Source Credit : Portfolio Prints

Latest Economic Data Shows Stalling Growth

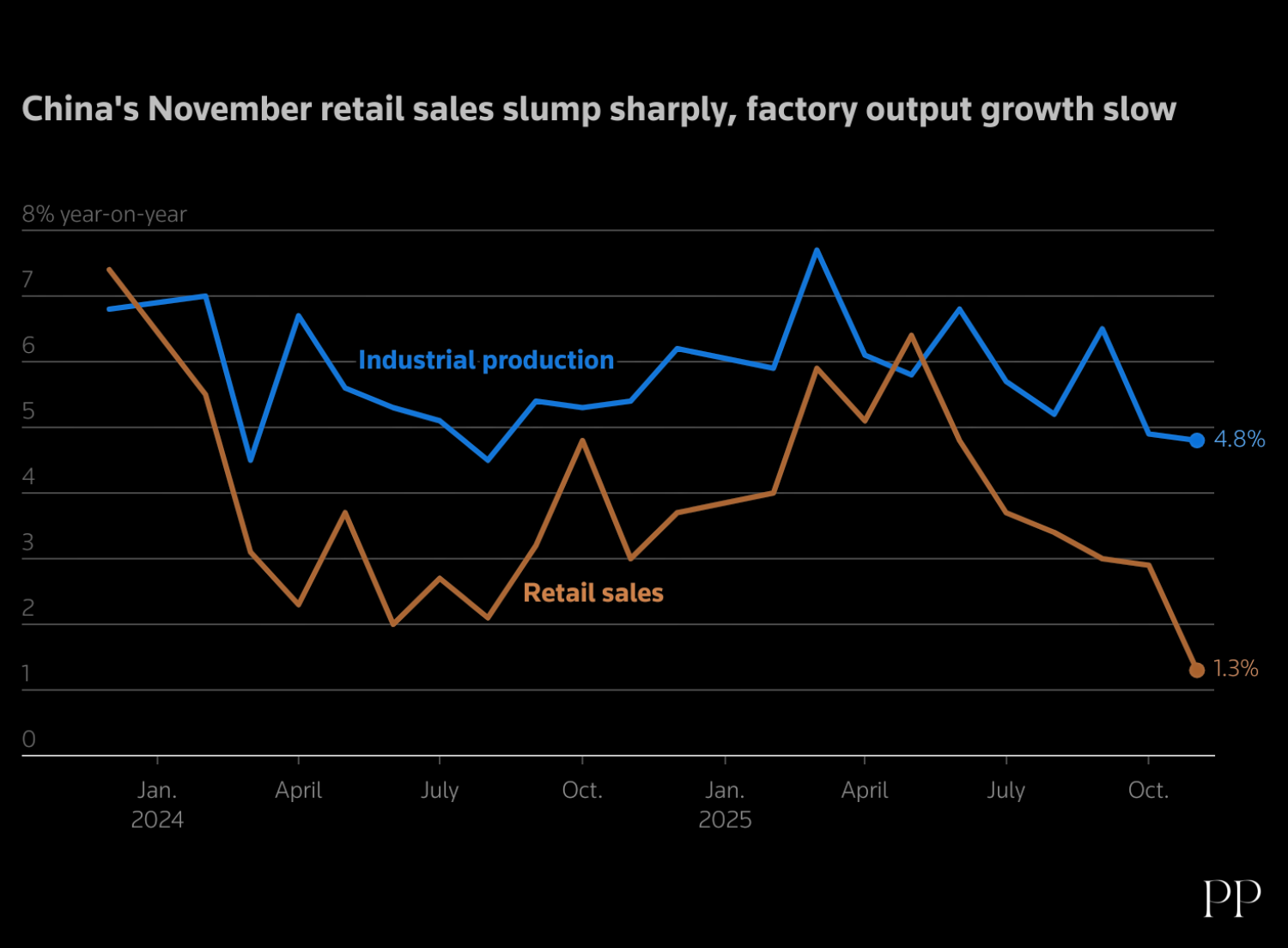

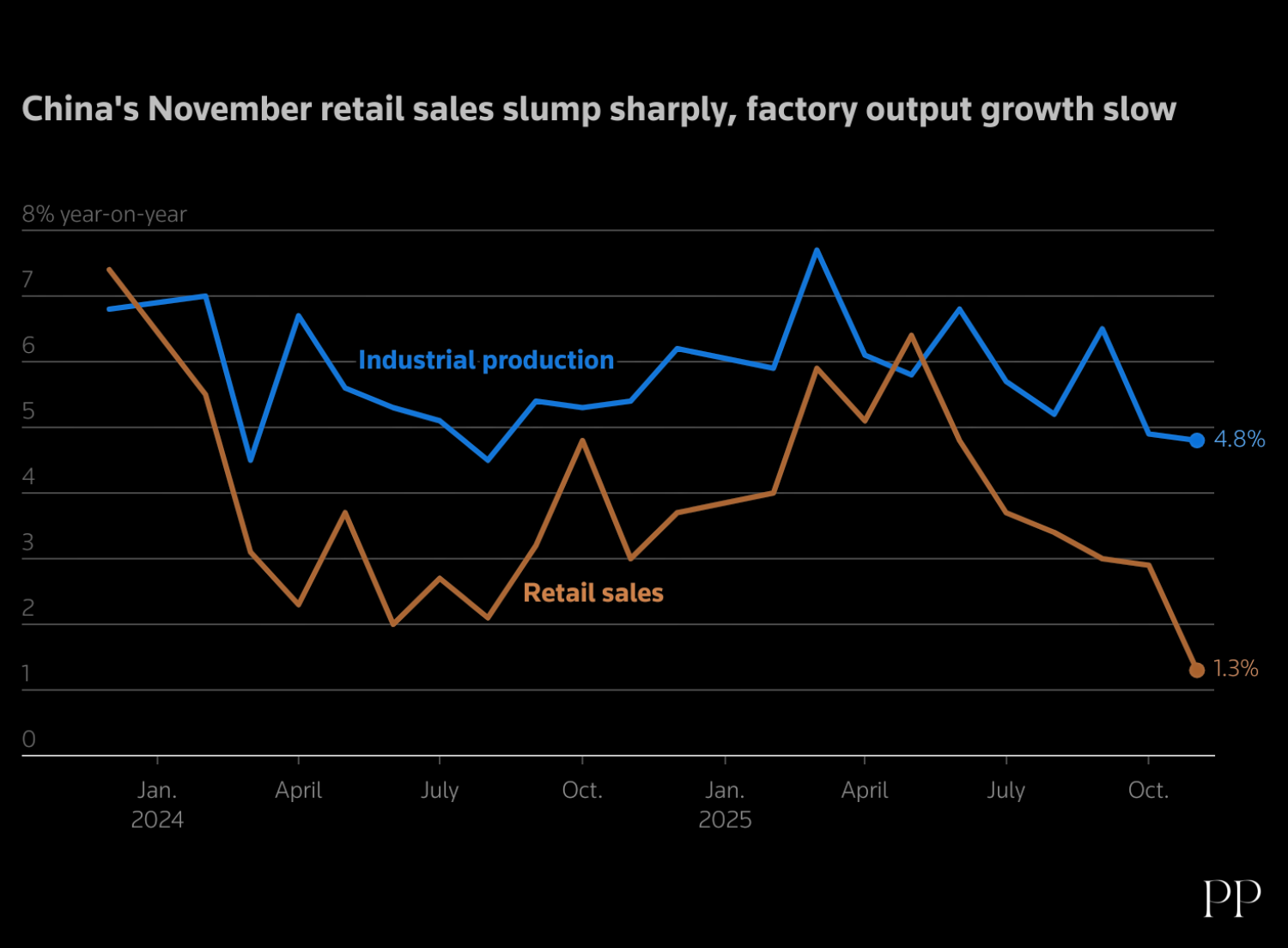

New data for November 2025 reveal that China’s economic momentum has faltered significantly:

- Industrial output growth slowed to 4.8% year-on-year, the weakest pace since August 2024. This was below market expectations and marked a notable reduction from earlier months.

