy hard assets like silver.

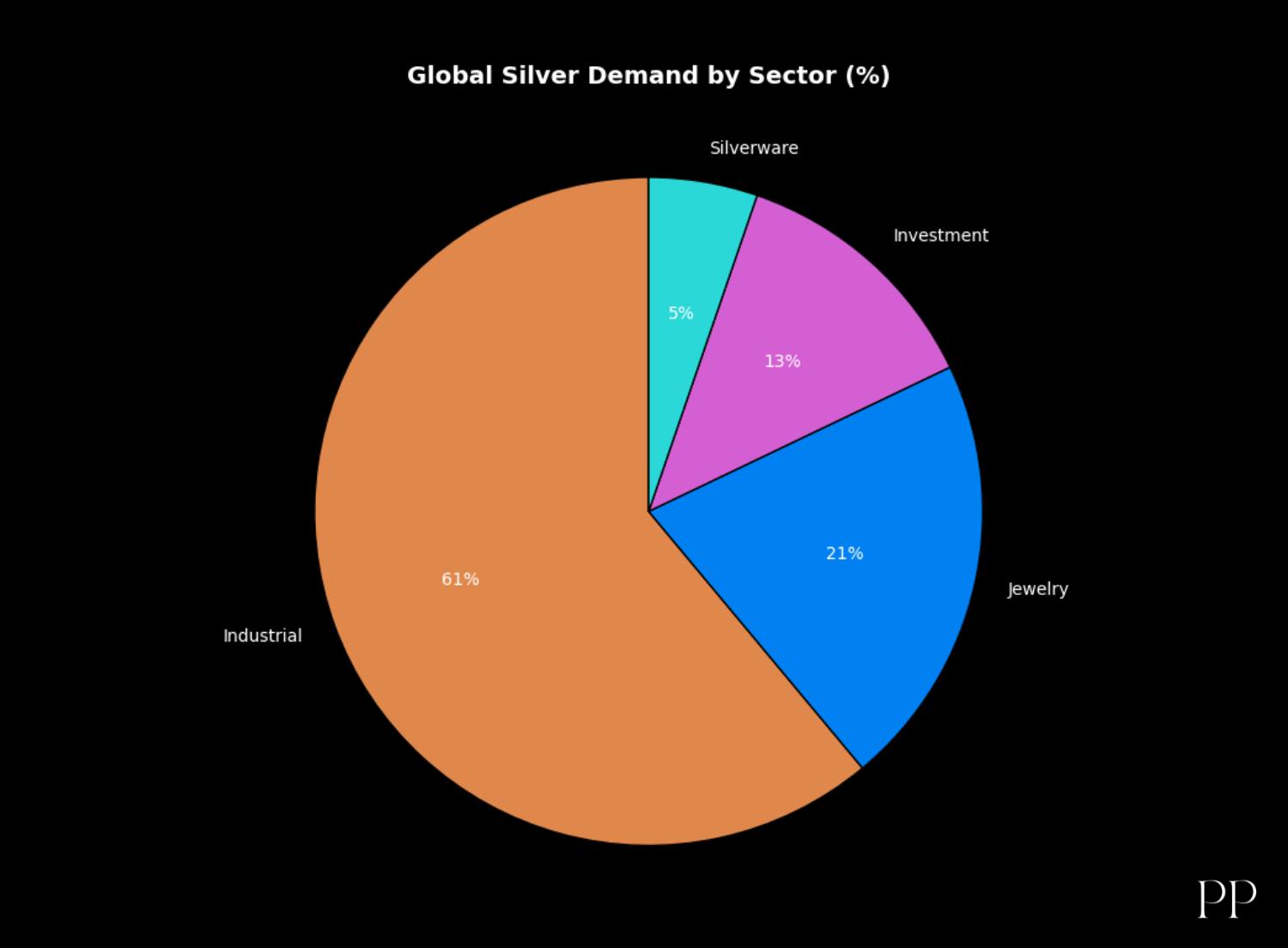

Industrial Demand: From Background Role to Prime Driver

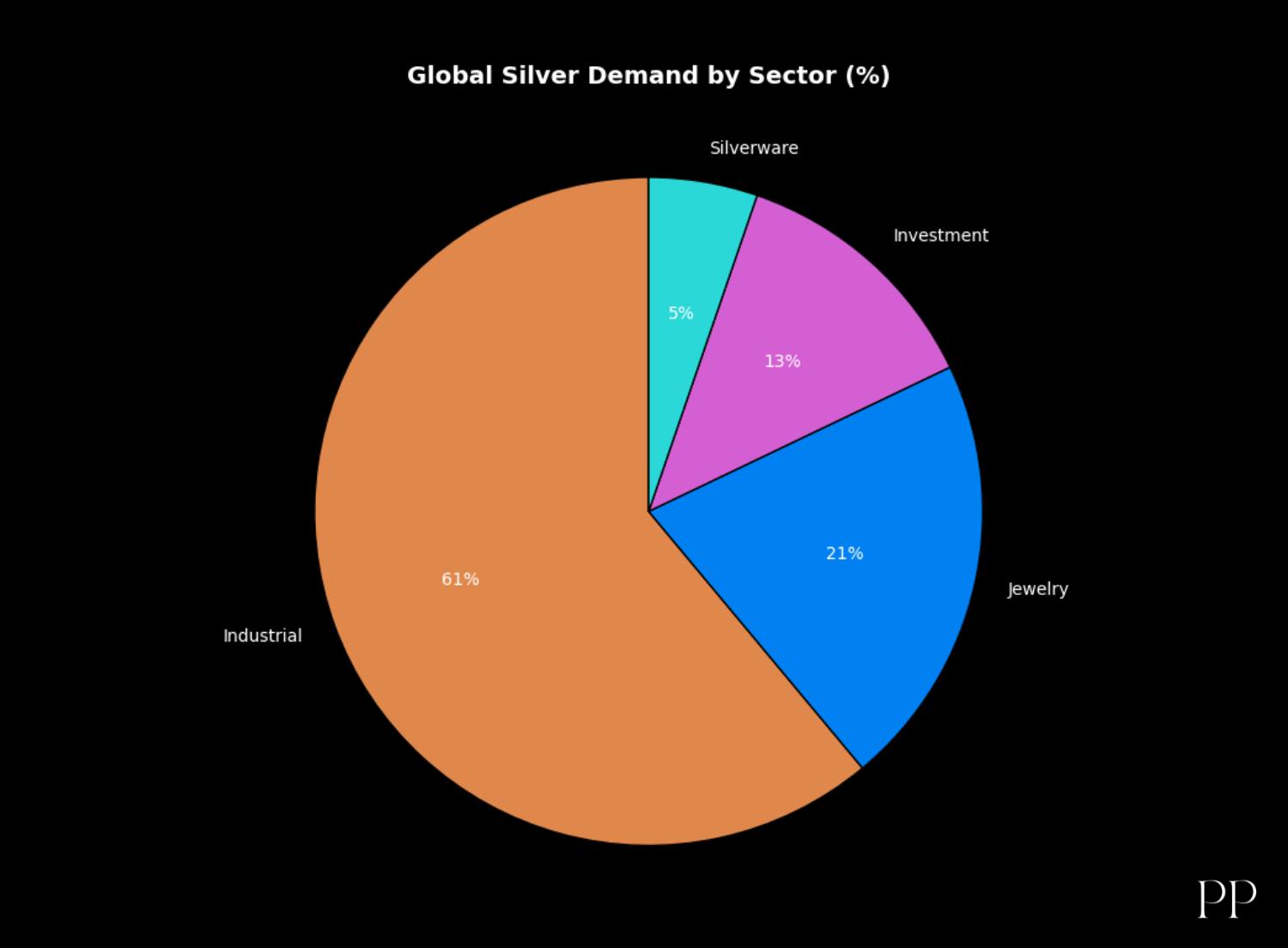

While silver has long been regarded as a precious metal alongside gold, its industrial utility has become a central component of its current price surge:

Green Technology and Renewable Energy

Silver is an essential input in solar photovoltaic (PV) cells — due to its superior electrical conductivity — and demand from renewable energy sectors has surged as countries accelerate clean-energy installations.

Electronics, EVs & Data Centers

Modern electronics-centric technologies — including electric vehicles, AI data centers, semiconductors, and 5G infrastructure — also consume increasing amounts of silver. These sectors have expanded rapidly, tightening available physical supplies and placing upward pressure on prices.

Analysts note that this strong industrial demand has coincided with consistently tight supply fundamentals, as global mine production struggles to keep pace with consumption. Even as demand grows, inventories have been squeezed, contributing to mounting structural deficits in silver markets.

Analysts note that this strong industrial demand has coincided with consistently tight supply fundamentals, as global mine production struggles to keep pace with consumption. Even as demand grows, inventories have been squeezed, contributing to mounting structural deficits in silver markets.

Supply Constraints Intensify the Rally

Silver’s price action isn’t solely a story of demand — supply issues play a key role:

- Global physical inventories have been drawn down sharply, leading to what some analysts describe as a supply squeeze.

- Measures such as export limits — notably Chinese export restrictions on silver — have amplified concerns over global availability, adding to upward price pressure.

- Structural supply deficits — where demand exceeds production — are projected to continue, underscoring how supply limitations are intertwined with rising industrial needs.

Monetary and Macroeconomic Forces

Beyond industrial uses, broader macroeconomic trends have supported silver’s surge:

Interest Rates and Dollar Dynamics

