Global Factory Activity Slips as 2026 Approaches

Image Credit : Bloomberg

Source Credit : Portfolio Prints

A Broad Economic Slowdown

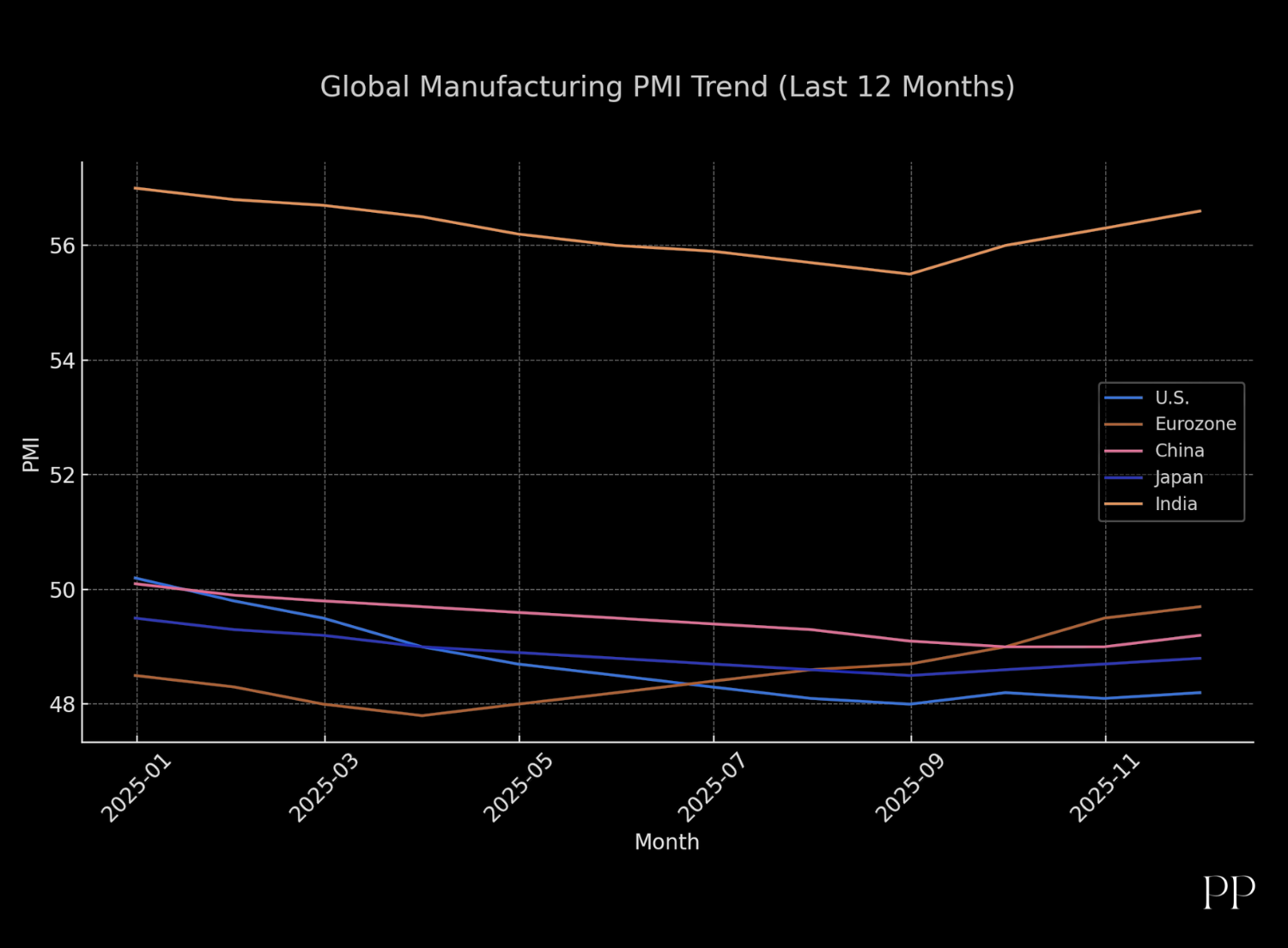

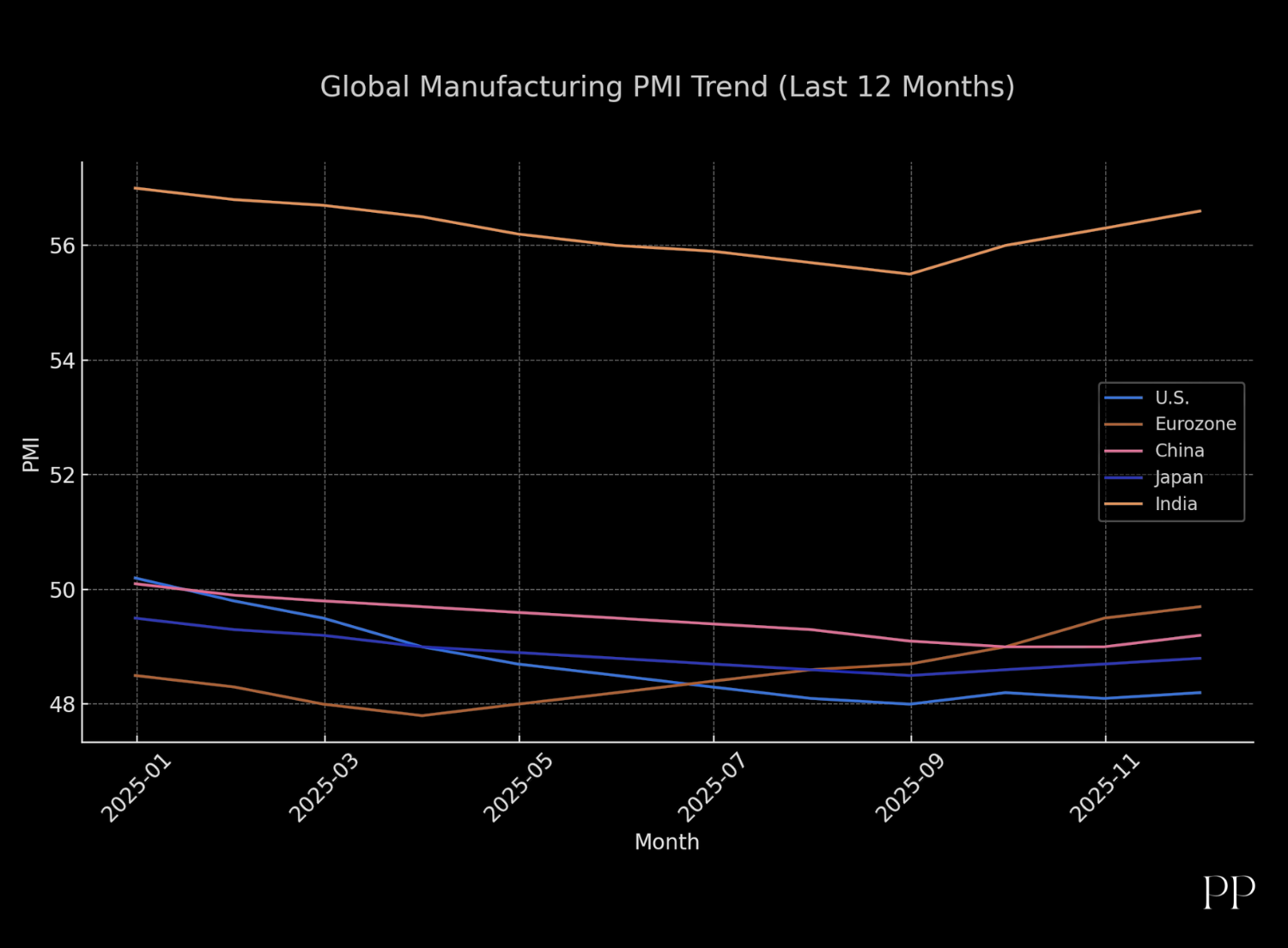

Recent data shows that global manufacturing is flagging. In November 2025, factory activity weakened across major economies — including the U.S., the eurozone, China, and Japan — under the weight of soft demand, high inventory, tariffs and broad global uncertainty.

