China’s Rare Earth Controls Spark Global Industry Shift

Image Credit : Politico

Source Credit : Portfolio Prints

What’s happening?

People’s Republic of China has expanded export controls on rare earth elements (REEs) and permanent magnets — a move that is reshaping global supply chains for high-tech and defence industries.

- In October 2025, China’s Ministry of Commerce of the People's Republic of China announced new licensing requirements for foreign firms exporting magnets or goods that contain even small amounts of Chinese-origin rare earths (or use Chinese processing/technology) — representing a big escalation.

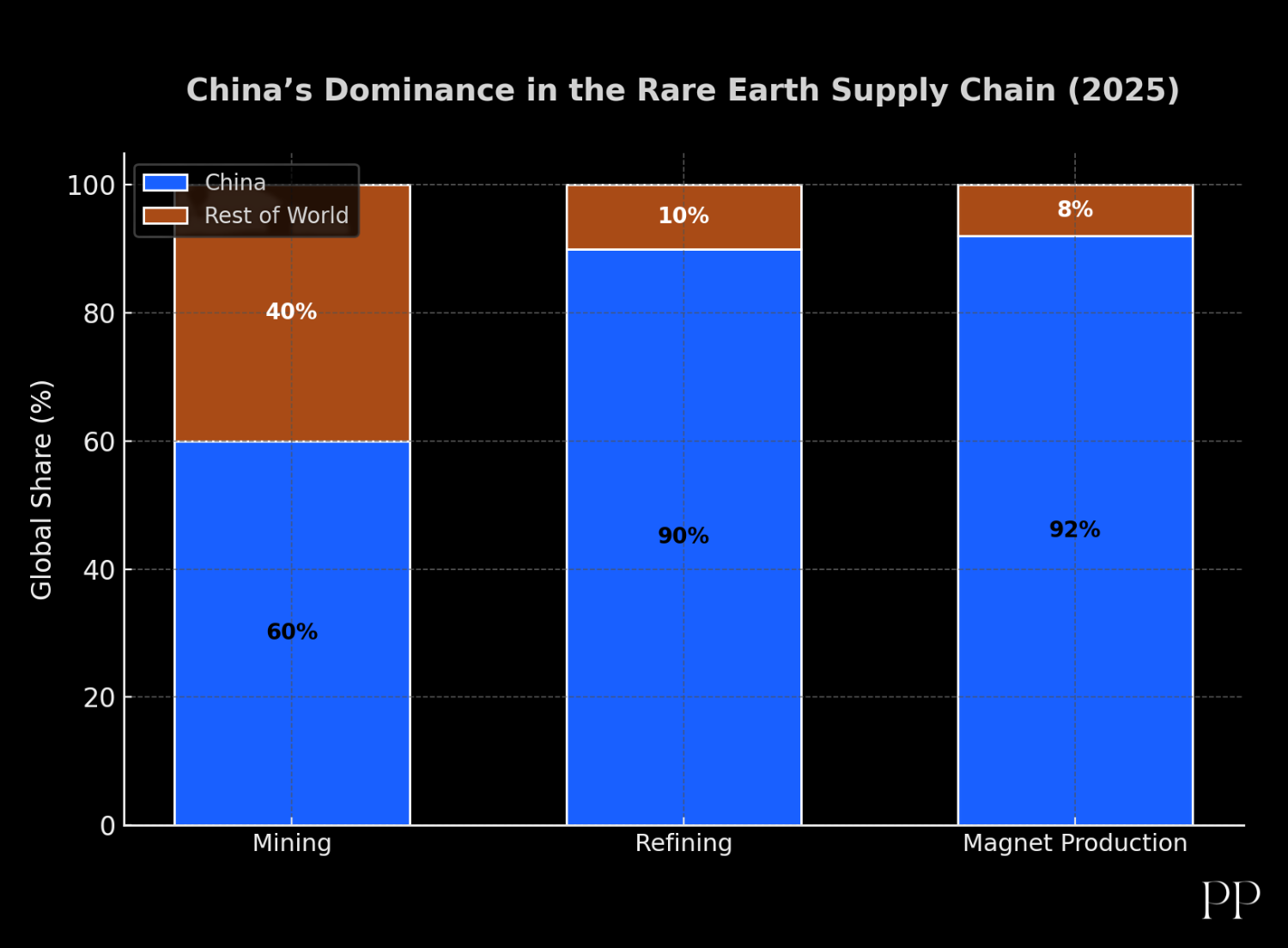

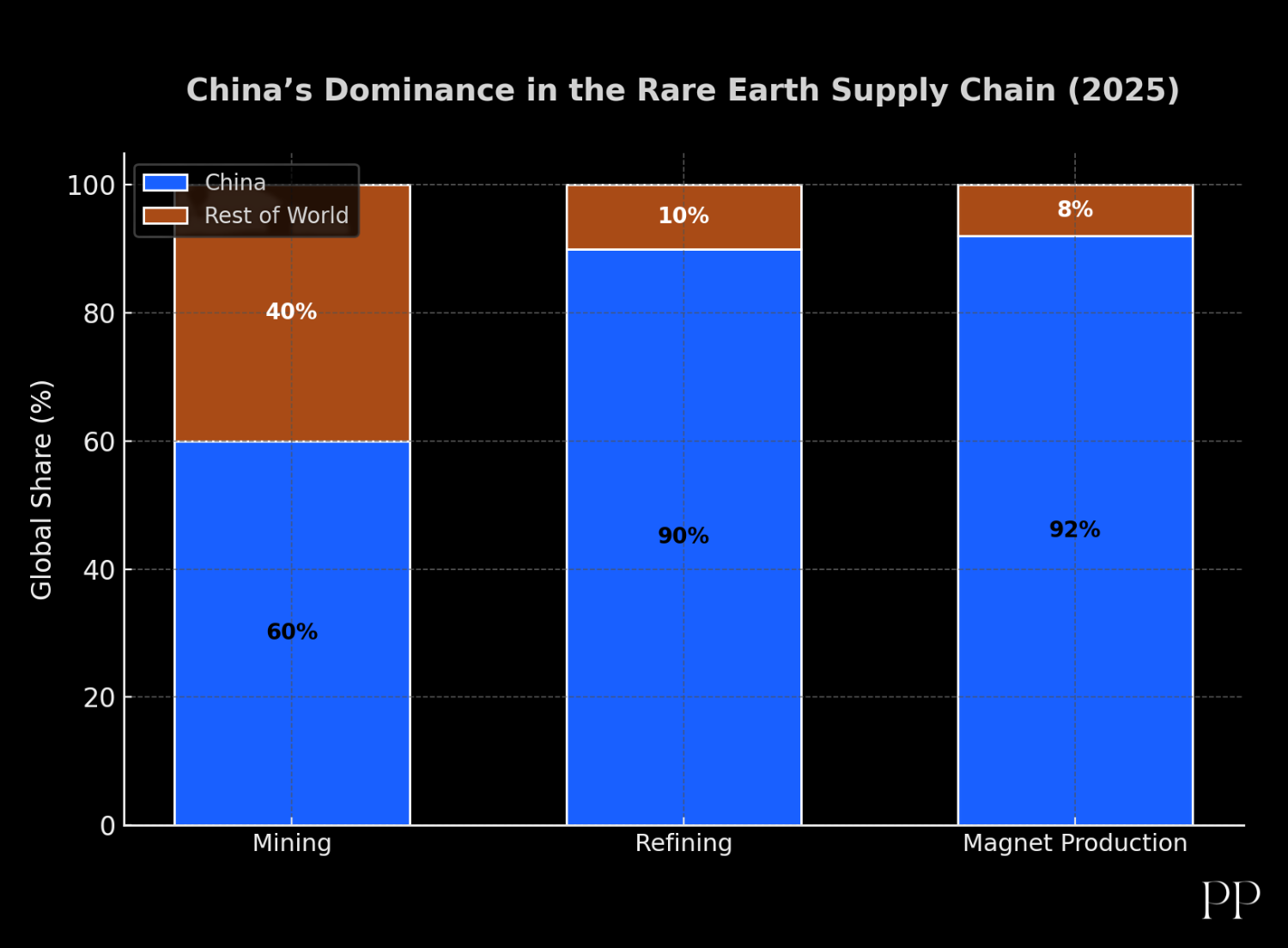

- China already dominates REE supply: ~60 % of global mining output in 2024 and ~90 % of the separation/refining step in key materials.

- The controls extend the earlier April 2025 restrictions (which covered seven elements) by adding five more elements (e.g., holmium, erbium, thulium, europium, ytterbium) in October.

- These changes are seen as geopolitical leverage, especially in the context of US-China trade tensions.

Why it matters — Key implications

Strategic leverage & supply-chain risk

China’s actions have put the vulnerability of global industries into sharp relief. The International Energy Agency (IEA) has warned that supply concentration in critical minerals is no longer theoretical: one country (China) remains heavily dominant in critical steps such as refining and magnet production.

