Source Credit : Portfolio Prints

Background

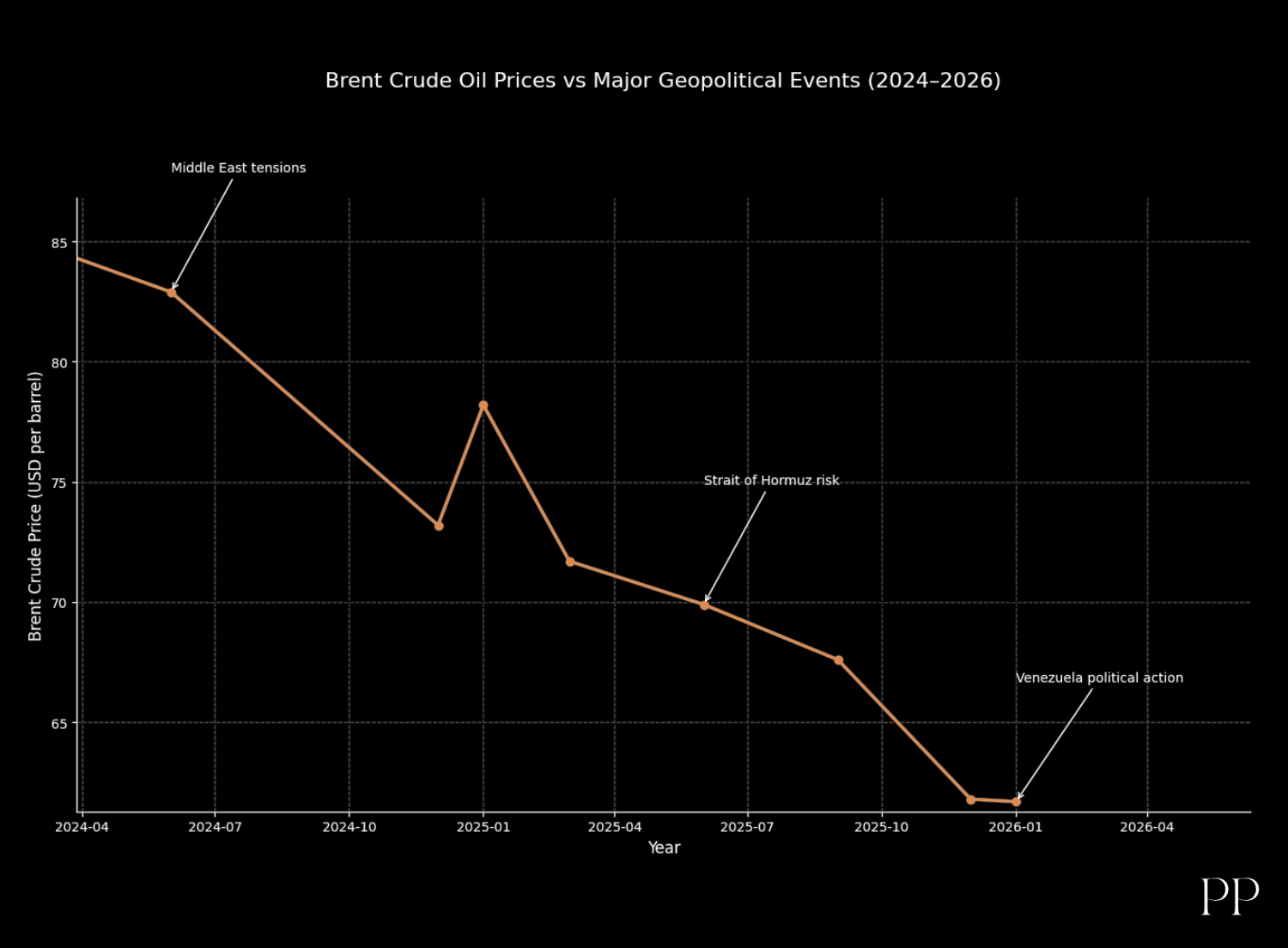

In early 2026, global financial markets continue to navigate a turbulent landscape shaped by an intensification of geopolitical risk, significant developments in oil-producing nations, and the resulting uncertainty in energy markets. These forces are forcing investors across asset classes — from commodities and equities to bonds and currencies — to rethink traditional strategies and manage risk with greater nuance.

