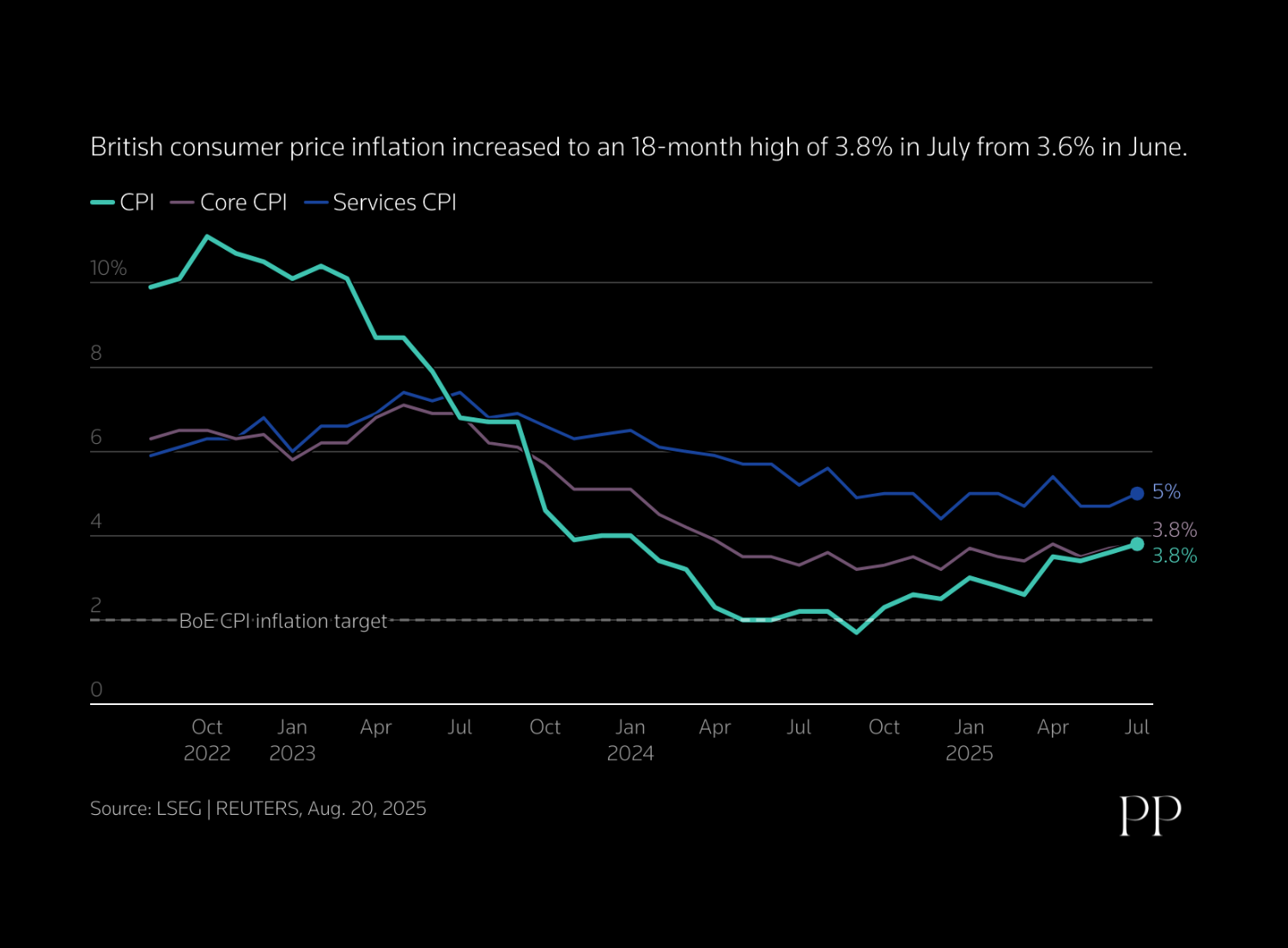

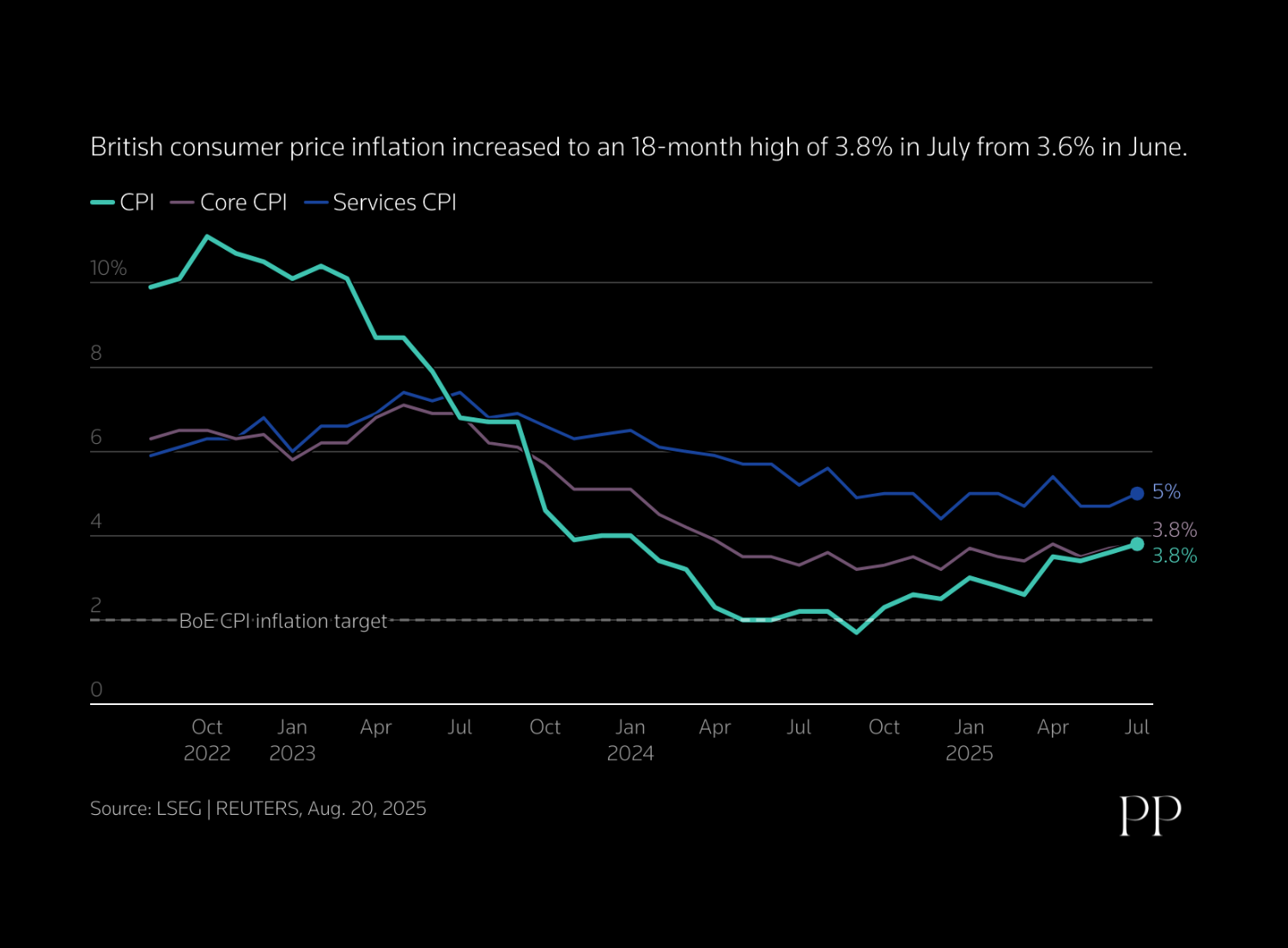

UK Inflation Rises to 3.8% in July

Image Credit : IStock

Source Credit : CNBC

The U.K.’s annual inflation rate hit a hotter-than-expected 3.8%in July, according to data released by the Office for National Statistics (ONS) on Wednesday.

Economists polled by Reuters had anticipated inflation would reach 3.7% in the twelve months to July, after it picked up to 3.6% in June, exceeding forecasts.

July core inflation, which excludes more volatile energy, food, alcohol and tobacco prices, rose by an annual 3.8%, up from 3.7% in the twelve months to June.

The rise in inflation pushed the consumer price index to its highest annual rate since the beginning of last year, Grant Fitzner, chief economist at the ONS, commented Wednesday.

How Inflation in the UK has moved

“The main driver was a hefty increase in air fares, the largest July rise since collection of air fares changed from quarterly to monthly in 2001. This increase was likely due to the timing of this year’s school holidays,” he noted in a post on the X social media platform.

“The price of petrol and diesel also increased this month, compared with a drop this time last year. Food price inflation continues to climb, with items such as coffee, fresh orange juice, meat and chocolate seeing the biggest rises,” he added.

U.K. Chancellor Rachel Reeves responded Wednesday that there was more to do to ease the cost of living.

“We have taken the decisions needed to stabilise the public finances, and we’re a long way from the double-digit inflation we saw under the previous government, but there’s more to do,” she said in emailed comments.

The British pound was largely steady against the dollar following the data release, trading at $1.3489.

Services inflation gained to 5% in July from 4.7% in the previous month. The print is seen as another obstacle in the Bank of England’s attempts to tame inflation, analysts say, as service-focused businesses raise prices to cover the costs of rising wages and the recent hike to National Insurance contributions.

The higher July reading also diminishes the chance of any further interest rate cut by the Bank of England this year.