Expectations of future interest rate cuts by the U.S. Federal Reserve have weakened the dollar and reduced the opportunity cost of holding non-yielding assets like silver, prompting inflows from both institutional and retail investors.

Safe-Haven Demand

Geopolitical uncertainty — including conflicts in Eastern Europe and tensions in global trade — has lifted demand for precious metals as hedges against risk. Silver, while more volatile than gold, has benefited from this safe-haven appeal.

Investment Sentiment and Market Psychology

Investor interest in silver has intensified beyond industrial consumption:

- Retail investors are increasingly optimistic about silver’s prospects, with many expecting prices to move higher — even toward $100 per ounce in 2026.

- Exchange-traded product holdings and futures positioning have amplified momentum, bringing a new wave of capital into silver markets.

However, market analysts caution that silver’s high volatility — while attractive for short-term gains — also introduces risk for investors that must be understood within broader economic cycles and supply-demand balances.

Implications for the Future

Price Outlook

Many analysts now view the current rally not as a speculative spike, but as a structural shift in the market, where fundamental supply constraints and rising industrial consumption underpin potentially long-lasting price momentum into 2026 and beyond.

Market Balance

Despite the rapid ascent, some profit-taking and short-term pullbacks have already occurred, reminding traders and investors that silver — like all commodities — faces cyclical pressures alongside long-term structural forces.

Conclusion

The surge in silver prices in late 2025 reflects more than speculative excitement — it is at the intersection of robust industrial demand, constrained supply, and shifting macroeconomic expectations. As industries increasingly rely on silver for green technologies and advanced electronics, and as investors seek both strategic and safe-haven assets, silver has emerged as one of the most closely watched commodities on global markets.

Whether this rally will lead to sustained long-term gains remains a key question for analysts, but the shift in silver’s market role — from mostly precious metal to essential industrial component — may define its trajectory for years to come.