For the U.S., manufacturing has now contracted for the ninth month straight, per the Institute for Supply Management (ISM), with falling orders, rising input costs, and shrinking demand cited as key issues.

Meanwhile in the HCOB euro-zone manufacturing index, output declined in November, new and export orders dropped, and job cuts accelerated at the fastest pace in seven months.

In Asia, the picture is similar: National Bureau of Statistics of China (NBS) data showed China’s manufacturing PMI remaining below the 50 threshold in November — a mark of contraction — marking the eighth consecutive month of shrinkage.

Together, these signals suggest that global manufacturing is entering the end of 2025 and early 2026 under heavy pressure — likely pointing to a duller industrial phase worldwide.

What’s Driving the Weakness

Multiple converging factors are undermining factory activity globally:

-

Weak demand (domestic and export)

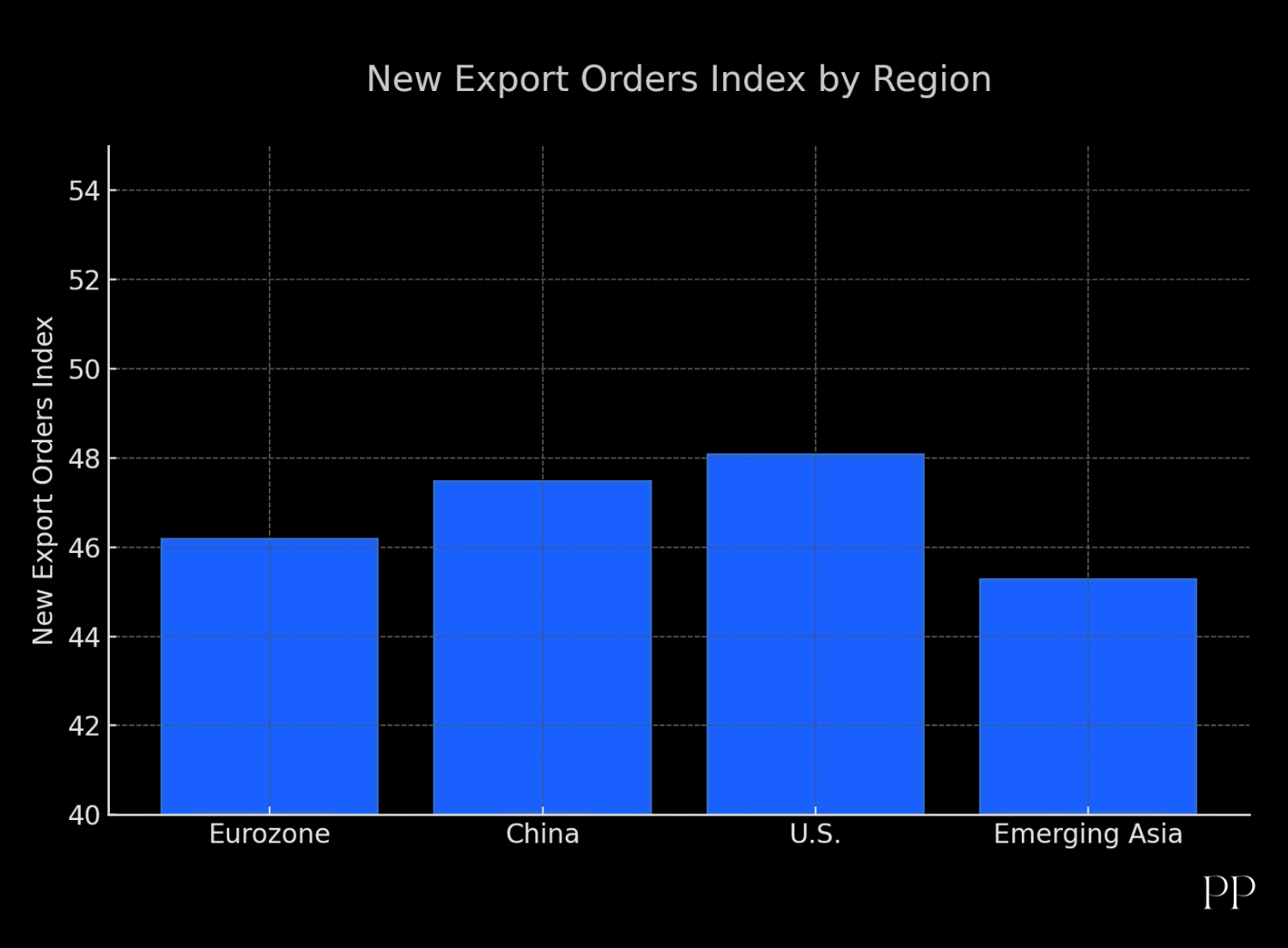

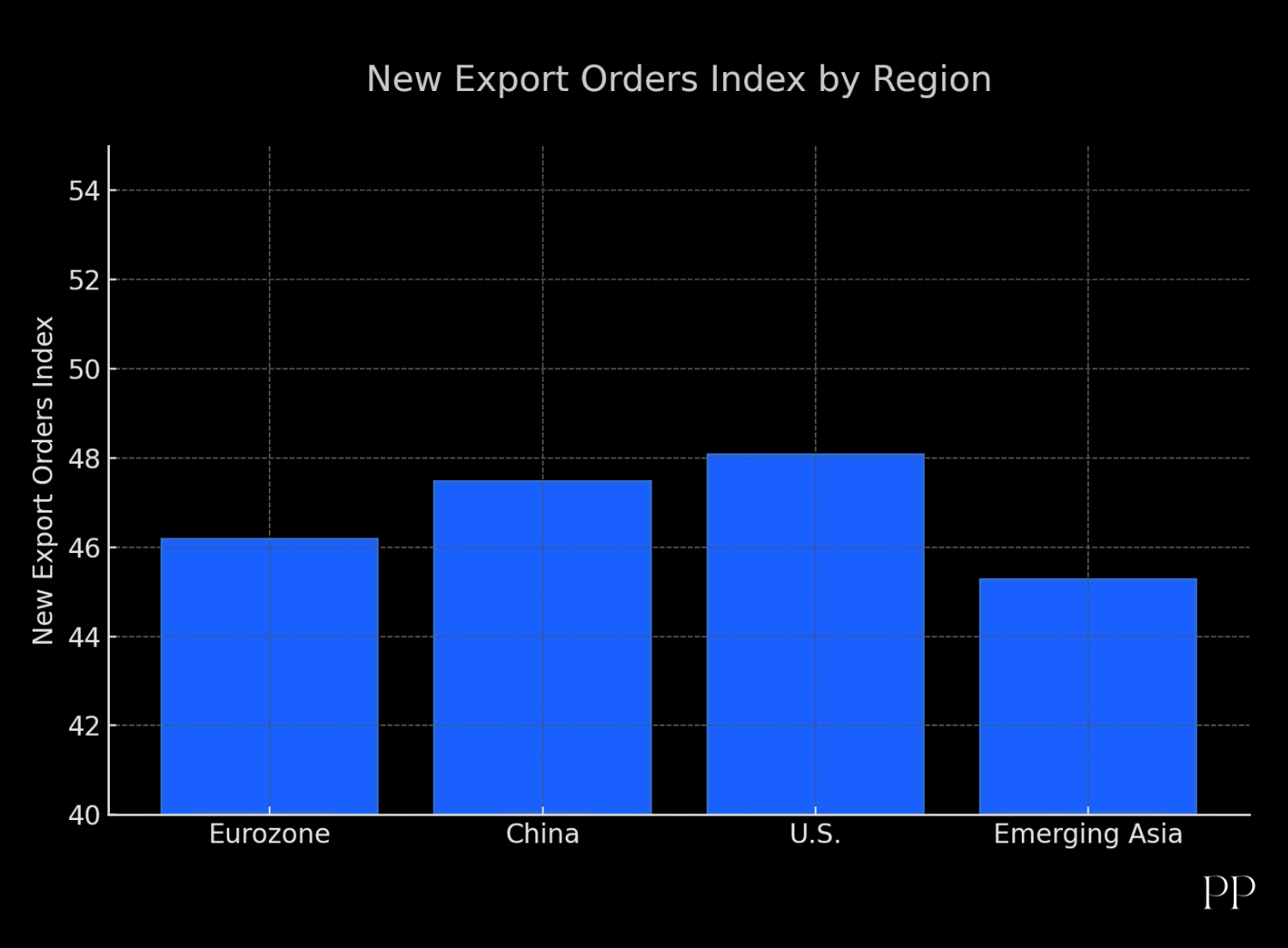

Businesses report falling orders, both from local markets and foreign buyers. Export orders in Europe, China and even some emerging markets have dropped sharply.