A Turning Point in Venezuela: Market Repercussions

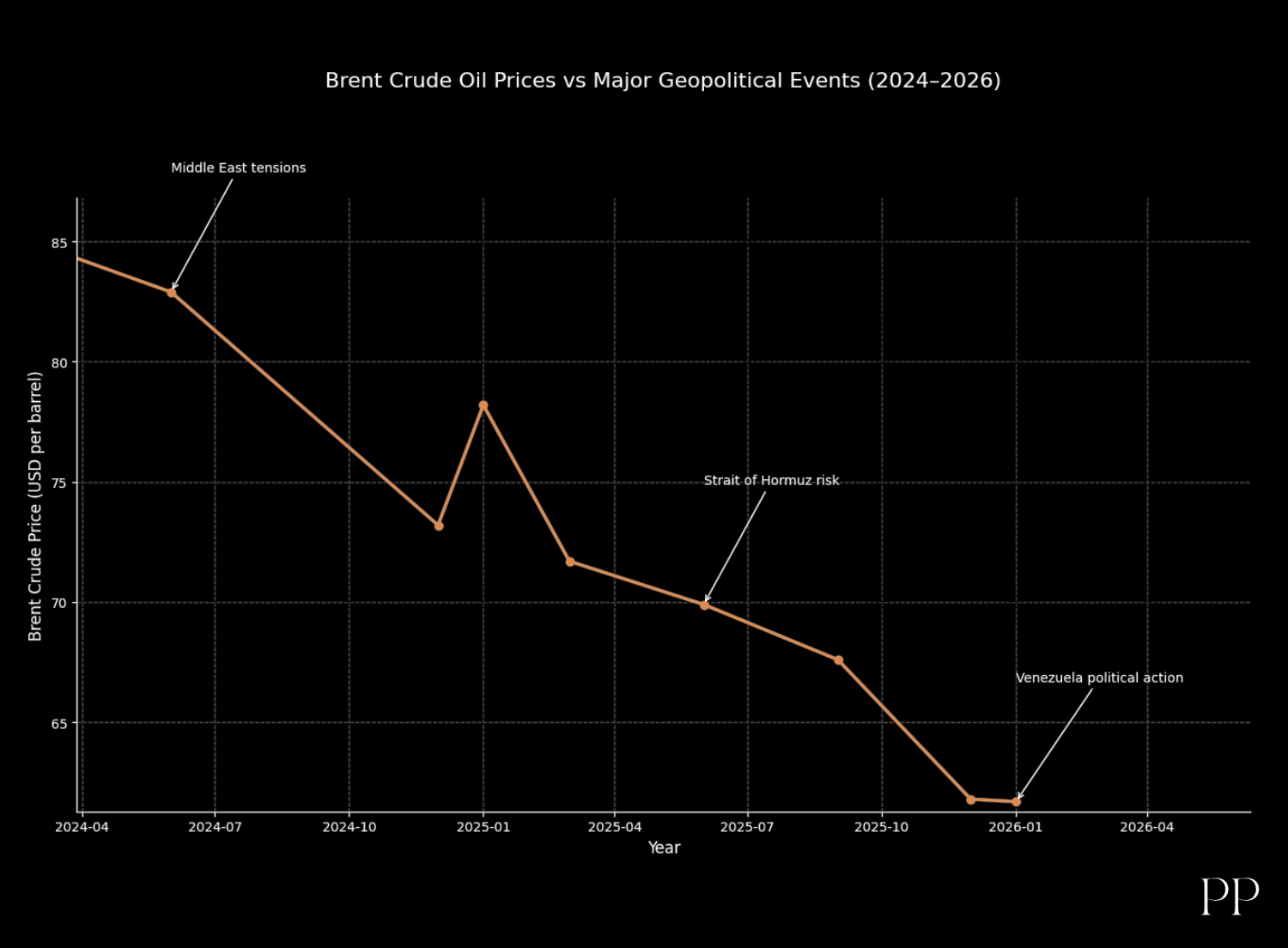

A defining catalyst of recent risk repricing came from geopolitical events in Venezuela. On January 5, 2026, U.S. forces captured Venezuelan President Nicolás Maduro — a dramatic escalation in U.S.–Venezuela tensions tied directly to control of one of the largest crude oil reserves on earth.

