Source Credit : Portfolio Prints

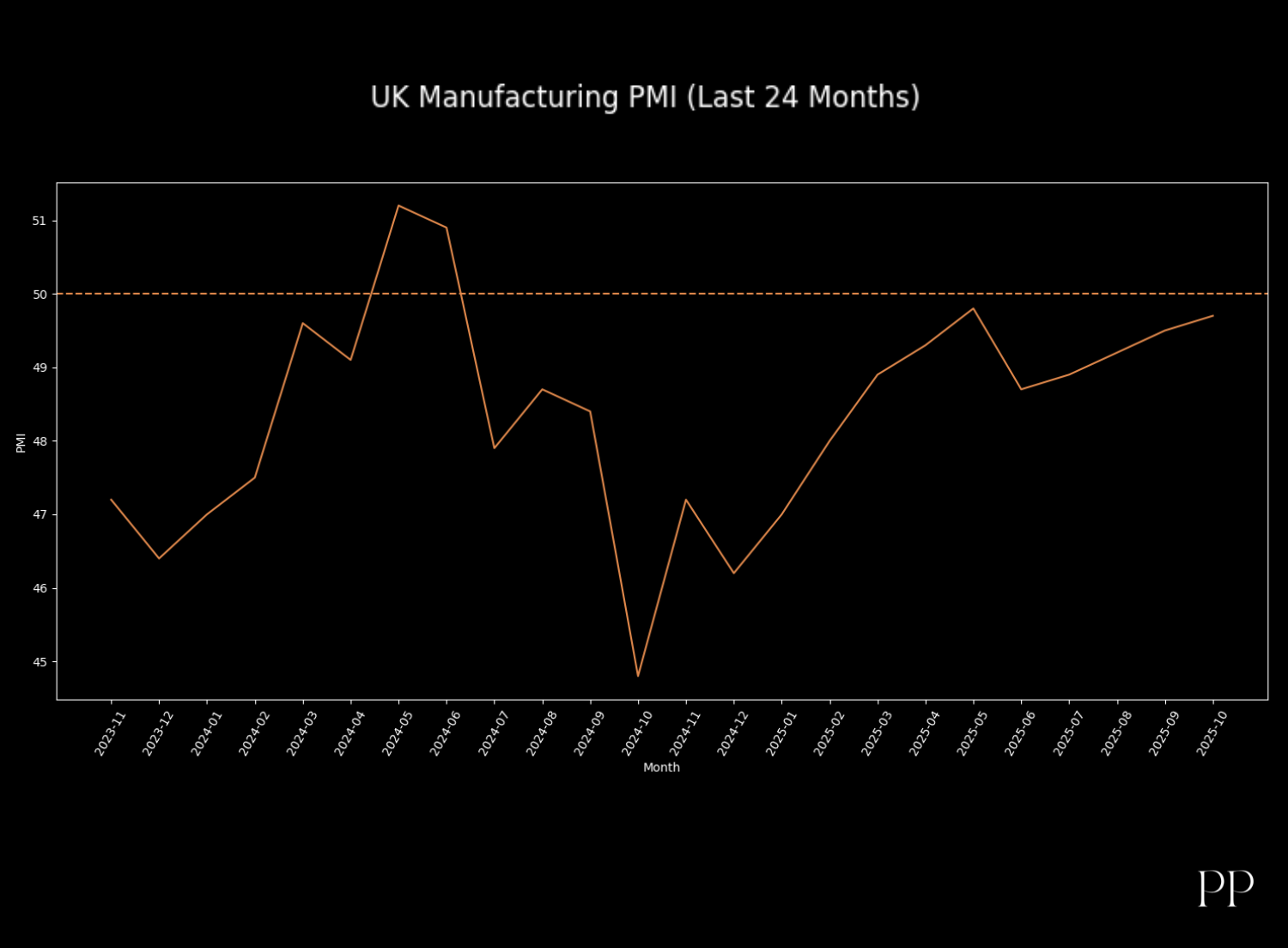

The United Kingdom’s manufacturing sector is showing signs of a tentative rebound after a prolonged period of contraction. In the most recent survey from S&P Global, the UK manufacturing Purchasing Managers’ Index (PMI) climbed to 49.7 in October, up from 46.2 in September.