“I’m annoyed about the services inflation, it’s looking sticky, and given the importance of services to the U.K. economy I look at that and think, if the MPC [the central bank’s monetary policy committee] is looking at that as well — and I’m sure that they are — the chance of a rate cut in November are vanishingly small,” James Sproule, chief U.K. economist at Handelsbanken, told CNBC’s Squawk Box Europe.

“The main driver was a hefty increase in air fares, the largest July rise since collection of air fares changed from quarterly to monthly in 2001. This increase was likely due to the timing of this year’s school holidays,” he noted in a post on the X social media platform.

“The price of petrol and diesel also increased this month, compared with a drop this time last year. Food price inflation continues to climb, with items such as coffee, fresh orange juice, meat and chocolate seeing the biggest rises,” he added.

U.K. Chancellor Rachel Reeves responded Wednesday that there was more to do to ease the cost of living.

“We have taken the decisions needed to stabilise the public finances, and we’re a long way from the double-digit inflation we saw under the previous government, but there’s more to do,” she said in emailed comments.

The British pound was largely steady against the dollar following the data release, trading at $1.3489.

Services inflation gained to 5% in July from 4.7% in the previous month. The print is seen as another obstacle in the Bank of England’s attempts to tame inflation, analysts say, as service-focused businesses raise prices to cover the costs of rising wages and the recent hike to National Insurance contributions.

The higher July reading also diminishes the chance of any further interest rate cut by the Bank of England this year.

“I’m annoyed about the services inflation, it’s looking sticky, and given the importance of services to the U.K. economy I look at that and think, if the MPC [the central bank’s monetary policy committee] is looking at that as well — and I’m sure that they are — the chance of a rate cut in November are vanishingly small,” James Sproule, chief U.K. economist at Handelsbanken, told CNBC’s Squawk Box Europe.