- U.S. energy stocks surged sharply — Chevron, ExxonMobil, and Halliburton saw strong gains as traders priced in potential future investment and reconstruction of Venezuelan oil infrastructure.

- Venezuelan sovereign and PDVSA bonds rallied — some distressed bonds jumped ~30%, rewarding hedge funds and distressed debt investors that had accumulated positions at deep discounts.

- Indian oil equities responded positively — shares of Gandhar Oil Refinery climbed sharply, reflecting global investor sensitivity to energy sector implications.

- Safe-haven assets outperformed — gold and silver saw sharp gains as geopolitical risk premiums widened, with gold climbing over 2 % on the day.

- Broader equities showed resilience — despite the shock, major indices like the FTSE 100 reached new highs, signaling that equities may still absorb geopolitical shocks when fundamentals remain strong.

These market moves highlight the complex interplay between geopolitics and global financial flows: investors balance fear of supply disruptions with fundamental oversupply in oil markets, creating divergent price responses across assets.

Why Oil Markets Are So Sensitive to Geopolitics

Oil remains one of the most geopolitically sensitive commodities. Several structural and event-driven factors explain this sensitivity:

Supply Surplus vs. Risk Premium

Despite frequent geopolitical headlines, oil markets today reflect a deep supply surplus. Forecasts show global crude inventories elevated and oversupply projections continuing into 2026 — even as OPEC+ pauses supply increases.

In this context, markets are increasingly demanding substantial, sustained disruptions — not just headlines — before prices rally sharply. This has led some analysts to believe geopolitical premiums have largely flattened out compared with past cycles.

Hotspots and Chokepoints

Critical oil shipping routes — especially the Strait of Hormuz, through which roughly one-fifth of the world’s crude flows — remain strategic flashpoints. Even the threat of disruption can elevate risk pricing, pressuring both oil and global financial conditions.

Middle East and Global Conflicts

Ongoing regional tensions — particularly between the U.S. and Iran — have kept the market on alert. Historical episodes of conflict have briefly pushed Brent crude toward higher bands, even if fundamentals ultimately moderated the moves.