Though still just under the 50 mark (typically considered the threshold separating contraction from expansion), this marks the first time in a year that output has grown and represents the highest level in the past 12 months.

What’s powering the up-turn

- A critical boost came from the restart of production at the British car-maker Jaguar Land Rover (JLR), which had been shut down by a cyber-attack and had pushed UK car production to a 73-year low. The resumption of operations created a backlog of orders and triggered increased output in automotive supply-chains.

- Input-cost pressures are easing: the survey noted that input-price inflation dropped to its lowest level since December 2024. This helps relieve cost burdens on manufacturers.

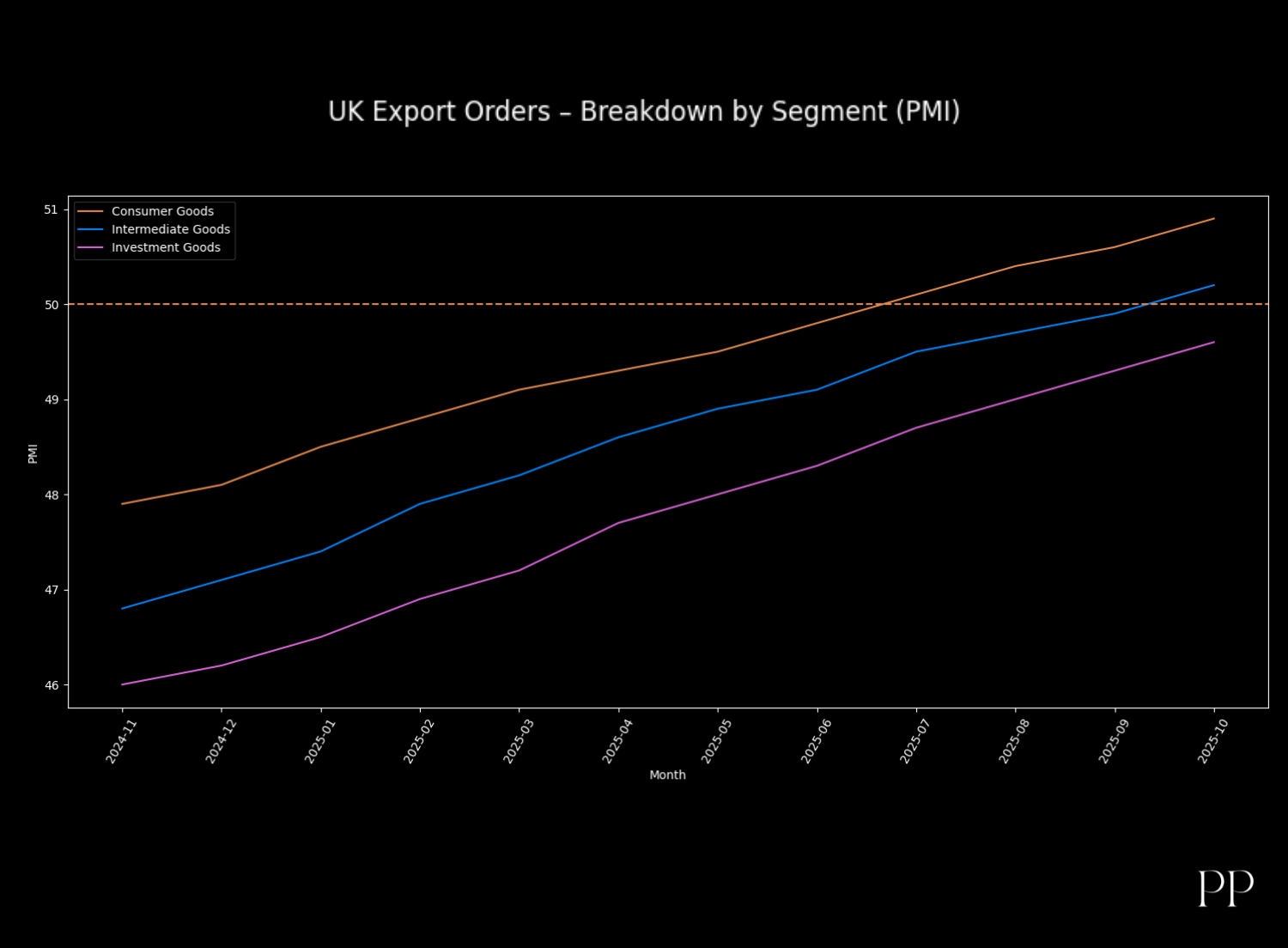