- Retail sales expanded just 1.3%, marking their weakest performance since the end of the strict “zero-COVID” lockdown era. Weak consumption is now one of the chief concerns for policymakers.

- Fixed-asset investment contracted year-on-year, underlining a continued slowdown in business spending and property investment—a key engine of China’s growth.

Overall, multiple indicators are now below trend, with consumption, investment, and industrial activity all signaling a broad loss of economic steam.

Underlying Causes of the Slowdown

Weak Domestic Demand

China’s consumption engine has lost momentum due to several factors:

- The effects of trade-in subsidies and other consumption stimulus measures are fading, leading to weakening retail sales.

- Household confidence remains low, influenced by ongoing property market stress and job insecurity.

- Major categories like household appliances and autos have seen sharp declines in sales.

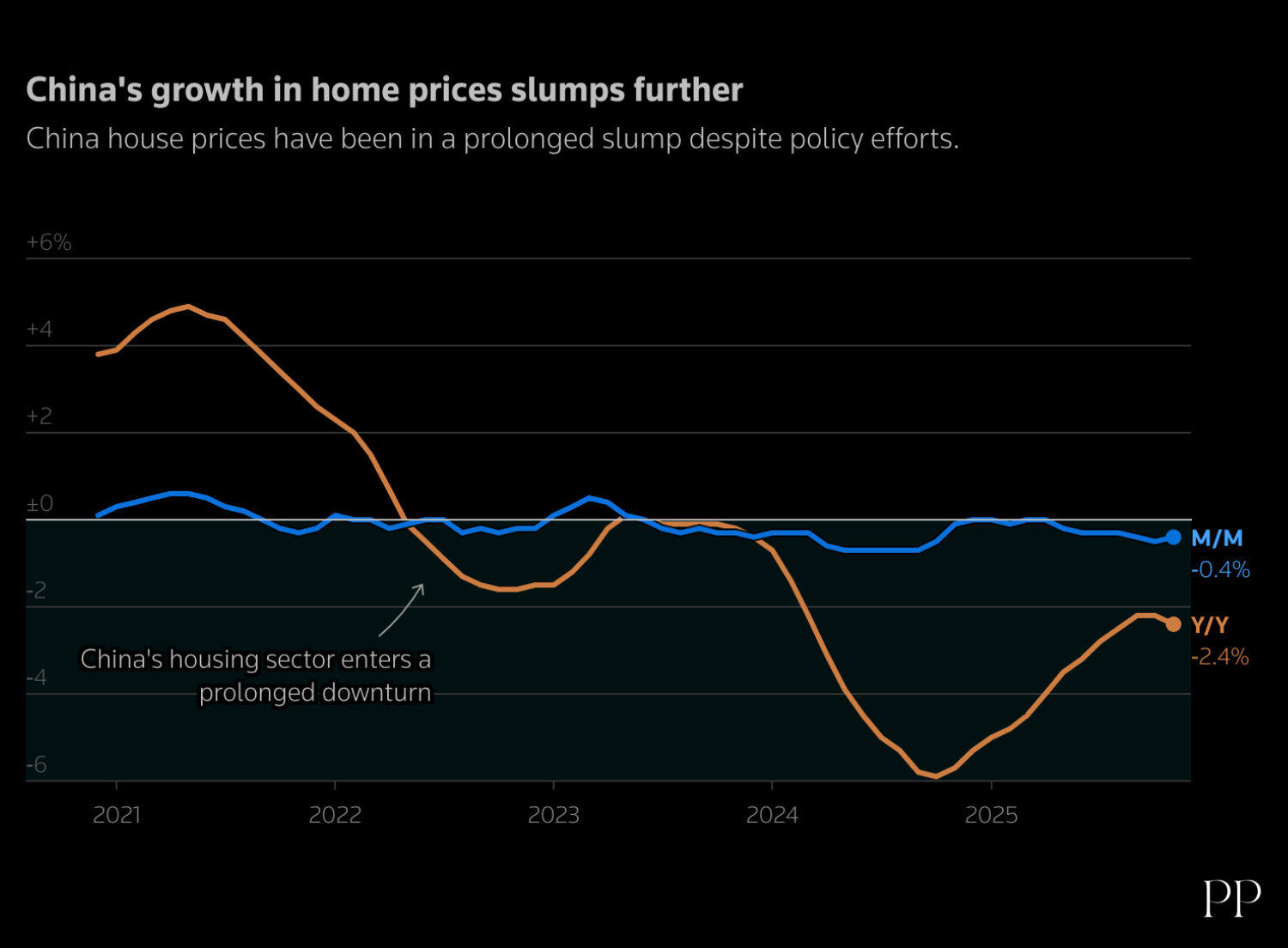

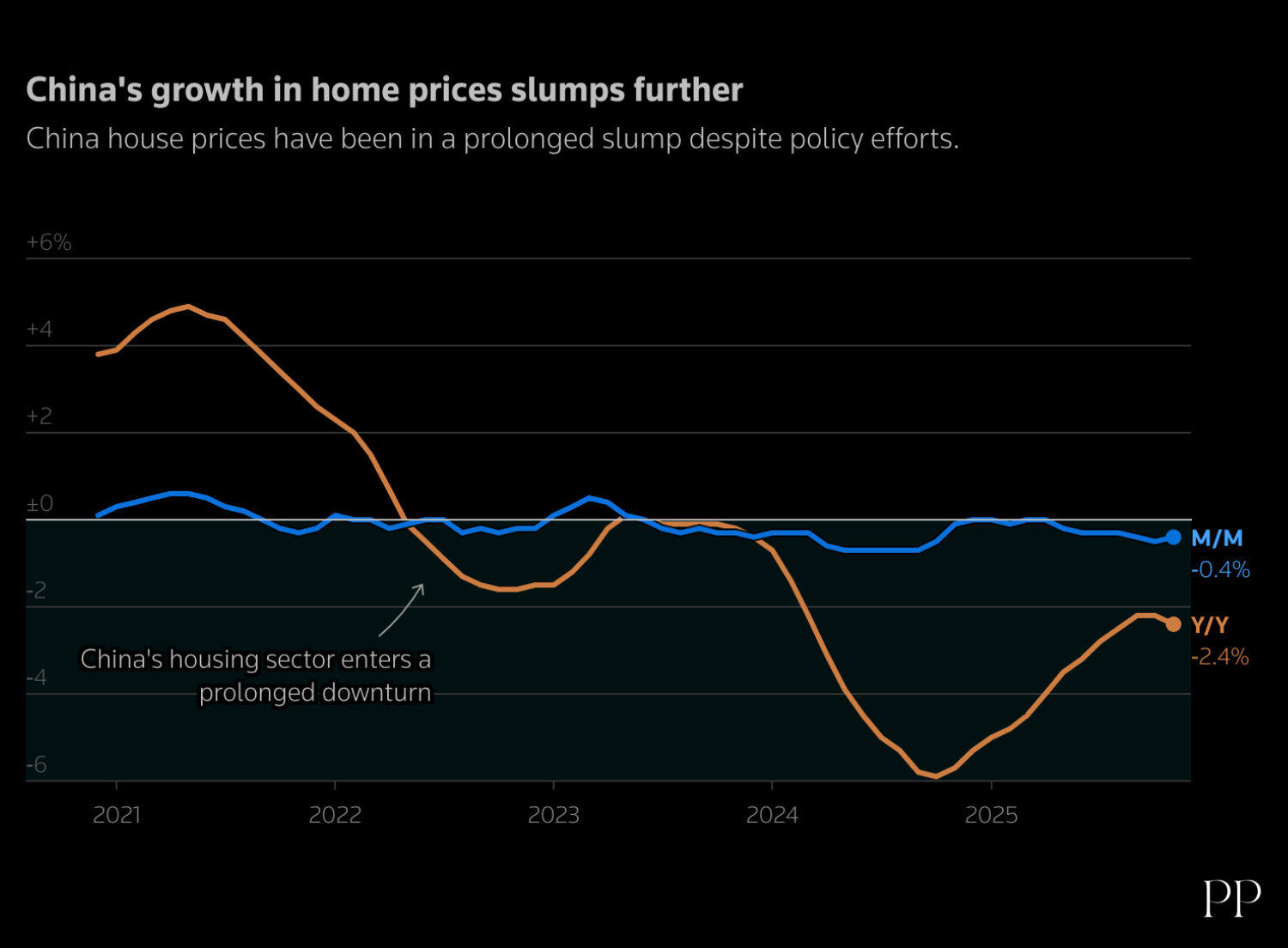