How Investors Are Adjusting Strategies

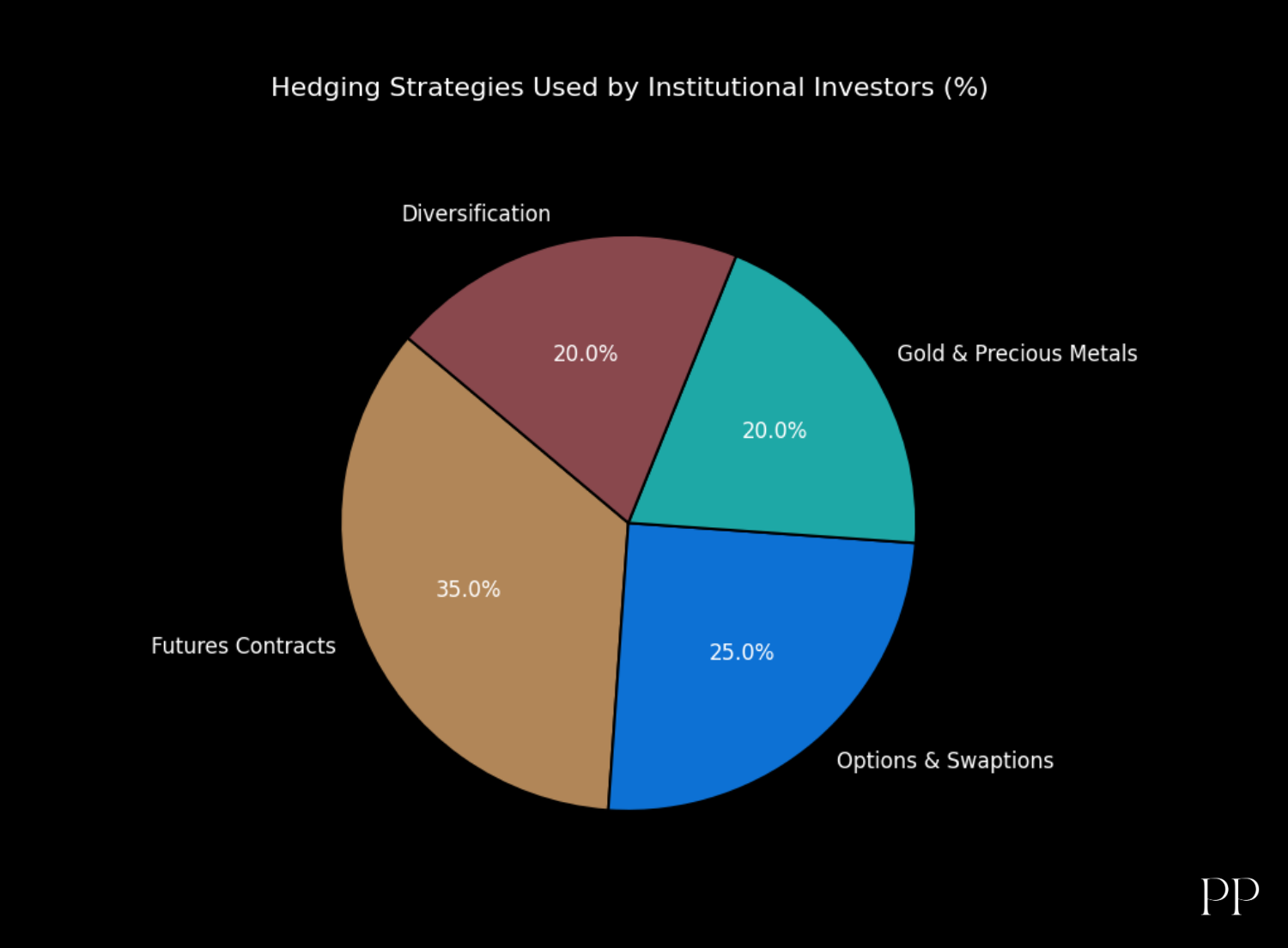

Given this context of mixed signals — geopolitical flare-ups on one hand and persistent oversupply on the other — investors are adapting their playbooks in several key ways:

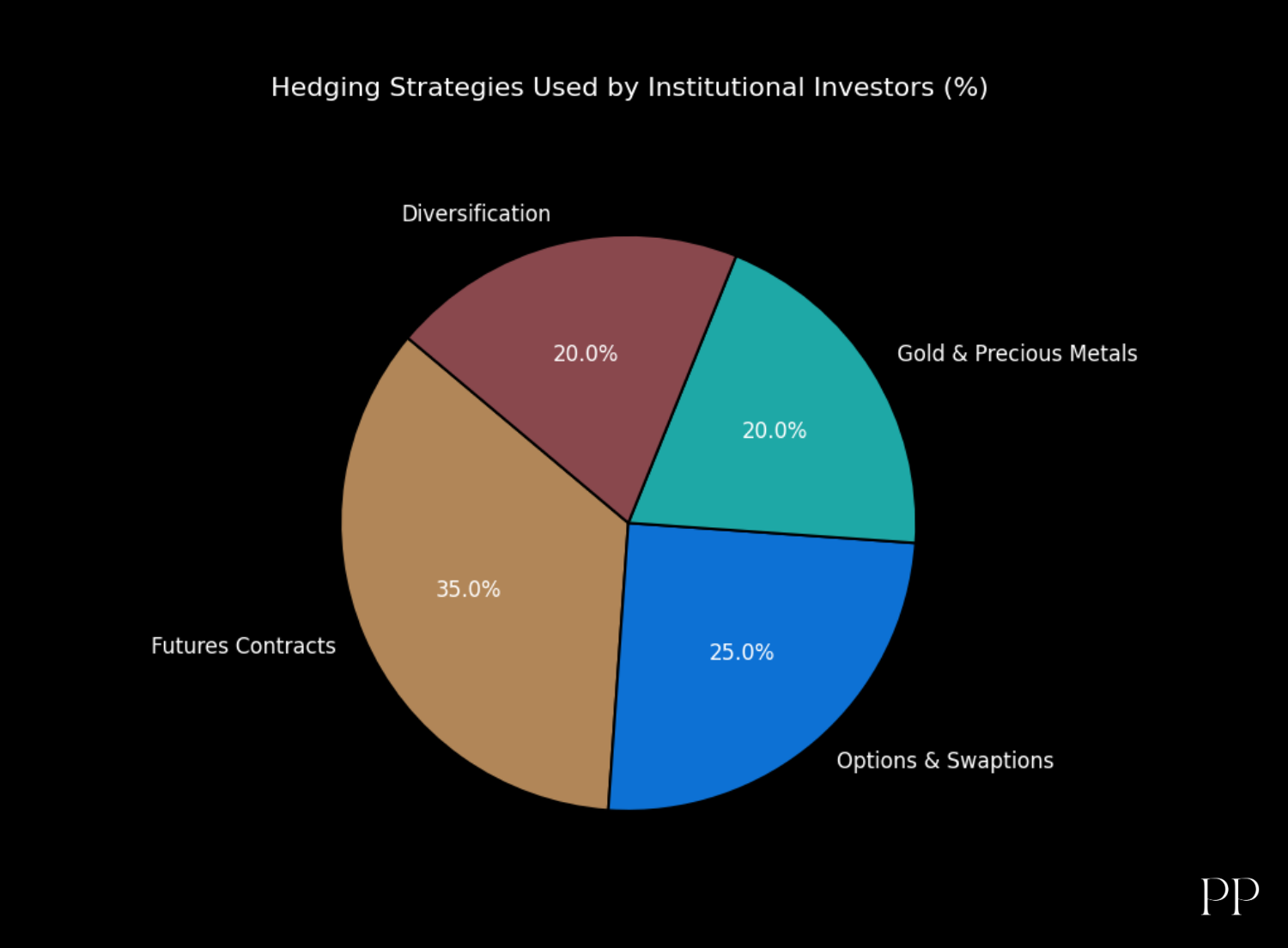

Hedging with Safe Havens

With market volatility and uncertainty rising, allocations to gold, silver, and government bonds have increased, serving as hedges when equities and commodities fluctuate.

Selective Equity Exposure

Energy sector equities with strong balance sheets and diversified operations are being favored over pure long oil bets. Broad imperfect pricing in oil markets has made indiscriminate long positions less attractive.

Embracing Diversification

Smart investors are broadening exposures beyond traditional oil and gas into commodities, alternative energy, and even inflation-linked assets to balance risk. This includes maintaining liquidity reserves to exploit opportunities when prices get dislocated.

Risk-Aware Fixed Income Playbooks

The rally in Venezuelan debt shows how geopolitical events can create unique fixed-income opportunities — but also underscores the need for careful risk management due to political and credit uncertainty.

Quantitative and Machine-Assisted Risk Models

As geopolitical risk data becomes more granular and real-time, asset managers increasingly deploy AI and machine learning tools that blend financial and news-driven indicators to forecast risk impacts and adjust portfolios accordingly.

Broader Implications for the Global Economy

The ripples of oil uncertainty and geopolitical volatility extend beyond markets:

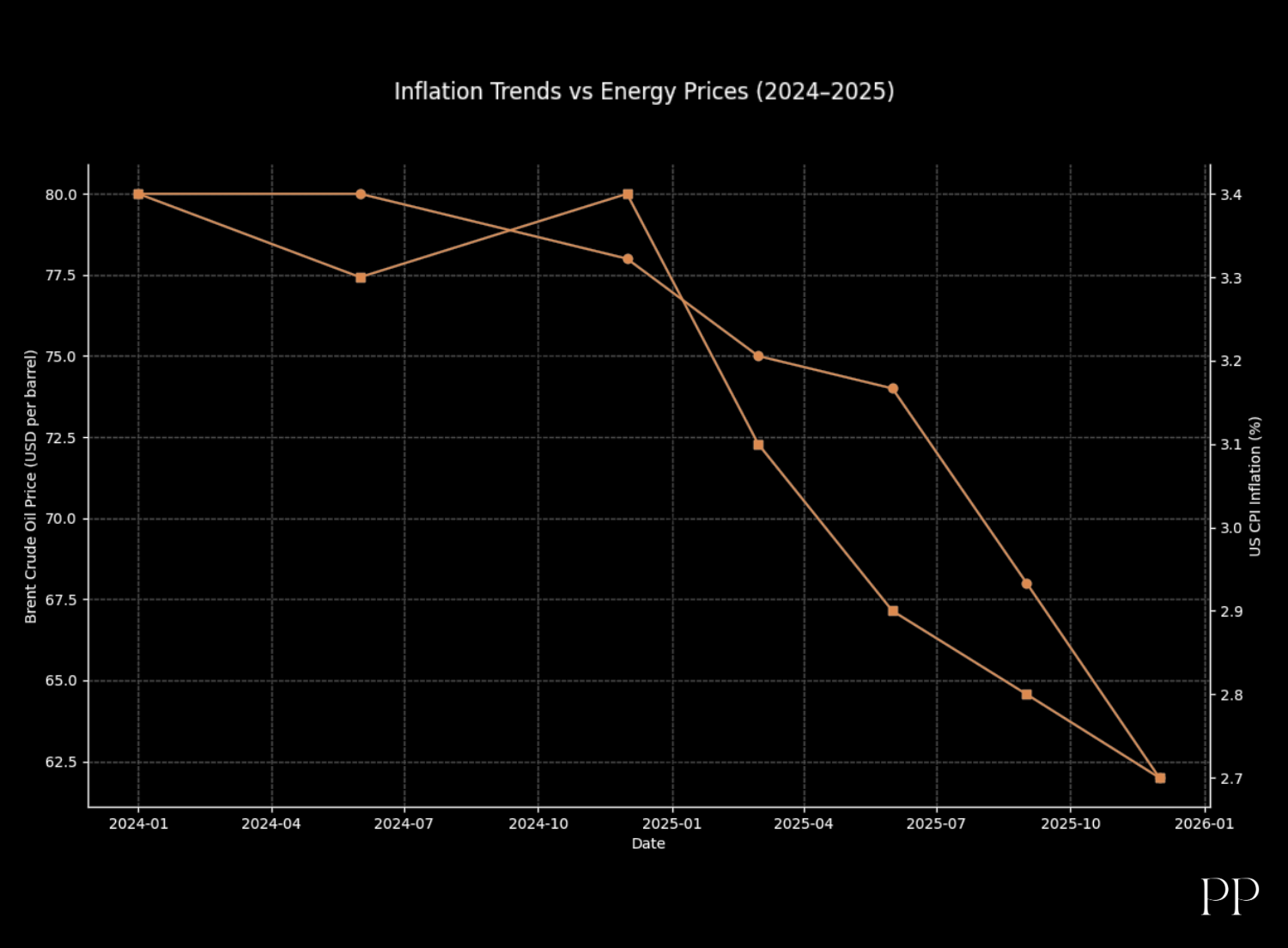

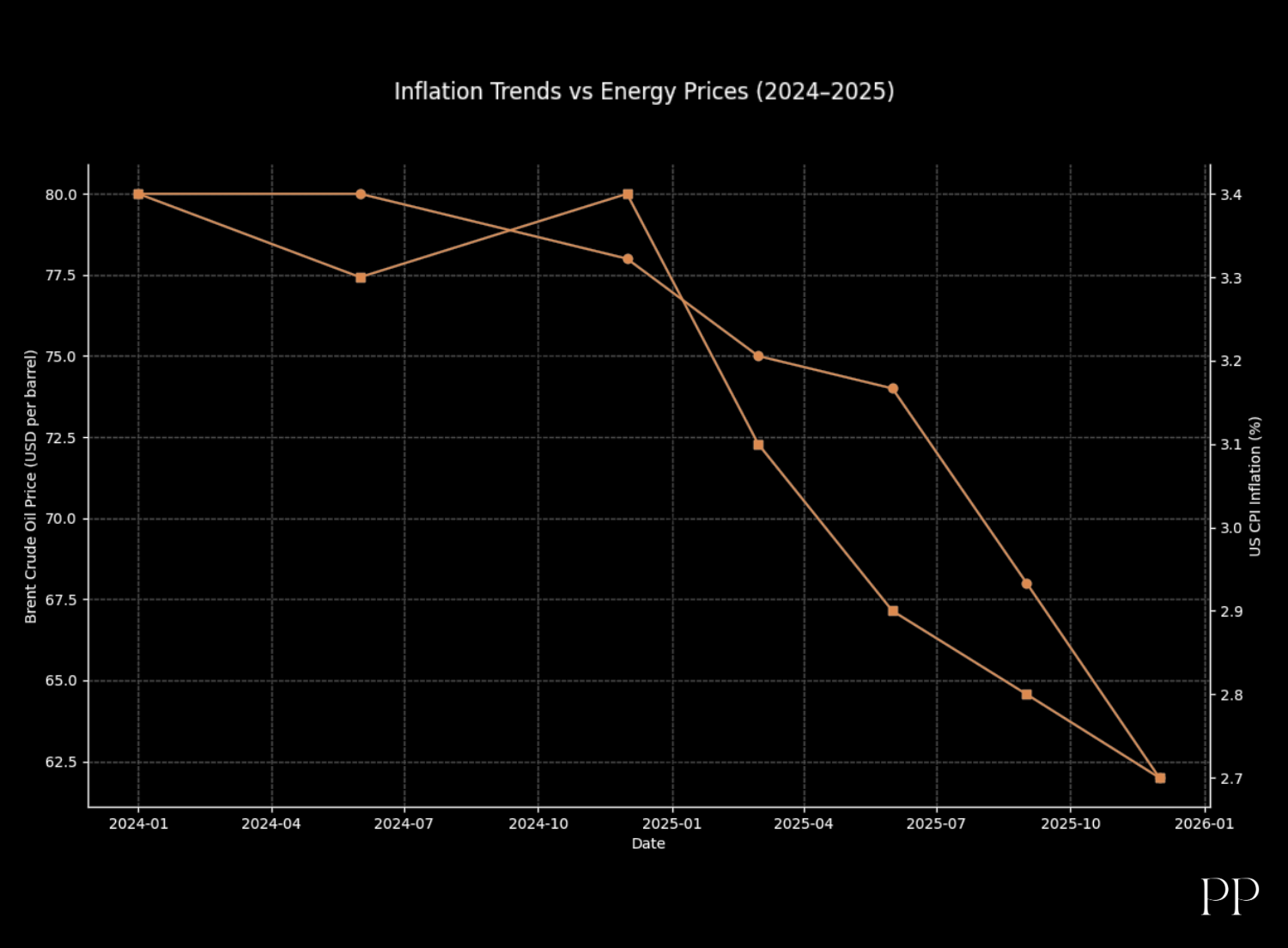

- Inflation and central bank policy: Persistent energy volatility complicates inflation forecasts and may influence interest rate decisions.

- Fiscal planning for oil-importing countries: Nations reliant on oil imports, especially in Asia, face potential pressure on trade balances and currency stability.

- Supply chain dynamics: Ongoing sanctions and political tensions can reshape global energy supply sources, prompting diversification or nearshoring strategies.

Conclusion

Today’s investment landscape is defined by a high-stakes balancing act: geopolitical risks can quickly change market psychology, yet oil supply fundamentals still exert powerful downward pressure. The result is an environment where investors must blend risk management, agile positioning, and diversification to navigate uncertainty.

In this complex setting, markets are no longer driven purely by supply-demand curves — political calculation, strategic resources, and investor psychology now play equally critical roles.