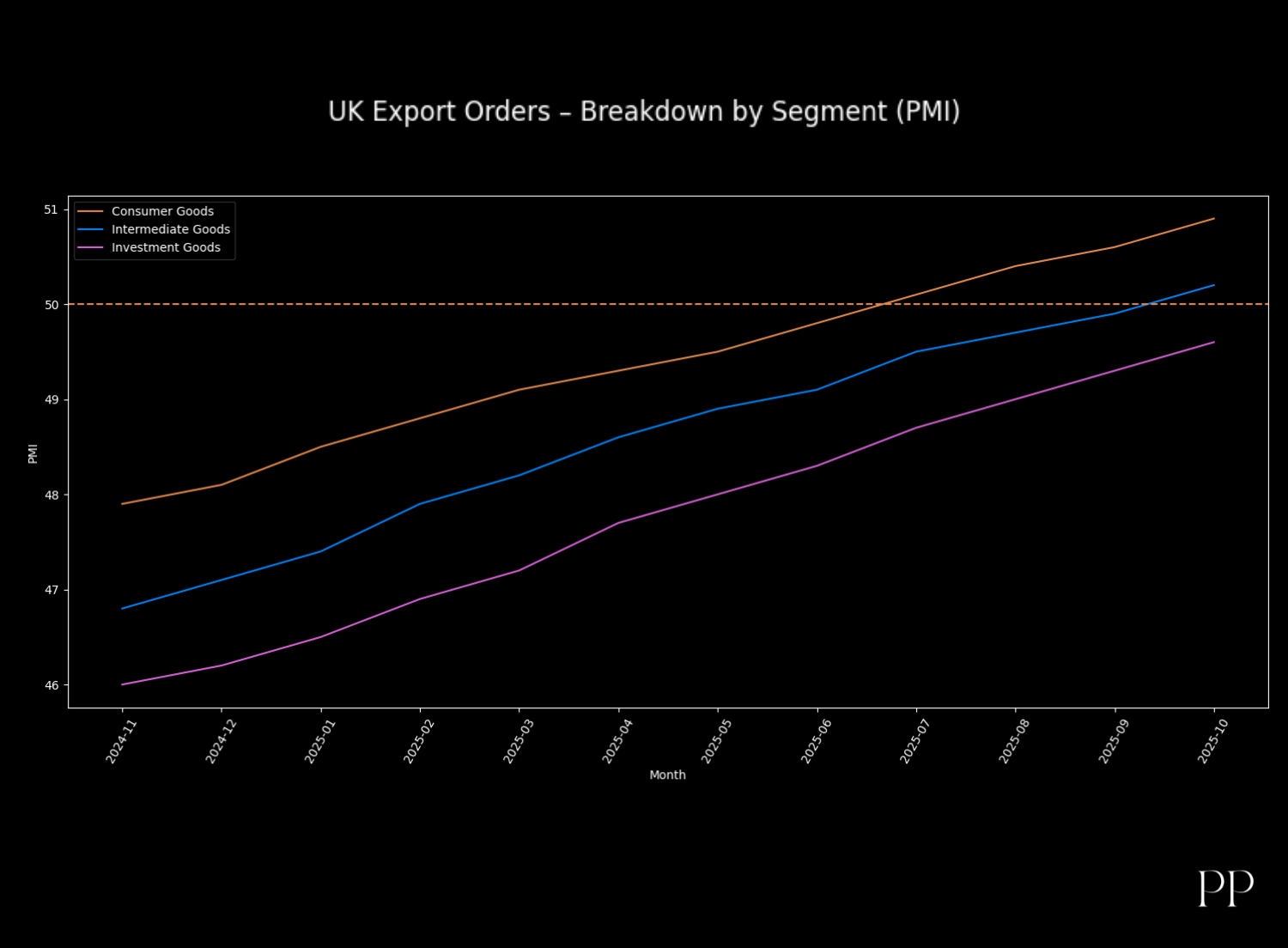

- Some consumer and intermediate goods production saw improvement, even if investment goods still lagged.

But the recovery is fragile

Despite the positive headline, the rebound comes with several important caveats:

- Export orders and new orders remain in decline, though the pace of decline has slowed.

- Employment in manufacturing is still falling (though at a softer pace), and investment intentions remain weak.

- Business sentiment, while better, remains below long-term average levels. The revived output is partly attributed to clearing back-logs rather than fresh demand.

- Structural headwinds remain: high energy costs, skills shortages, and policy/investment uncertainty continue to weigh on manufacturers.