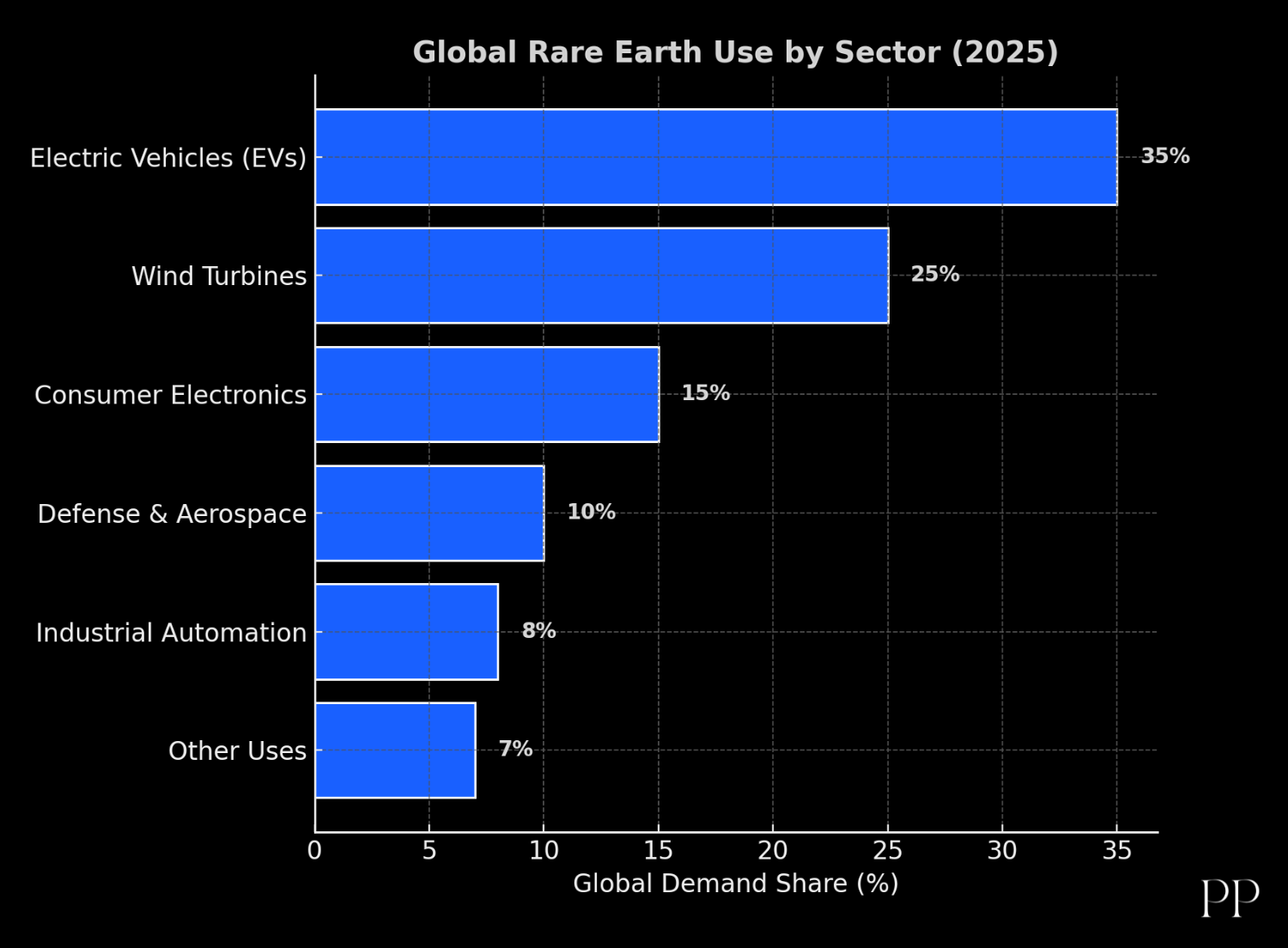

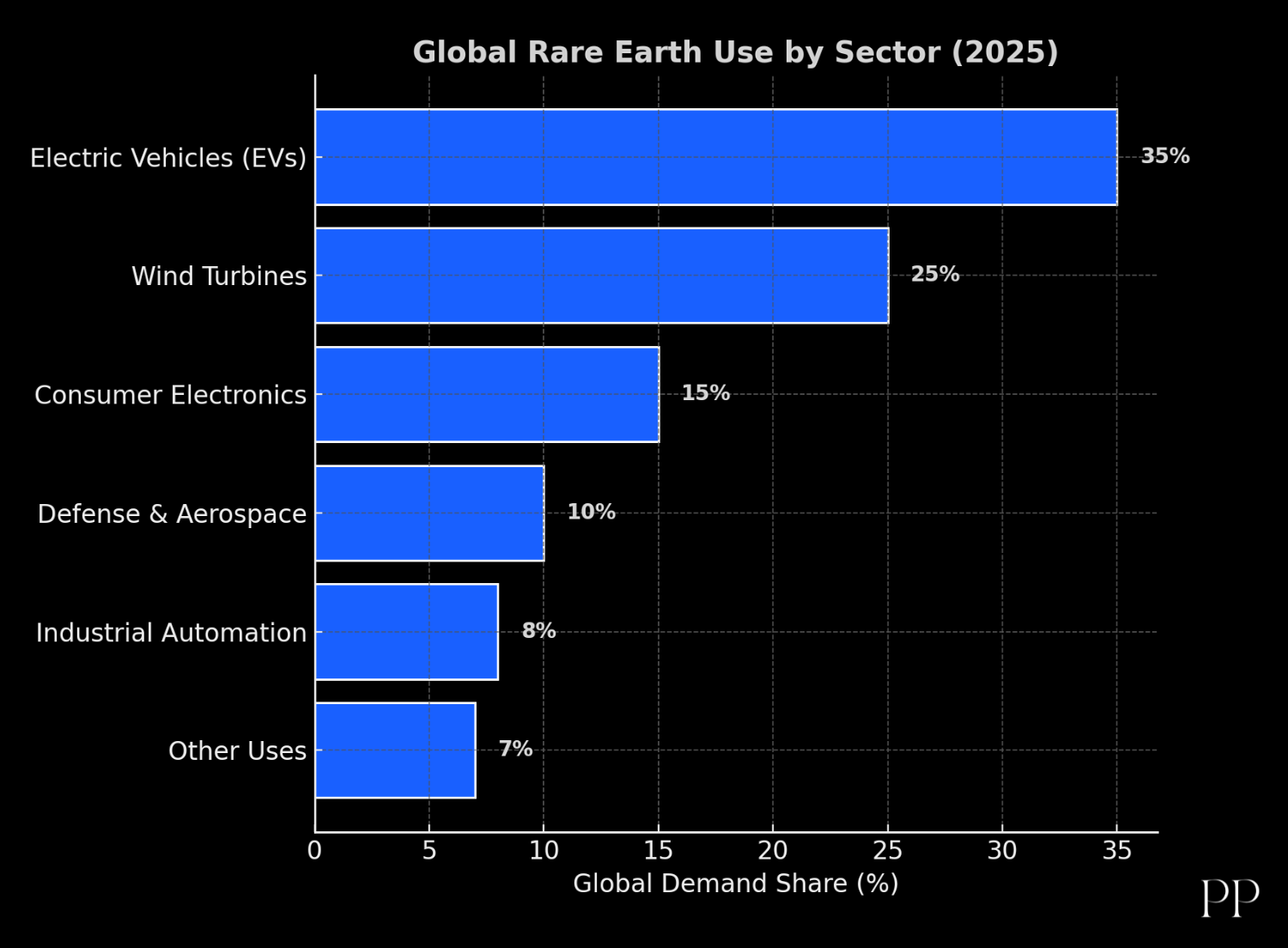

- REEs are essential for electric vehicles (EVs), wind turbines, consumer electronics, and advanced defence technologies (e.g., magnets in motors, guidance systems)

- If China delays or restricts exports, downstream producers globally face costly disruptions or supply-shortages.

Global ripple effects

- In the EU: Companies are scrambling for alternatives; the EU is exploring “joint purchasing” and strategic projects to build local capacity of critical raw materials.

- In the US: The lack of domestic capacity (especially in processing and magnet manufacturing) means the US is particularly exposed. The US is also considering export-controls on software/technology in response.

- In India: India’s plans to build a ₹7,300 crore magnet-manufacturing initiative face headwinds because China is constraining key equipment/machinery exports needed for magnet production.

The wider context & motivations

China’s strategy is tied to several factors:

- Controlling a strategic resource: REEs are classified by many governments as “critical minerals” due to their dual-use (civil + military) nature.

- Negotiating leverage: The timing ahead of major trade talks (e.g., between Donald Trump and Xi Jinping) suggests the export controls are used as bargaining chips.

- Industrial policy: China has for years ensured not just mining, but refining and magnet-manufacture stay predominantly under its control.

What’s next? Likely scenarios

- Diversification by other countries: Expect increased investment in Australia, Canada, Southeast Asia, Africa to mine/process rare earths. The US and EU are accelerating efforts.

- Industrial re-shoring or new supply-chains: Firms dependent on Chinese supply will shift or invest in alternate supply chains or stocks to mitigate risk.

- More trade/tech friction: China’s controls may provoke counter-measures (e.g., via trade tariffs or export-controls by the US/EU) deepening frictions.

- Cost and timing pressures: Building comparable capacity outside China takes time and large capital. Meanwhile, industries (EVs, renewables, defence) must make decisions under uncertainty.

What this means for India & the region

- India’s magnet and EV-component efforts are at risk because China’s control is not only on raw minerals but also on key processing equipment and technology.

- There’s an opportunity for India to partner with other producers or build regional hubs (e.g., via ASEAN) to be part of the new supply-chain re-alignment.

- Strategic planning is required: the industry needs to anticipate disruptions and invest early in processing and value-addition, not just mining.

Conclusion

China’s tightened export controls on rare-earth metals and magnets mark a watershed moment for the global industry. These materials, once seen as just one part of supply-chains, are now central to geopolitics, industrial strategy and national security.

For companies and governments alike, the message is clear: dependence on a single dominant supplier is no longer acceptable if you want resilience. The scramble to build alternate supply chains, invest in processing, and restructure reliance is already underway — and those who act early will likely have an advantage.