-

Tariffs and trade policy uncertainty

Rising tariffs — especially from the U.S. — have disrupted global supply chains and increased input costs, discouraging many from ordering or producing more.

-

Rising inventories & overcapacity

Especially in China, high inventories and weak output have piled pressure on producers, limiting new production and encouraging firms to hold back.

-

Cost pressures and inflation

Input costs and materials are more expensive in many regions. That eats into margins and discourages expansion or hiring.

-

Business pessimism & weaker confidence

Across the board, firms report lower confidence in future demand — the result: delaying investments, freezing hiring, or cutting back output.

Regional Differences

While most major economies are seeing declines, not all manufacturing holds are equal:

While most major economies are seeing declines, not all manufacturing holds are equal:

- The eurozone has had steep drops, especially in new orders and job cuts, with large economies like Germany and France hit hard.

- China faces persistent contraction due to overcapacity, weak domestic demand, and subdued consumer confidence, even though some sectors (e.g. transport equipment) show limited resilience.

- On the other hand, some emerging markets — particularly in Southeast Asia — appear to be faring better, with relative strength or modest rebound in manufacturing activity.

- In certain regions like India, manufacturing growth has slowed but hasn’t collapsed: A recent survey showed manufacturing PMI falling to a nine-month low — still above the “expansion” line — but with weaker export orders and softening demand.

This patchwork outcome suggests that while global manufacturing is under strain as 2026 approaches, resilience is uneven. Countries with diversified domestic demand or proximity to growth markets may fare relatively better.

What This Means for 2026

Experts expect that the challenges facing global manufacturing — trade friction, weak demand, supply-chain stress — will linger heading into 2026.

- Some firms are turning toward “smart manufacturing” — automation, digital tools, and supply-chain optimization — as a way to stay competitive and lean in uncertain times.

- Lower input-price inflation in some regions may ease short-term pressure on margins, possibly allowing firms to stabilize or gradually adjust output.

- Emerging markets with cost advantages or regional demand upticks may attract investment as companies rethink global supply chains — potentially redistributing manufacturing away from traditional hubs.

Still, for a broader recovery to take hold, many conditions must improve: stable trade policies, renewed demand (both consumer and industrial), and firms’ willingness to invest again. Until then, 2026 could well start off as a lagging—or at best slow-growing—year for global manufacturing.

Still, for a broader recovery to take hold, many conditions must improve: stable trade policies, renewed demand (both consumer and industrial), and firms’ willingness to invest again. Until then, 2026 could well start off as a lagging—or at best slow-growing—year for global manufacturing.

Why This Matters

- Economic growth and employment: Manufacturing remains a backbone of industrial economies and a major employer. Persistent contraction threatens jobs, wages, and overall growth.

- Trade and geopolitics: With tariffs and trade uncertainties still a central drag, global trade dynamics — especially between major economies — will shape which regions recover and which lag.

- Supply-chain realignment: Weakness in traditional manufacturing hubs may accelerate relocation of factories or shifting of supply-chains toward emerging markets — a transformation that could reshape global production geography.

- Policy and investment trends: Governments and firms may accelerate digitalization, automation, and smarter manufacturing practices to build resilience — a shift with long-term implications for labor markets, productivity, and competitiveness.

Summary

As 2026 draws near, the global manufacturing sector looks more fragile than at any other time in the past few years. Slumping orders, trade policy uncertainty, high inventories, and weak business confidence have combined to drag factory output — with ripple effects likely across economies worldwide. That said, pockets of resilience remain. The coming months — and how companies and governments respond — will shape whether global manufacturing merely sputters or begins a cautious recovery.