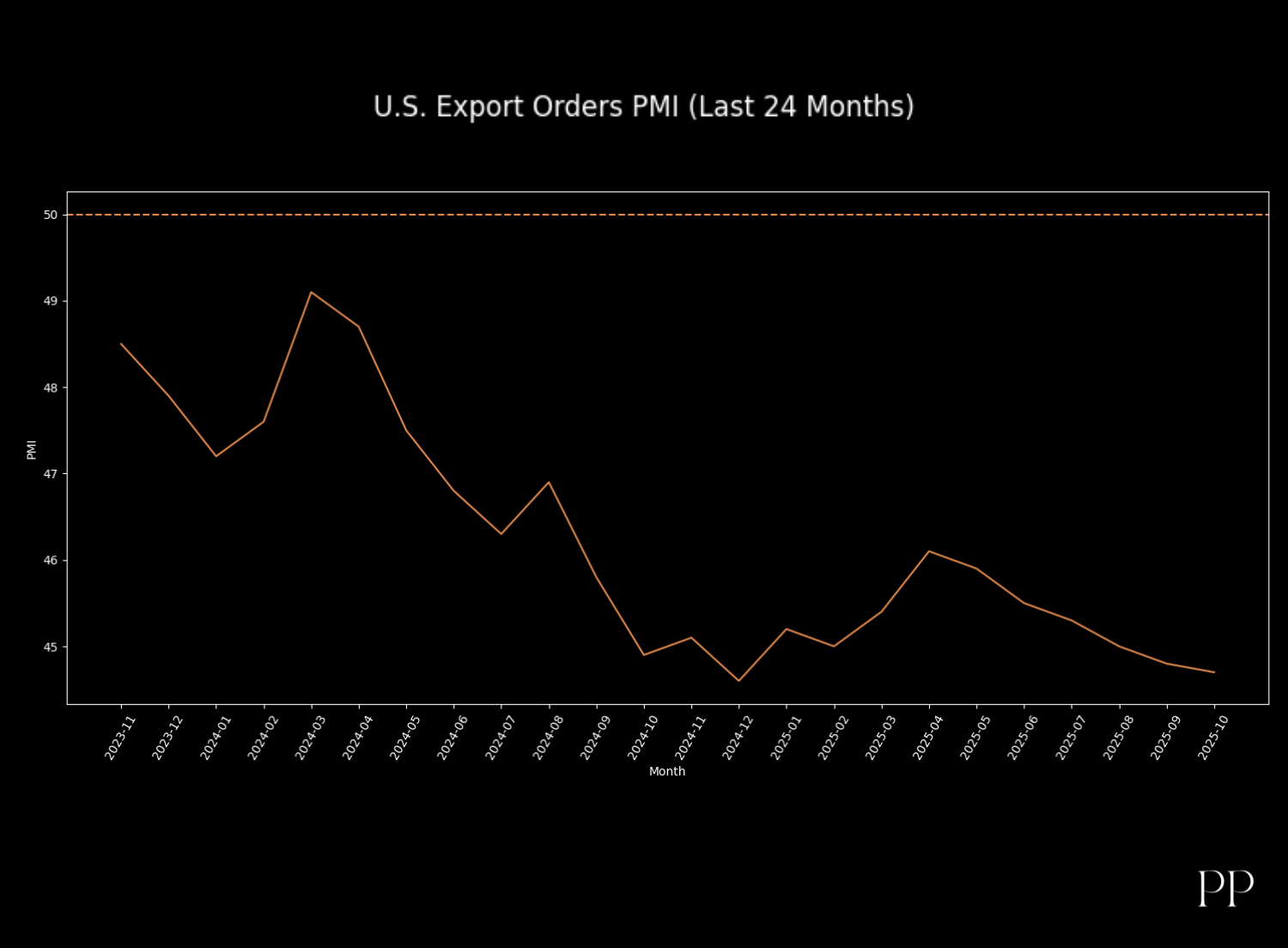

U.S. exporters and manufacturing under strain

Export demand and tariffs weigh heavily

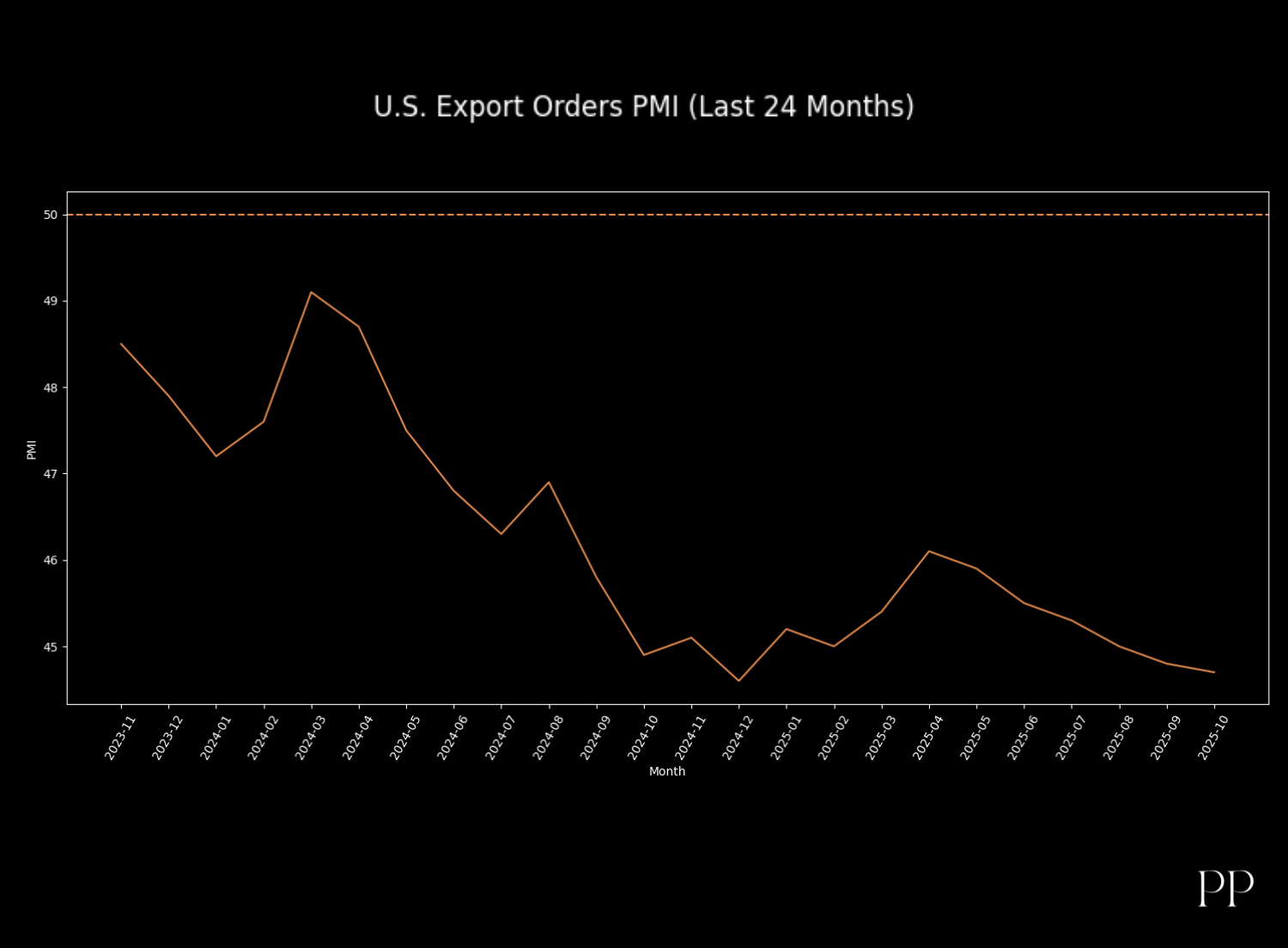

- According to a recent survey, U.S. manufacturing exports are weakening. The report noted that new export orders fell in October, which respondents linked with tariff pressures and global demand softness.

- Separate analysis shows the U.S. manufacturing sector remains stuck in near-recession territory: the PMI index was at 48.7 as of recent data, indicating contraction for the eighth straight month.

- Tariffs and trade uncertainty are sapping business confidence and making firms hesitant to invest or expand.

Broader implications

- As U.S. exporters struggle to secure new overseas orders, inventories of finished goods are reported to be building up, according to firms.

- A persistently weak export sector in the U.S. could have knock-on effects: reduced production leads to lower employment, less investment, and slower growth in regions dependent on manufacturing.