Property Sector Drag

China’s long-running property downturn, which began around 2020, continues to weigh heavily:

- A slump in property sales and investment has dampened household wealth and spending.

- Financial pressures on developers and continued tight credit conditions discourage both buyers and investors.

Investment Slowdown

Business investment has contracted, particularly in fixed assets—a critical gauge of future production capacity and infrastructure spending.

Export Reliance and Risks

China’s economy has increasingly leaned on exports as domestic demand weakens. While exports remain relatively resilient, this strategy faces rising global resistance due to trade tensions and emerging tariffs from trading partners.

Structural and Long-Term Challenges

Shifts in Growth Model

China’s traditional growth model was heavily dependent on investment and exports. However:

- Structural imbalances have emerged as household consumption’s share of GDP declines and reliance on external demand increases.

- Analysts and the International Monetary Fund (IMF) have flagged the need for deeper reform to rebalance growth toward domestic consumption.

Risks of Deflation

There are emerging concerns that weak demand could lead to broader deflationary pressures, with weaker prices at the factory gate and limited pricing power in many sectors.

Broader Economic and Financial Market Impacts

Stock Market Reaction

Chinese equities have responded to the weak economic data:

- Shares of major tech and consumer firms—such as Alibaba, JD.com, and Baidu—fell following the disappointing retail and output figures, reflecting market unease about domestic demand.

Policy Responses

Beijing acknowledges the slowdown:

- Policymakers recognize the need to shift toward boosting household consumption and incomes to sustain long-term growth.

- There is growing discussion among economists of more stimulus measures in 2026, including potential fiscal support to revive demand.

Contrasting Perspectives: Resilience Amid Weakness

Despite these headwinds:

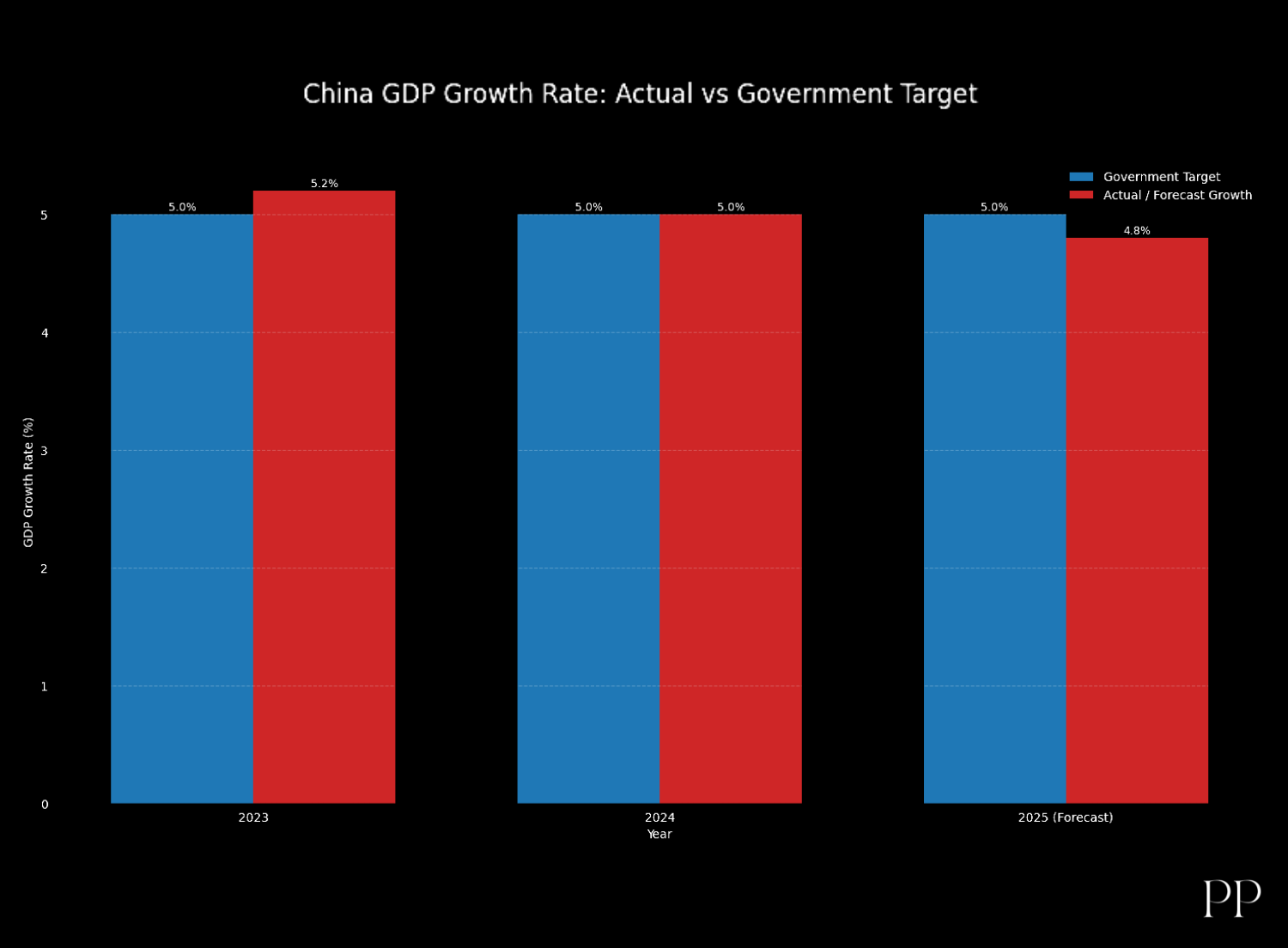

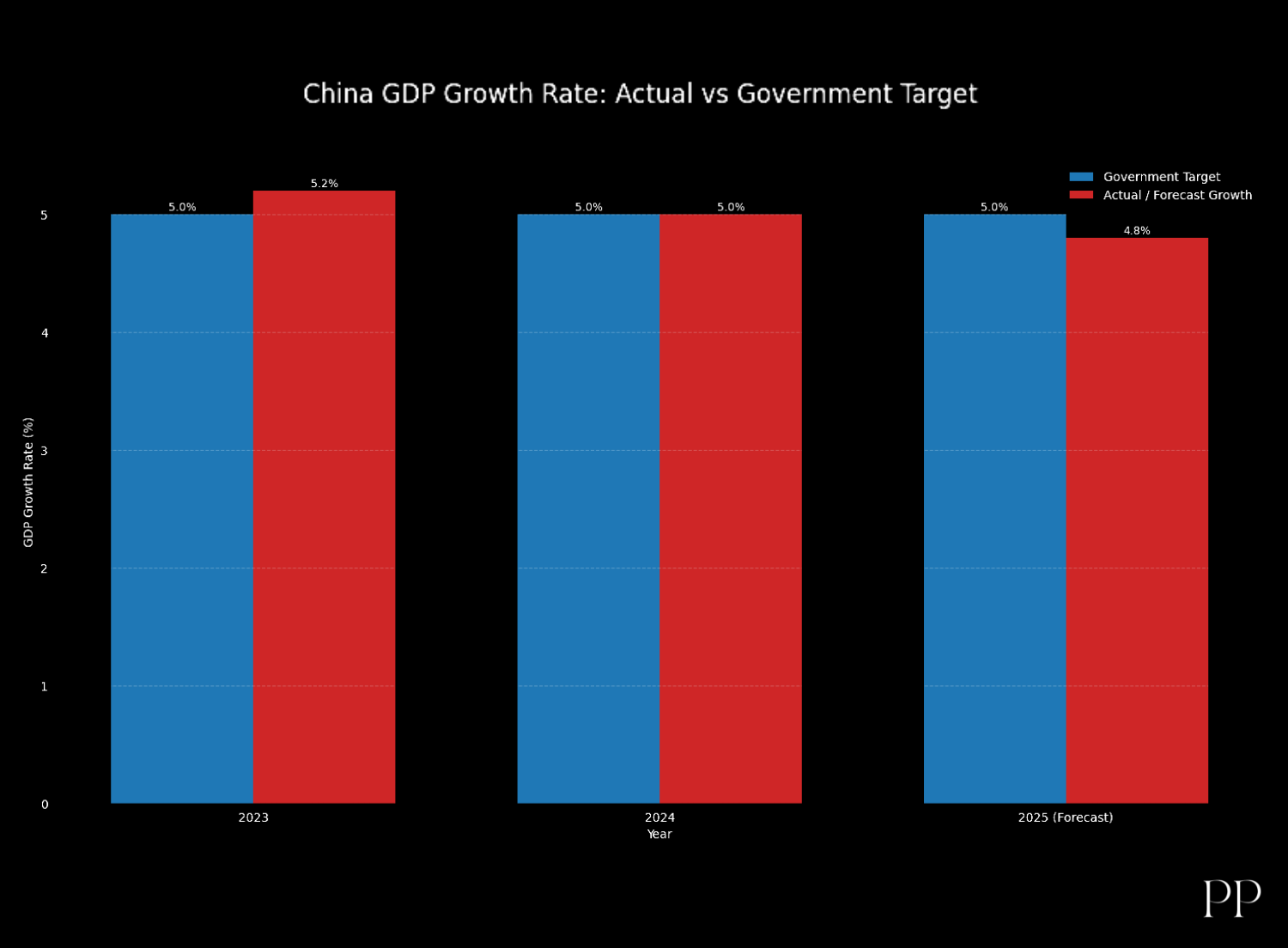

- China’s headline GDP growth in early 2025 remained above 5%, showing that the economy hasn’t collapsed outright but is slowing relative to expectations.

- Some sectors—like industrial production tied to exports and strategic manufacturing segments—continue to show relative strength even amid the slowdown.

This resilience highlights that the economy is not uniformly weak, but the balance between strong export output and weak domestic demand is growing more precarious.

This resilience highlights that the economy is not uniformly weak, but the balance between strong export output and weak domestic demand is growing more precarious.

Outlook and Key Questions for 2026

As China approaches its 2026 economic planning horizon, several questions matter:

Will policymakers implement more aggressive stimulus?

Economists predict stronger stimulus efforts focused on household demand may be needed.

Can China rebalance its economy away from exports and property?

Structural reforms aimed at boosting private sector confidence and consumption are widely recommended but politically challenging.

Will global trade tensions escalate?

Rising tariffs and protectionist pressures could further complicate China’s export-driven growth.

Is deflation a real risk?

If domestic demand doesn’t recover, price declines could become more widespread, adding complexity to monetary policy responses.

Conclusion

China’s economic slowdown is deepening and broadening beyond isolated sectors. While some growth persists, especially through industrial output tied to external demand, domestic consumption, investment, and confidence indicators are faltering. Structural imbalances, a prolonged property slump, and fading policy stimulus all contribute to this trend.

The strategic pivot toward consumer-led growth will be key as China navigates this slowdown into 2026. The outcome will have major implications not only domestically but for the global economic landscape as well.