- The divergence between U.K. manufacturers registering some revival while U.S. exporters remain under pressure highlights how global trade dynamics and domestic policy/regime differences matter significantly.

Outlook & implications

For the U.K.

- If the improvement in manufacturing sustains, it could help the broader U.K. economy, create momentum in industrial investment, jobs and boost confidence.

- But given the fragility, the government and industry must address structural impediments: energy costs, skills gaps, supply-chain resilience, access to export markets.

- A full recovery would require fresh demand—both domestic and international—not just back-log fulfilment.

For the U.S.

- Continued contraction or stagnation in manufacturing/export orders is a warning sign for the broader economy. It may weigh on growth, employment in manufacturing-heavy regions and investment cycles.

- Trade policy clarity, easing of tariffs, and improved global demand would help, but firms remain cautious until such uncertainties are resolved.

Global trade & supply-chain meaning

- The contrasting stories underscore how global manufacturing cycles are uneven: one country may show signs of revival due to specific triggers, another may lag because of entrenched headwinds.

- It also highlights how export-oriented manufacturing is vulnerable to global demand swings and policy shifts, whereas firms serving domestic or specific niche markets may be more insulated.

Summary

UK manufacturing is showing signs of recovery, with production and export orders steadily improving over recent months. The UK’s PMI has climbed closer to the 50 expansion threshold, supported by stronger demand for consumer and intermediate goods. In contrast, U.S. manufacturers continue to face weakening export activity, as global demand softens and tariff pressures weigh on competitiveness. Export orders in the U.S. have remained in contraction for nearly two years, with investment goods hit the hardest. The divergence highlights shifting trade dynamics, where UK producers are regaining momentum while U.S. exporters struggle to secure new overseas orders.